To put things into context, Chocolate Finance is not a bank. They do not have a banking licence. They have a Capital Markets Services Licence issued by the Monetary Authority of Singapore. This allows them to do fund management. They are also an Exempt Financial Adviser. This allows them to advise on investment products. Namely, collective investment schemes.

For starters, let me explain how a bank works when you put your monies the bank. For example, DBS is a bank. When you place SGD$100 with DBS, that $100 does not belong to you. In fact, when you open up the DBS app to check your balance and it shows SGD$100, that is not monies that belong to you. That is a debt that DBS owes to you. Therefore, when you put say SGD$150,000 in your bank account with DBS, DBS owes you SGD$150,000. In the event that the bank goes bankrupt, you are a creditor of the bank. You will rank equally with all the other creditors. In this case, if your friend has a bank account with that bank, he will also be a creditor, just like you. Hence, if upon bankrupcy. the balance is only sufficient to return half of what all the bank owes to all creditors, then all creditors will only get back half of what the bank owes them. All depositors rank equal. In my example, you will get back SGD$75,000 of the SGD$150,000 that you placed in the bank.

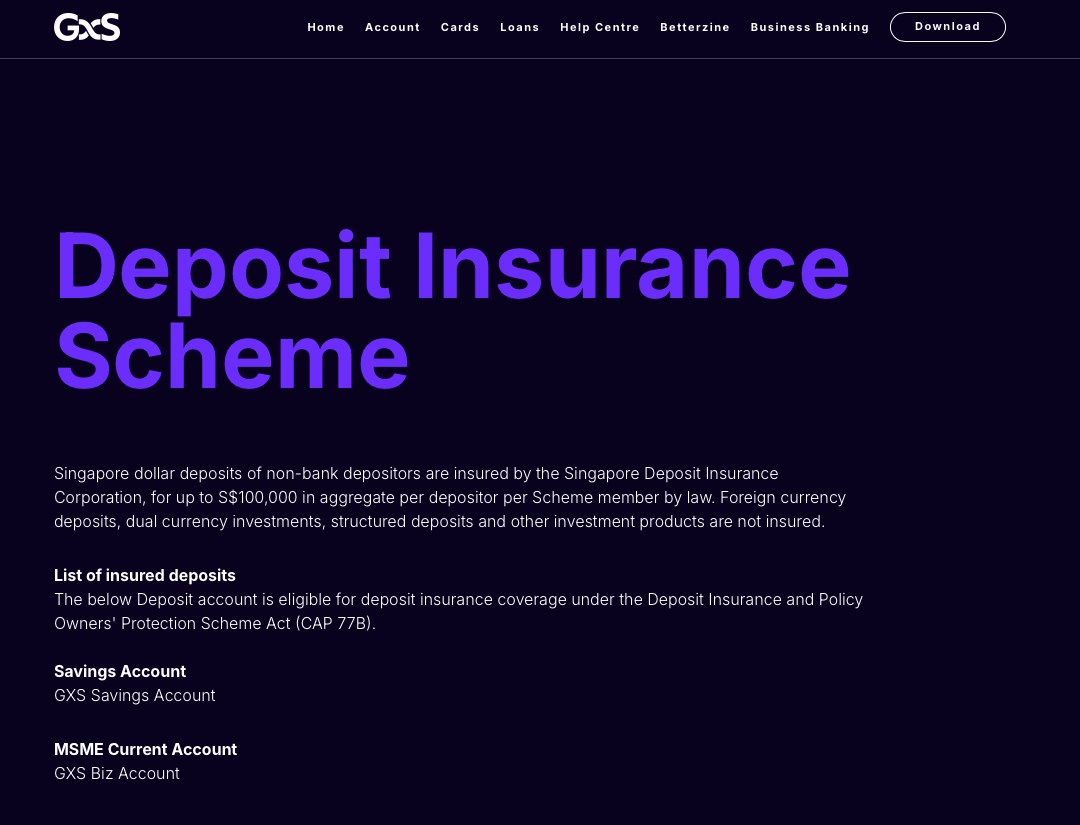

Singapore has a Deposit Insurance (DI) Scheme. This protects insured deposits held with a full bank or finance company. The maximum that will be compensated is SGD$100,000. In my example, you will get back SGD$100,000 of the SGD$150,000 you placed with the bank.

If you want to learn more about the DI Scheme and who and what is covered, you can refer to the frequently asked questions on the SDIC website.

The Chocolate Finance platform works similar to how a digital bank operates. You put the monies with them and they provide you with an account. To most, it looks and feels like you are banking with a bank. However, you are not. Therefore your deposits with Chocolate Finance are not covered by the DI Scheme.

So how did it all start?

