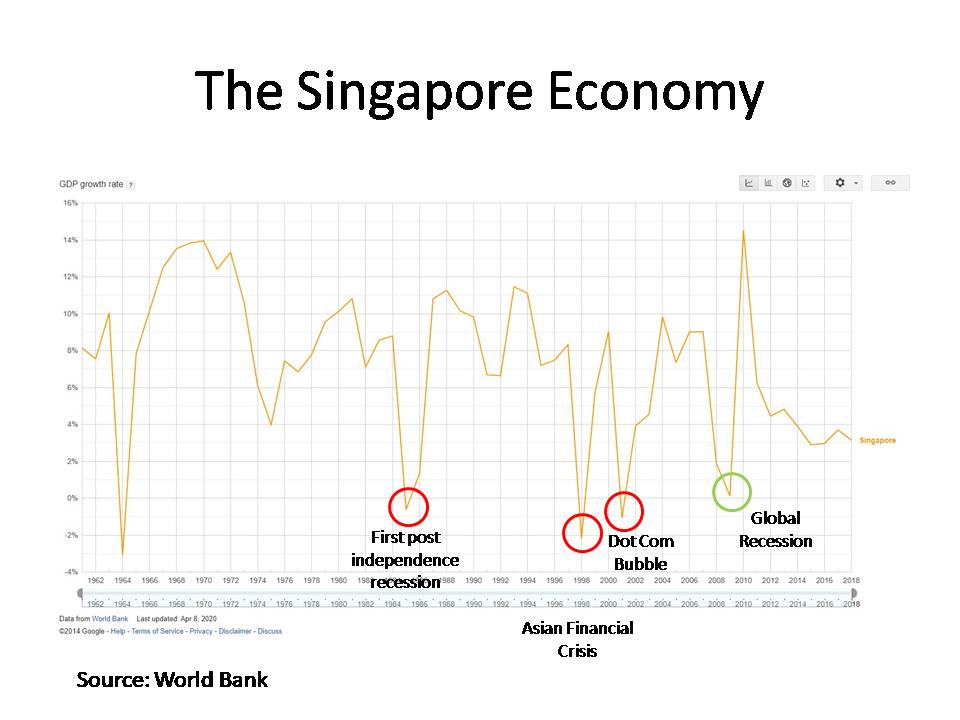

Make no mistake, this recession is turning out to be the worst recession since Singapore gained independence in 1965. Based on the International Monetary Fund’s GDP growth forecast, the Singapore economy is expected to contract 3.5% in 2020. This would be the largest economic contraction in Singapore’s history. Even during the last Global Financial Crisis, Singapore’s GDP figures posted an anaemic growth rate of 0.1% which was still nonetheless in positive territory. That recession did, however, cause an uptick in unemployment numbers and the Singapore government did have to did into its past reserves to fund two stimulus packages to the tune of SGD$2.6 billion in November 2008 and a further SGD$20.5 billion in January 2009. That stimulus pales in comparison to the nearly SGD$100 billion that the Singapore government has set aside for four separate budgets to deal with the current recession, brought about due to the COVID-19 pandemic.

IMF GDP Growth Forecast

The Singapore Economy

The current recession will be extremely severe and if were not for the Singapore government supporting jobs and businesses, unemployment rates would be much higher than what it is today. The US is already grappling with record levels of unemployment with the April unemployment rate at a record 14.7%. This number is expected to get higher although I would think that the rate of increase would slow down due to the gradual reopening of the US economy. Many sectors like aviation, entertainment, hospitality and food and beverage are very adversely hit from the pandemic and I believe that many more jobs will be loss if the pandemic is not brought under control before the stimulus packages expire. This will hold true for just about every country in the world and I do think that the pandemic will outlast most stimulus packages around the world.

So the conditions are pretty bleak for Singapore. We depend heavily on exports and trade. Singapore’s trade to gross domestic product (GDP) ratio is among the highest in the world at about 400%. Singapore is also the most open economy in the world and tourism accounts for about 4.1% of our GDP. In all aspects, we will definitely see a record economic contraction unless a medical solution can be found pretty soon. Unlike previous recessions, fiscal and monetary policies will not help to reverse the downturn. Such policies will only help to alleviate some potential hardship. The issue is a medical one and the solution has to also be a medical solution. In spite of all the doom and gloom, there are some silver linings which I do think that anyone looking to invest in Singapore should take note of.

