This article is written to aid investors in making a more informed decision when investing in properties in Singapore. The data in this article was referenced from various sources.

The Singapore property market has seen a sudden deterioration in terms of sales numbers ever since the Singapore government implemented the latest round of cooling measures to try to rein in property prices. Exhuberance was building in the Singapore property market and the government had to step in to taper expectations. Here are some factors which support the notion that Singapore property prices are too high.

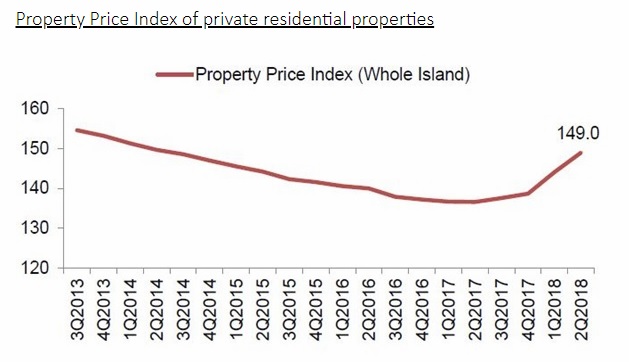

1) Prices are close to the all-time high

Singapore Property Price Index (Source: URA)

As of the 2nd quarter of 2018, the Singapore residential price index stood at 149. This was an increase of 3.4% from the previous quarter. The peak of the Singapore property market was in Q3 2013. During the same period, the Singapore government introduced another round of property cooling measures and introduced the Total Debt Servicing Ratio (TDSR). Consequently, prices then fell for 15 consecutive quarters before staging a strong comeback in the 2nd half of 2017. Judging by the pace of the increase in the last two quarters, the Singapore government had every reason to believe that prices could once again spiral out of control. In fact, Morgan Stanley went as far as to say that Singapore home prices would double by 2030. Such attention-grabbing headlines are not what the Singapore government wanted to hear. Discontentment with the high cost of living in the city-state had been brewing for some time. If property prices were to rise at such pace, it would not bode well for the ruling party.

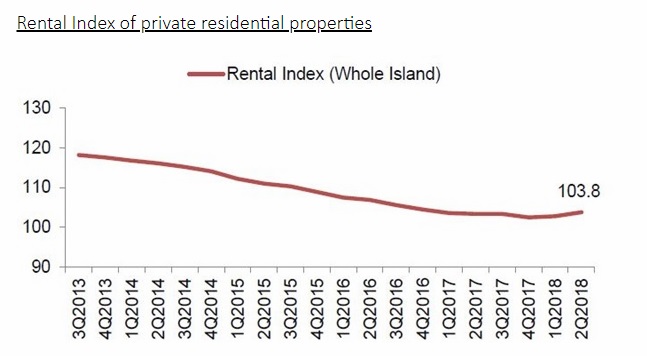

2) Rents are very low

Singapore Rental Index (Source: URA)

On the flip side of things, rents are extremely low. In fact, all the time that property prices were rising, rents have been gravitating back to almost base period price index levels. The base period (base year price index is 100) is Q1 2009 and the rental index in Q2 2018 stood at 103.8. This means that although the resale prices in Q2 2018 are 49 per cent higher than Q1 2009, rental prices are a measly 3.8% higher for the same period. If this divergence continues, it would be unattractive for property investors to purchase Singapore properties for rental yield. There are only two ways to have

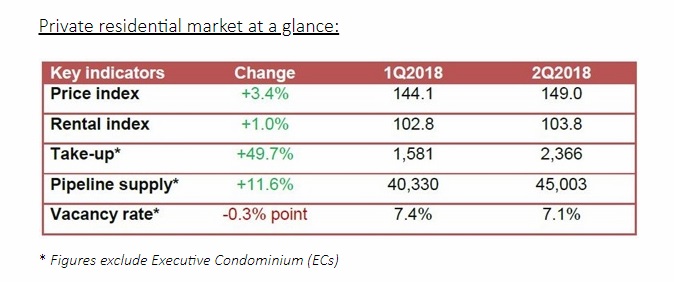

Private residential market at a glance (Source: URA)

Even though the rental market was starting to pick up in early 2018, this did not substantiate the Property Price Index from deviating so far from the Rental Index. In fact, a large number of buyers is buying to try to rent the properties out. If rents continue to stay low as prices continue to rise, then yields are going to fall even further. Eventually, investors may look at the meagre rental and look elsewhere for better returns.