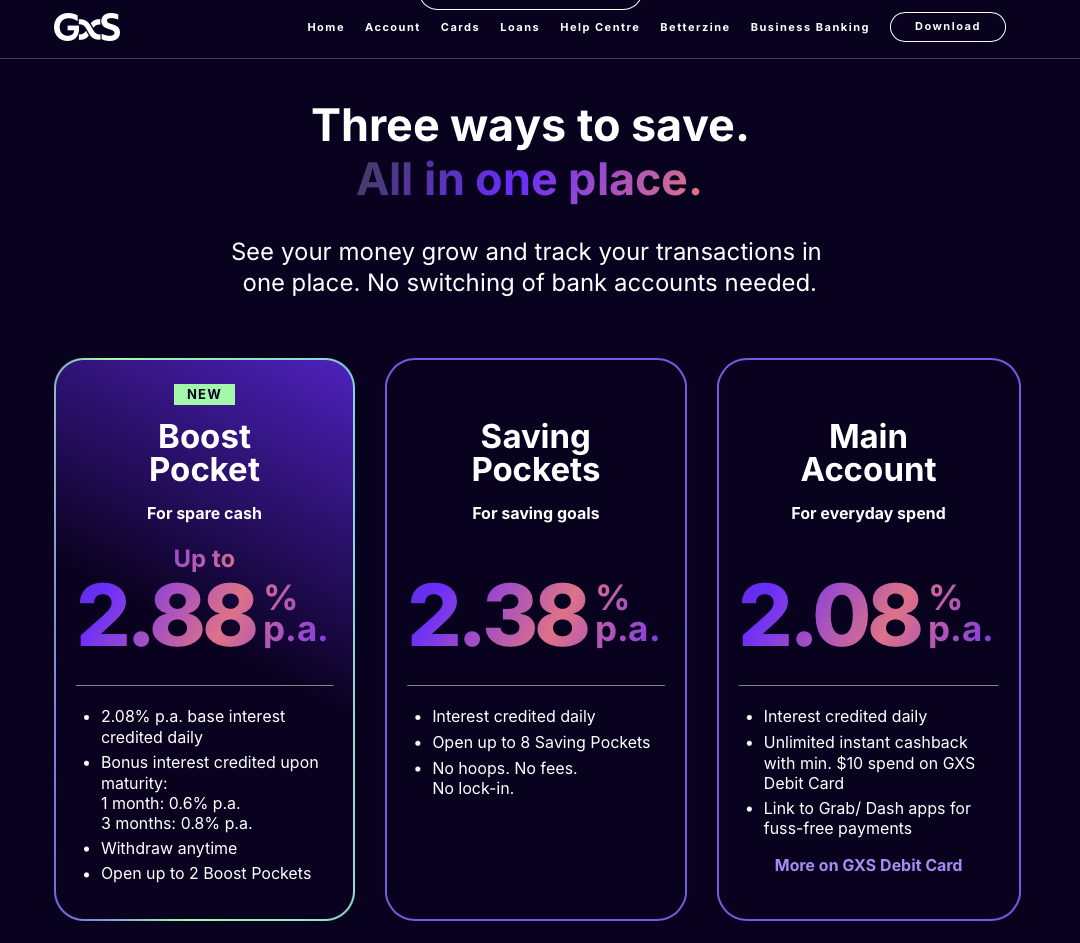

Chocolate Finance gave attractive terms to depositors who placed their monies with them. As of today, they are offering 3.3% returns per annum (p.a.) for the first SGD$20,000 placed with them. This is very high. As a point of comparison, a digital bank like GXS, which is by Grab and Singtel is offering up to 2.88% interest p.a.

(Update: At one point in time, they were offering 4.5% returns p.a.. I believe also on the first SGD$20,000.)

The difference, to me, is that GXS is a digital bank and Chocolate Finance is not. This is on GXS’ webpage. This cannot be placed on Chocolate Finance’s webpage because monies placed with Chocolate Finance cannot be covered by the DI Scheme as Chocolate Finance is not a bank.

However, the key benefit was Chocolate Finance’s miles rewards when you used their debit card. Their debit card is called The Chocolate Card. It boasted zero FX fees and 2 Max Miles for every SGD$1 spent. The key was that it allowed users to earn miles when they paid their bills on the payment platform, AXS. This was a major differentiating factor when comparing The Chocolate Card to other debit card rewards.

I do not think that you can earn miles off many cards while making AXS payments. When a debit card is used to make payments, there is a fee that is paid to Visa or Mastercard. Visa or Mastercard will then share that fee with the card issuer. The card issuer can then use that amount of money for their incentive programs.

In this case, AXS transactions do not attract any fees that are payable to Visa or Mastercard. Therefore, the card issuer, in this case Chocolate Finance, will bear the cost of the miles that will be issued to the card holder. I believe that Chocolate Finance’s strategy was that Chocolate card holders would not only use The Chocolate Card on AXS payments but also on other payments. However, the main reason why people signed up to The Chocolate Card was to make payments on their bills on AXS. Let’s call this the AXS-miles advantage. That was the main draw and that was how the card was promulgated to the public. Even if Chocolate Finance did not aggressively promulgate the AXS-miles advantage on The Chocolate Card, they did not set any limit to people who, according to them “gamed” the system. My question to them is, “how is that gaming the system when it was one of the functions of The Chocolate Card?”