Singapore is not borrowing to fund its stimulus packages

This is a very significant point. Unlike many major economies, the Singapore government is not issuing debt to try to fund government spending during the pandemic. Pre-COVID-19, my assumption was that there would be a debt crisis which would affect the global economy and send it into its usual 10 to 11-year downturn cycle. Many economies around the world, most notably in Europe, were already crumbling under the amount of debt which they undertook. With the COVID-19 pandemic, countries around the world are having to spend even more money to battle the virus and keep their economies afloat. This is adding on to the debt burden which will be handed over to future administrations.

The Singapore government is extremely supportive in keeping jobs and helping companies

To be frank, I am a bit surprised by the Singapore government’s willingness to withdraw so heavily from past reserves. In many cases, the Singapore government has been handing out direct cash to its citizens to try to support everyone financially. Four budgets were announced totalling almost SGD$100 billion and in these budgets, the main focus was to support companies so that job losses will be kept to a minimum. The helicopter money that was given by governments around the world was also given to Singaporeans by the Singapore government. The Singapore government handed out cash directly to households depending on their income levels and the type of property which they resided in. This helped keep the economy going and gave the people a bit more security that their welfare was being taken care of. Singapore did not see a spike in the unemployment rate as compared to many other major economies around the world. The US is grappling with an unemployment rate of 14.7% whereas Singapore’s unemployment rate inched up by 0.1% to 2.4% in the last quarter. I do still believe that the unemployment rate in Singapore should go higher as the Jobs Support Scheme expires but I do think that most companies may choose the option of either furloughing their staff or handing out pay cuts to keep their bottom line afloat.

The fact that workers are employed would mean that these same workers could continue to fulfil their financial obligations like mortgage or motor vehicle loans. This would keep financial institutions and asset markets healthy although there is a general consensus that asset prices should fall in the short run.

Despite early troubles, Singapore has generally responded well to the pandemic

Singapore has an alarmingly high number of COVID-19 infections as compared to the rest of South-East Asia. In fact, it has the highest number of reported infections in South-East Asia. In my opinion, I think that this high number has a few contributing factors. There was perhaps an oversight in the potential for the virus to spread in foreign worker dormitories but then Singapore also has one of the most comprehensive testing strategies in the world. In fact, as we speak, Singapore plans to ramp up testing to the tune of 40,000 a day. For a very small nation, this number is extremely high. I must say that the dormitories are already gazetted as isolation areas and thus that cluster of infections are isolated whereas the general population’s numbers are very indicative of how far COVID-19 has spread through the community. The high numbers are due to the fact that there are large parts of the community that have undergone testing. The more a country tests its residents, the higher the number of COVID-19 cases. I do believe that if many other countries were as meticulous as Singapore in testing their residents, reported numbers would be significantly higher. That being said, today, 28th of February 2020, marks the first time since 23rd of February 2020 that there were no new cases among Singaporeans or permanent residents. To me, the takeaway from this episode has been Singapore’s transparency in reporting its infection rates. More than perhaps any other country, Singapore’s handling of the pandemic, although there are many aspects which could be improved, shows how important transparency is to instilling confidence that things are getting under control and are improving.

COVID-19 has shown Singapore’s willingness to maintain transparency

This expands on the end of my previous point. Transparency is something that reverberates through a sound economic system. Singapore, its people and its businesses are known for being transparent in just about all of its dealings. This is the main reason why Singapore is one of the easiest places to start a business. Fees are extremely transparent and there is zero-tolerance when it comes to corruption. Information about taxes, legal fees and procedures and just about any information needed by any foreigner can be found through the relevant government portals and this pandemic might have helped to further digitize many processes, making it even easier for foreigners and anyone offshore to reach out to the relevant departments or businesses in Singapore.

Singapore was already moving towards becoming a fund management hub

In 2018, the Variable Capital Companies Act was passed in parliament. The passing of this act was to domicile foreign funds by creating a corporate structure that is conducive for fund management. Typical companies cannot vary their paid-up capital easily. Reduction in paid-up capital could only be done through a court application or the directors guaranteeing that the company could fulfil its liabilities moving forward. This is not an efficient structure when managing investments. Typically when investments are realised, a company should be able to return its profits to shareholders by reducing issued shares. This variable capital structure was prevalent in jurisdictions like the ones in the Cayman Islands or the British Virgin Islands. This is the reason why fund managers typically set up companies there. However, with the Variable Capital Companies Act, regional and global funds will find Singapore an attractive place to domicile their operations. There is not much spotlight on this matter but I do think that this is a significant move that will see more inflows of funds into Singapore.

