Executive condominiums (“ECs”) are a hybrid form of property—a somewhat middle ground between a private condominium and public housing. ECs are built by private developers but sold under public housing schemes. ECs offer HDB upgraders a more affordable route to upgrading to a condominium. It also offers first-time home buyers more subsidised options than just HDB flats. There are eligibility conditions and ownership restrictions in the first 5 years.

As ECs, at launch, are public housing, therefore, purchasers will need to form a core family nucleus to purchase an EC. A core family nucleus is formed by the core members. The core members are the applicants and occupiers who enable the household to qualify to purchase and own an EC under one of the eligibility schemes. All core members must be the applicants, remain as applicants and occupy the EC during its minimum occupation period (MOP). If their names are removed, the household will be ineligible to own that EC unit.

For example, a household consists of a husband and wife and two children. The husband and wife are the core members as the EC was purchased under the husband and wife or spouse scheme.

Let us break the EC application into steps.

Step 1: Consider your eligibility

Eligible Households

The household must have one of the following groups as its core members to be eligible to purchase an EC

- Fiance and fiancee

- Husband and wife

- Parent and child

- Siblings (must be orphaned and single)

- Two or more singles (up to four)

Citizenship requirements

For fiance and fiancee, husband and wife and/or parent(s) with child(ren), orphaned siblings

- One party must be a Singapore Citizen.

- There must be at least another Singapore Citizen or Singapore Permanent Resident (PR).

For two or more singles

- All singles applying jointly for the EC must be Singapore Citizens.

Age

- All applicants must be at least 21 years old.

- For singles who are applying jointly, they must all be at least 21 years old.

Income ceiling

The total monthly income of all persons listed in the application must not exceed SGD$16,000.

Ownership and/or interest in property in Singapore or overseas (excluding HDB flat)

All applicants and occupiers in an EC application

- must not own or have any interest in any local or overseas private residential property; and

- may only apply for an EC 30 months after disposing of their private residential property.

If you purchase an uncompleted property, be it local or overseas, you do not have ownership of the property as the property is uncompleted. You only have a beneficial interest in that property. If you want to apply for an EC, you must not have such interest.

Ownership and/or interest in HDB flat

If an applicant owns or has an interest in an HDB flat, that flat must be disposed of within 6 months of the completion of the EC purchase. The disposal date refers to the legal completion date.

Resale levy (if applicable)

If one or more core member applicants have taken a housing subsidy, he or she will be considered a second-timer and will need to pay the applicable resale levies. If any core member has taken more than 1 housing subsidy, he or she will not be eligible to apply or be listed as a core occupier in the EC application.

Step 2: Obtain an in-principle-approval (IPA)

If you fulfil the eligibility criteria, you will next need to get an IPA from the bank. This is in essence the bank telling you that it will grant you a mortgage to purchase the property you intend to purchase. Do note that if your financial situation changes, for example, you changed your employment, then you will need to obtain a new IPA as the IPA was issued based on your previous employment.

Step 3: Submit your application to purchase an EC

You will submit your application and documents with the developer of the development which you intend to purchase. You will be given a ballot number to select a unit of your choice on the day of the launch.

Step 4: Selecting a unit on the day of the launch

You can still back out if you eventually do not want to continue the purchase. If you intend to book a unit, you will have to issue a cheque with an amount equivalent to 5% of the purchase price of the unit. The developer will grant you the Option to Purchase (OTP).

