This article is contributed by Elwyn Chan of Stirling Fort Capital (A Registered Fund Management Company with MAS).

In his first speech to the US Congress, US President Donald Trump lamented that many foreign companies pay almost nothing when they ship their products into America. This is a hint that Mr Trump may impose a border tax adjustment (a tax on imported goods to US), so as to protect US manufacturers and penalise US importers. An import tariff may trigger a trade war and disrupt economic growth globally. If a trade war is to happen, this could signal the Trump Top scenario i.e. the peak in the strong rally in equities market.

Alternatively, the markets may shrug off this possibility and continue to persist in the Top Trump scenario i.e. the Trump reflation trade of long equities and short bonds. But the possibility of the Top Trump scenario looks increasingly stretched with great expectations built into the markets. This leaves little room for Mr Trump to have any policy missteps and disappoint the markets.

We share key thoughts on these Trump-related scenario:

- Trump Top scenario of trade war (Bearish)

- Top Trump scenario of Trump reflation trade (Bullish)

- Trump Top scenario of trade war

Trade make up 40% of China’s GDP in 2016 and any trade war will have a substantial repercussion on economic growth and capital flows. During his election campaign, Mr Trump has brought up the possibility of a 45% tariff on Chinese import. Such an import tariff will knock off 60 bps off China’s nominal GDP as estimated by Goldman Sachs. In response, China could sell their US Treasuries and embark on retaliatory tariffs.

The ensuing trade war will signal the Trump Top scenario i.e. the peak in the strong rally in equities market. During such a scenario, export-dependent countries such as Japan, South Korea, Taiwan and Singapore will be negatively impacted. In addition, Chinese industries with high trade imbalances and low tariffs such as chemicals, electronics, textile and steel may be vulnerable.

In addition, the US face the deadline on 15 March where the moratorium of the debt ceiling expires. A multi-trillion dollar hike in the debt ceiling will have to be debated and passed. This will create uncertainty on whether Mr Trump has sufficient budget levers to pull off greater spending on defence and infrastructure while implementing “big, big” corporate tax cuts and a “massive tax reduction for the middle class.” To raise funding for his tax cuts, Mr Trump may push through import tax to raise funding for its spending policy and open up the possibility of a trade war.

- Top Trump scenario of Trump reflation trade

A Top Trump scenario has unfolded after Mr Trump won the US Presidential elections – global equities, MSCI World Index, were bid up 9.4% where else bonds corrected with US 10 yields hitting a peak of 2.64% in December. Copper and steel prices have also climbed up, signalling a global upturn. Similarly, Asia has performed well but it has lagged behind with returns of 5.7% only.

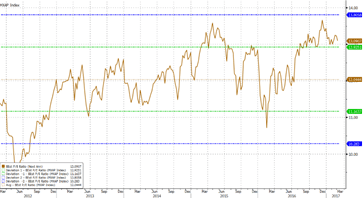

The Trump reflation trade has resulted in risk markets at inflated levels with the rally driven more by valuation gains rather than earnings growth. MSCI Asia Pacific Index is at an expensive valuation and trades at 13.1x forward P/E, more than 1 standard deviation above its 5-year mean. Volatility is also benign and this leaves the market vulnerable to tail risk events.

One tail risk event could be the upcoming FOMC meeting on 17 – 18 March where various Fed officials have in recent days hinted a rate hike. The probability of a rate hike has been re-priced with the markets now ascribing an 80% probability of a rate hike in the March meeting.

Increasingly, markets will likely turn their attention to Fed Chair Yellen, away from President Trump. If this happened, the Top Trump trade may just be broken where rising bond yields possibly induce a risk-off correction in the equities market.

The coming weeks will be critical for risk assets with key dates in mid-March (15 March US Budget deadline and 17 March FOMC meeting). With risk sentiment and valuations at cycle highs, there is little margin for error. A risk off environment will mean the Trump Top has happened and the Top Trump trade is over.

5-year chart of MSCI Asia Pacific Index P/E

Source: Bloomberg

Best regards

Elwyn Chan, CAIA

————————————–

CEO, Stirling Fort Capital Pte Ltd

391A Orchard Road #08-07 Ngee Ann City Tower A S238873

(A Registered Fund Management Company with MAS)

– Director, Stirling Fort ASEAN Real Estate Fund I SPC

– Director, Catalyst Stirling Fort Pharma Fund SPC

– Director, Stirling Fort Asia Income PLUS Fund