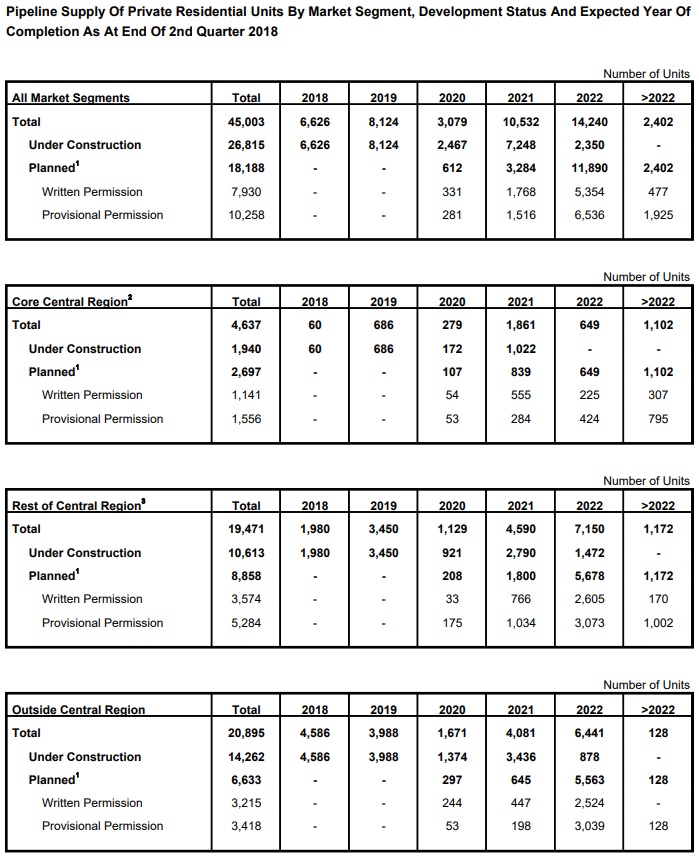

3) There is still a lot of supply in the pipeline

Pipeline supply of private residential units (Source: URA)

To date, there are 45,003 private residential units in the pipeline. These figures do not include executive condominiums. To put things into perspective, a development like the recently launched Jui Residences consists of 117 units. Even one of the largest new project launches of 2018, Parc Esta, consists of 1,399 units. 45,003 units are more than 32 Parc Estas or more than 384 Jui Residences.

4) Demand is waning as immigration is tight

From 2016 to 2017, the total population grew by a mere 0.1 per cent to 5.61 million. On average Singapore gives 18,500 citizenships to foreigners every year and this is in line with the yearly target of new citizens of between 15,000 to 25,000. In the past decade, Singapore’s average yearly citizen birth rate is about 32,200. It is inconceivable that the Singapore government will ramp up immigration aggressively in the near future. Thus Supply should outstrip demand in the coming years. Demand cannot keep up with the impending supply that is coming on board in the coming years. Foreign interest in Singapore property is extremely weak. The stamp duty is restrictively high and the rental returns are meagre compared to other international cities. Sure there are still foreign buyers making purchases in the city-state but these are few and far between and are usually restricted to the core central region.

5) Interest rates are still at very low rates

Even though interest rates have been rising, they are still extremely low when compared to the early 2000s. Before the Global Financial Crisis, interest rates were much higher. It was due to the excessive quantitative easing across the globe that caused interest rates to remain below 2 per cent for such an extended period of time. In fact, we have already had private home loan rates lower than the HDB fixed rate of 2.6% for more than a decade already. In some cases, buyers of HDB flats immediately after the Global Financial Crisis may have been better off taking a bank loan to finance their flats as compared to an HDB loan and HDB loan has always been touted as the more financially prudent option as it was deemed to be a subsidised rate from HDB.

6) We are in the midst of an extended bull run

The past slowdowns were in 1997 (Asian Financial Crisis), 2000 (Dot Com Bubble), 2001 (Terrorist attacks on US soil on September 11), 2003 (SARS outbreak), 2008 (Global Financial Crisis). Since 2008, the market has been on an upward trajectory and the stock markets across the world are at record highs. We may be due for a slowdown around the corner. The US is winding up its asset purchases and there is a possibility of a trade war between the two largest economies, the US and China.

7) Singapore is vulnerable to external shocks

Singapore is never insulated from external shocks. We depend a large deal on our trading partners and thus when one of them faces a slowdown, we are affected as well. The trade war between the US and China is of grave concern to Singapore. In fact, China is Singapore’s top trading partner, followed by Hong Kong, Malaysia, Indonesia and the United States. In 2017, Singapore shipped US$373.2 billion worth of products around the globe which represents about 2.3% of overall global exports. As Singapore is heavily dependent on trade, we are susceptible to any slowdown in any of our major trading partners.

8) The Singapore government’s intervention

It is quite obvious that the Singapore government intends to keep property prices in check. A 9% growth in property prices from 2Q2017 to 2Q2018 is not ideal and thus the latest round of cooling measures came in. If prices were to rise at anything close to 9% per annum, you can be sure that the Singapore government would be stepping in once again. In fact, Singapore has one of the most restrictive buying stamp duties in the world. The additional buyer’s stamp duty for foreigners is at 25%. Coupled with the usual buyer’s stamp duties of about 3%, a foreigner would have to pay about 28% in stamp duties just to buy a property in Singapore. This has caused foreign interest in Singapore to slow to a crawl. Sales are driven by the resident population and with the property prices being such a hot topic every election season and thus I fail to see how the ruling party can let property prices rise at rates previously seen. I have always maintained that property prices and Singapore politics are deeply intertwined.