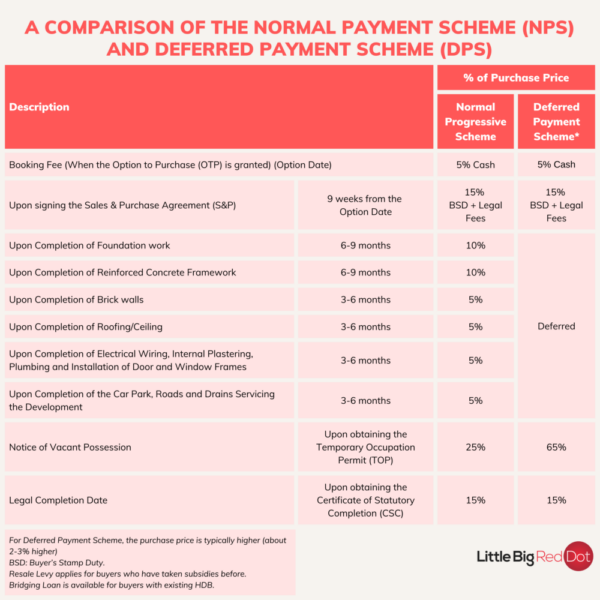

It is at this point that you will need to decide whether you intend to be on the Normal Payment Scheme (NPS) which is progressive payments or under the Deferred Payment Scheme (DPS). This is because there is a price difference. If you select DPS, the purchase price is usually 2-3% more expensive.

Subsequently, you will receive the Sale and Purchase Agreement which you will need to sign and return to the developer.

These documents will be submitted by the developer to HDB for review. At this point in time you will need to make an application to the CPF board if you intend to use your CPF monies to make payments towards your EC.

For DPS, you will not need to make payment on anything after the initial 20%.

For example, if the bank agrees to grant you a loan of 50% of the purchase price, when the property obtains its TOP and 65% of the purchase price is due, you will need to fork out 30% in cash and the other 35% can be covered by the bank loan. (This is because the first 50% needs to be paid by the purchaser before the remaining bank loan kicks in. Here, there was already an initial 5% + 15% paid when the OTP was granted and upon signing of the S&P.)

An additional example, if the bank agrees to grant you a loan of 60% of the purchase price, when the property obtains its TOP and 65% of the purchase price is due, you will need to fork out 20% in cash and the other 45% can be covered by the bank loan. (This is because the first 40% needs to be paid by the purchaser before the remaining bank loan kicks in. Here, there was already an initial 5% + 15% paid when the OTP was granted and upon signing of the S&P.)

For NPS, you will need to make payments progressively. The point at which your bank loan kicks in is also dependent on the amount of loan that the bank is willing to extend to you. For example, if the bank is willing to loan you 60% of the purchase price, you will need to make payments on the first 40% before the bank loan kicks in. In this case, referring to the chart below, you will need to make payments up to the completion of the reinforced concrete framework. After which, the bank loan will be disbursed progressively. When the bank loan is disbursed, you will only pay instalments on the amount disbursed. So if the first disbursement is at the point where the brick walls are completed, your bank loan is based on that 5% of the purchase price. Consequently, your instalments will be based on this 5% over the tenure granted and not the full 60%. Therefore, your instalments start small and gradually increase when the property is completed.

Credit: The design team at Little Big Red Dot

My take:

Considering the fact that the difference is about 2-3% of the purchase price, I would go for the Normal Payment Scheme (NPS) over the Deferred Payment Scheme (DPS). That 2-3% is about half the price of the stamp duty that you will need to pay for the property purchase. While it is very common for individuals to opt for DPS on the pretext that they can put that money to work in other forms of investments, the truth is that Singaporeans typically only have one investment and that is their property. Moreover, purchasers of ECs cannot make any private property investments. Be it locally or overseas, residential or otherwise. If you look at the comparison closely, you are only deferring 40% of the payments. At the point the development obtains its TOP, the bank loan will start. Additionally, as I mentioned, the instalments are only on the disbursed amount. If you consider a 5% disbursement on a $2 million loan over 20 years, at a 3% interest rate for a 25-year loan tenure, the monthly instalment is $474.

A 3% difference in that $2 million works out to be $60,000. Hence, selecting DPS merely defers your instalments of hundreds up to a few thousand over a year or so in exchange for you making a purchase on that same property for a few tens of thousands more.

Personally, it does not make sense to me.

But that is just my take.

Yours sincerely,

Daryl