Hong Kong is losing its shine as a financial hub

Hong Kong’s autonomy is slowly but surely being ebbed away by Beijing according to sentiments out from the U.S. With China implementing a national security bill in Hong Kong, Hong Kong is expected to lose a significant amount of trade with the U.S. as tariffs are expected to be imposed on Hong Kong, in line with tariffs imposed on mainland China. There should be an outflow of capital out of Hong Kong into competing financial hubs. This is especially true for Chinese who have placed monies in investments in Hong Kong. The next logical place to consider would be Singapore.

The income tax act has provisions to attract foreign funds to complement the goal of becoming a fund management hub

One of the reasons why funds set up shop in places like the Cayman Islands and the British Virgin Island is because of their tax haven status. There are, however, provisions in sections 13CA and 13R of the Singapore Income Tax Act. Here is an extract from an article I wrote previously entitled: “How much taxes do fund management companies have to pay in Singapore?”

The tax treatments of funds are spelt out in sections 13CA and 13R of the Singapore Income Tax Act.

Offshore tax exemptions:

13CA mentions about the Exemption of income of prescribed persons arising from funds managed by a fund manager in Singapore. It deals with companies and trusts whereby the fund is not a tax resident of Singapore with no presence in Singapore other than the fund manager or trustee is the fund is a trust. The fund must not be wholly beneficially owned by Singapore investors. The fund manager must be Singapore based and holding a CMS license. Only non-qualifying investors (i.e. Singapore non-individuals with investments above a certain percentage) would need to pay a penalty based on a formula prescribed in the Income Tax Act. Annual statements are required to be sent to investors and non-qualifying investors will need to file taxes with the Inland Revenue Authority of Singapore (IRAS). However, the fund itself will not need to file taxes with IRAS.

Onshore tax exemptions:

13R mentions about the Exemption of income of company incorporated and resident in Singapore arising from funds managed by a fund manager in Singapore. It deals with companies that are incorporated in Singapore and are tax residents of Singapore. This onshore fund must not be wholly owned by Singapore investors. The fund manager must be Singapore based and holding a CMS license. Only non-qualifying investors (i.e. Singapore non-individuals with investments above a certain percentage) would need to pay a penalty based on a formula prescribed in the Income Tax Act. The annual fund expenditure needs to be at least SGD$200,000. Annual statements are required to be sent to investors and non-qualifying investors will need to file taxes with the Inland Revenue Authority of Singapore (IRAS). The fund will have to file taxes with IRAS.

On top of the exemptions laid out in these sections, the Financial Sector Incentive (FSI) scheme also reduces the income taxes on the fee income earned by the fund manager from the typical corporate tax rate of 17% to 10%. The qualifying criteria for this scheme would be that:

- the fund manager must hold a CMS license;

- the fund manager must employ at least three experienced investment professionals with a monthly salary of at least SGD$3,500;

- the fund must have assets under management of at least SGD$250 million.

As you can see, the tax treatments for funds are very attractive. Moreover, Singapore has extremely strict anti-money laundering laws and companies and funds from Singapore are generally seen in a more credible light as say those that come from the Cayman Islands and the British Virgin Islands.

A vaccine may come sooner than perhaps initially expected

With very much every biomedical lab in the world racing to develop a vaccine against COVID-19, the coordinated response has been rather impressive. Although typically vaccines do take about a year and a half to be developed and to undergo the necessary trials to ensure its safety, this process is being sped up all around the world. Both the Chinese and American administration are trying to outdo each other by coming up with a safe and working vaccine first and this could bode well for the health of humanity. We could never underestimate the fact that a working vaccine may be developed earlier than expected.

The economic fallout from COVID-19 is horrible and it should get a whole lot worse before it starts to get better. At the end of it, Singapore would be in a much weaker financial position considering how much we dipped into our reserves. Despite this, Singapore is not saddled with an alarming amount of debt due to our expenditure from COVID-19. However, the government will be wary that it will have to implement countercyclical fiscal and monetary measures to top up the reserves to prepare for the next rainy day. In spite of all the doom and gloom, perhaps Singapore stands to come out of this recession in a much better position than many other countries in the world.

Yours Sincerely,

p.s. I am not advocating that all is well and that we should be rushing out to buy Singapore property and stocks. I am just trying to temper the possible unrealistic expectations of some who might be thinking that there are no redeeming factors for the Singapore economy. I do still think that this recession is going to be the most challenging in Singapore’s short history but just because a recession is going to be perhaps three times as bad does not correspondingly result in a fall in asset prices three times worse than the previous recessions.