9) A nation of homeowners not a nation of landlords

The ruling political party has always maintained that one of the key factors that make up the backbone of our nation-building has been home ownership. By home ownership, they meant that the population own the homes that they live in. Somehow over the course of the years as the Singapore population became more affluent, some have come to the conclusion that they would like to make money through property investment and slowly the mantra of owning multiple properties to live off passive rental income has taken over some individuals. Property investment is not a sure win game and there are many instances whereby sellers have incurred significant losses in the property market. This is more probable if the purchase was made during the peak of a cycle. It is not the Singapore government’s interest to make it easy for individuals to acquire multiple properties. They will always focus on helping families own the home that they live in. This is very evident if you consider that first time home buyers were not affected in most of the cooling measures.

10) Land reclamation

Singapore’s land size is just 719 square kilometres. Despite Singapore being land scarce, the Singapore government has been reclaiming land to deal with this shortage. In fact, there are plans to further expand Singapore by 7 to 8 per cent by 2030. That is about 57 square kilometres. Although cost is extremely high, this is one of the methods that the city-state uses to increase its size and deal with the shortage of land.

11) There is a limit to how small new condominiums can go

The newer developments are made to seem affordable just by shrinking their size. There are 3 bedroom units on the market which are about 990 square feet. About a decade ago, the norm was perhaps 20 to 25% more. Older condominiums have 3 bedroom units that are about 1,200 square feet in size. In fact, the significantly older ones, perhaps those that were built in the 1980s, some had 3 bedroom units of over 1,500 square feet. How developers have been selling their new project launches are by shrinking the size of the units so that the quantum remains low even though the per square foot price is significantly higher than units sold in the resale market.

12) Even Hong Kong property prices are slowing down

If anyone needed reminding that property prices in even the most property crazed market can slow down then they should read the latest Bloomberg article about Hong Kong property developers cutting prices in Hong Kong to lure buyers. No asset in any market rises in a straight trajectory. The Singapore residential price index chart will show that there are occasional dips. I do agree that in the long run, property prices do increase but then would it not be better to buy when there is less exuberance? When prices are a little softer when it is a buyer’s market? Moreover, with property prices rising so much faster than incomes, the long run which I mentioned may be counted in decades. I still cannot fathom how prices in outside central region are supposed to rise past $2,000 per square foot as that would be the pricing that some property owners will need to sell in the future to realise a profit. As mentioned before, the Singapore government is keeping tabs on the market and at the same time, perhaps we are at an inflexion point. Where prices have really gone so far ahead of fundamentals. The basis of why buyers buy property seems to be one of a fear of missing out rather than working out numbers to see if they make sense. (i.e. if buying for rental, can the expected rental cover the monthly repayments and is the yield healthy?)

On the flip side of things, here are some factors which may drive prices higher in the future.

1) Singapore is still one of the best places to live in the world

Singapore is safe, corruption-free has low levels of pollution and is sunny all year round. In many cases, these form the basis of why many people around the world want to move to Singapore. For this particular reason, I do think that the demand for properties in Singapore will do well in the long run. That being said, the days of property prices increasing by multiple folds is long gone.

2) Loosening of the immigration policies

Businesses are finding it difficult to hire with rather restrictive immigration policies. The hiring quotas and levies that businesses have to pay have made some sectors uncompetitive. This may need to change if the government would like to help small, medium businesses grow. On top of this, if Singapore’s resident birth rate remains low despite all the incentives the government is giving to couples to start families, then a loosening of the restrictive immigration policies may be on the cards.

3) Singapore is more welcoming as compared to other countries.

There are many countries closing their doors to foreigners. In one of the most extreme examples, New Zealand has banned foreign property ownership. There are many countries that are starting to feel uneasy about letting foreigners work and purchase property in their country. As other countries close up and if Singapore remains open, then this may attract foreigners into Singapore and consequently the demand for Singapore properties, be it for rental or purchase, will increase.

The factors which I just mentioned come from a macro standpoint. If you were to look at how prices could rise from a micro standpoint, then you would be considering things like entry price and location of a particular development. There are many factors and buyers should look at the market in its entirety as well as analyse individual projects to ascertain if they are picking up a property at a good price. For this, you can read my Singapore property reviews.

As can be seen, there seem to be more reasons for me to come to the conclusion that Singapore property prices are too high. There seems to be more resistance on the upside and most factors do point to a softer property market in the near future. I do not foresee a property market crash as the Singapore government can remove the cooling measures whenever they think that the market is too weak.

Yours Sincerely,

Daryl Lum