In fact, six months ago, Chocolate Finance was featured on CNBC and the CEO was asked whether what he was offering was too good to be true. He was also asked about whether deposits are protected. To me, he did not answer the question directly. I saw this interview as rather confusing as the CEO did not seem to have direct answers to the questions which were posed to him.

Now back to my question, “how is that gaming the system when it was one of the functions of The Chocolate Card?” It is like you going to a buffet like Swensen’s Unlimited and then constantly choosing the most expensive item at the buffet to put on your buffet plate. For example, if you serve up snow crabs at a buffet and it is clear that that is the most expensive item at the buffet, you cannot tell customers that they should not take too much snow crabs as that is gaming the system. Also, when you remove the snow crabs from the buffet, it is expected that the number of people who will come to your buffet will drop. Therefore, when Chocolate Finance removed the AXS-miles advantage on The Chocolate Card, they must have expected that customers will no longer want to place their monies with Chocolate Finance. Anyway the main motivation for perhaps a large number of users of The Chocolate Card is the AXS-miles advantage. Then how can they say that they cannot handle the large number of withdrawals? You saw how fast you grew when you offered the AXS-miles advantage. Therefore, it would be reasonable for you to see an equally fast withdrawal of deposits from customers when this was removed.

This is a fintech company that has all the available information at its fingertips. It could see how many users were taking advantage of this AXS-miles advantage. It would have enough information to be able to anticipate the backlash when the AXS-miles advantage was taken away.

So why did Chocolate Finance come up with the AXS-miles advantage?

The way Chocolate Finance makes money is by using the monies that customers placed with it to make investments. Just like what I explained earlier. That money that you place with Chocolate Finance does not belong to you once you transfer it to Chocolate Finance. That is a debt that Chocolate Finance owes to you. Therefore, the moment that you pass the money to Chocolate Finance, it can use the money to make investments. If the market is buoyant, then the profits from these investments will make enough to cover the miles needed to be distributed to the users as well as the 3.3% p.a. returns that it needs to pay to depositors. Do not forget that Chocolate Finance still needs to generate money for its operations. Operations like the cost of maintaining its servers, salaries, rent, etc… The thing about every market is that there are always times where almost everything you purchase goes up. However, every market will inevitably go through corrections. If you are a participant in the market then you can only follow the market. You may be able to beat the market but your earnings will be closely pegged to how the market performs. For example, if the general market is giving returns of say 5% and your portfolio produces a return of 8%, you would have beaten the market. There will be times when the market is in negative territory of say -2% and you make a return of say 1%. You would still have beaten the market.

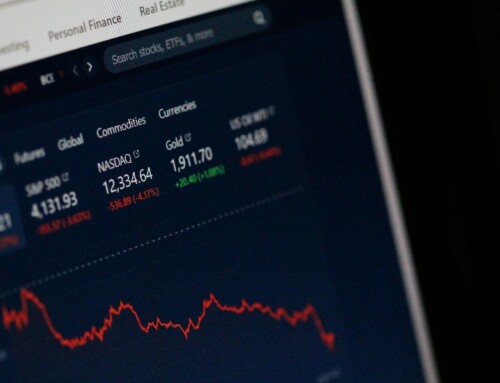

Look at the stock markets for the last two months. It has been easing off. Mainly due to uncertainty from all the tariff threats from the new US president. If you are Chocolate Finance and you need to make enough money to cover the promised 3.3% returns, provide the miles rewards and maintain operational costs, that is a tall order. In fact, in retrospect, I think they could have lowered their returns to just above 2% and depositors may not have left the platform in such haste. The question now is whether Chocolate Finance has sufficient monies to return everyone’s money if every one with deposits demands their money back.

The statement that Chocolate Finance put up on its website says little as to whether they have sufficient monies to return all deposits. It only states that the investment funds are secure and ring fenced. This just means that if Chocolate Finance received SGD$100 million, they could have invested this SGD$100 million. This SGD$100 million is secure in a sense that it cannot be used for any random purpose except within a certain mandate. In this case, that mandate is likely to be investing in various assets. The company cannot, for example, use this money to say hold a year end party for its employees. In the event that the market tanks say 20%, that SGD$100 million would become SGD$80 million. It would still be secure and ring fenced. However if everyone came to Chocolate Finance to withdraw their monies, then they may not have enough to return that SGD$100 million.

Let us consider the fact that not everyone withdraws their money. Perhaps only half do so. That would mean that SGD$50 million would be withdrawn, leaving SGD$30 million. That would leave a deficit of SGD$20 million. The market has to perform very well for that SGD$30 million to increase in value to SGD$50 million to ensure that all deposits are matched dollar for dollar. Judging from the recent market turmoil, this seems like a tall order.

The Chocolate Finance saga has highlighted one thing to the general public. There is a difference between companies like Chocolate Finance and traditional and digital banks. Banks are covered by the DI Scheme whereas companies like Chocolate Finance are not. This is something that the general public should know.

One more thing… if it is too good to be true, it probably is.

Yours sincerely,

Daryl