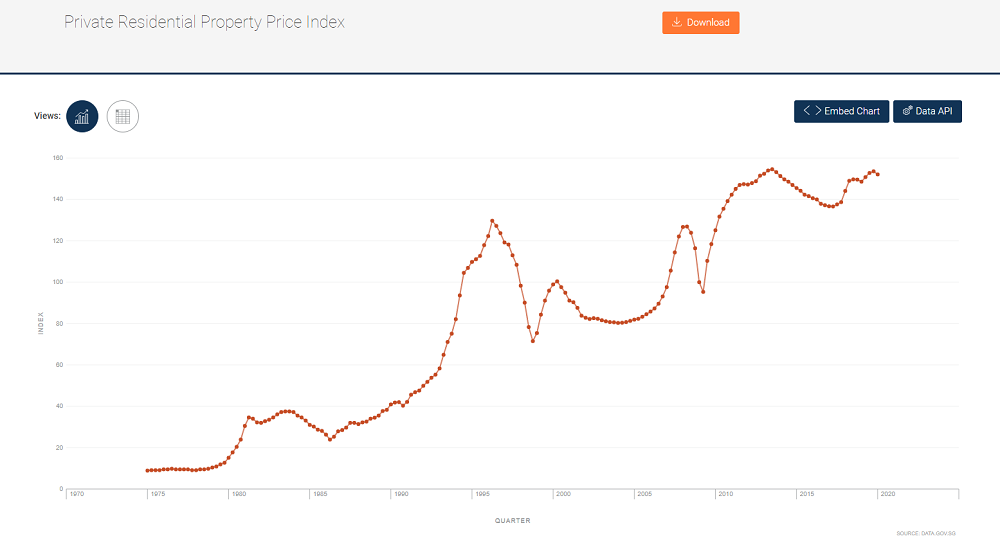

I personally have been in the real estate industry since the early 2000s. Over these two decades, property prices have gone up a great deal. Looking at the Private Residential Property Price Index, if one had bought a property in the early 2000s and held it till today, despite the ups and downs, the property would have almost doubled in value.

Private Residential Property Price Index (Source: Data.gov.sg)

This is one of the reasons why property investment is such a hot topic in land scarce Singapore. Many would be property investors look at past historical data and yearn for their pot of gold in the property market. To truly understand the mindset of property buyers, we will need to hold on to the concept that buyers buy property for their own use and/ or for investment.

Early on, most property buyers were more concerned with buying a property for their own use. Buyers would look to buy a property close to where they are familiar with, perhaps close to their parents. They may also want to purchase a property that can accommodate their parents, a helper and a study room. For those who could afford condominiums, it was not uncommon for them to purchase a condominium based on their lifestyle. For example, those who enjoyed playing tennis would seek out condominiums with tennis courts. In the past the train network was less extensive and it was less common to hear buyers purchasing a certain development to ride along the price increase when the area undergoes some transformation. The fact is that early property buyers did not have to do much homework when it comes to securing a property that would increase in value over the next 20 years. The Singapore government did it for them and overall just about every property that was purchased in the early 2000s is sitting on a sizable profit.

Fast forward 20 years later and here we are in year 2021. Property prices have almost doubled according to the Private Residential Property Price Index. While we are in the middle of a global pandemic and facing the worst economic contraction in independent Singapore’s history, we are still seeing property prices increase. Based on the index, the dips in the property prices accompanied periods of economic contractions. The mid-1980s, the ’97 Asian Financial Crisis, SARS, the dotcom bubble and the terrorists attack in early 2000s and the Global Financial Crisis in 2008. Yet despite the extremely bleak economic figures, property prices are still increasing. So what has changed?

1) The Singapore government is now the key driver of asset prices

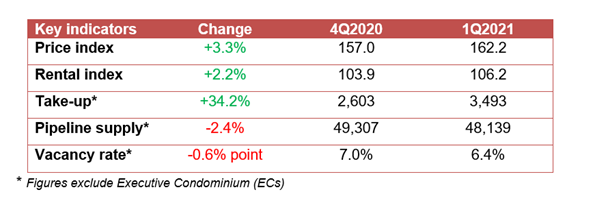

Without the huge unprecedented budgets to try to save jobs and prop up the Singapore economy, the unemployment numbers would be a lot higher and there is no doubt that asset prices, like property prices, would have fallen. There is a corelation between unemployment and property prices. Schemes like the Jobs Support Scheme, and the SGUnited Jobs Initiative helped keep unemployment low. In my personal opinion, artificially low. With jobs and salaries secured and with little to no opportunity to spend all this income on international travel, this money had to go somewhere. To some, this was the opportune time to enter the property market. The notion that if even a major recession cannot damper the property market thus think of where prices could go when the economy opens up was born. The result was a 3.3% increase in the Private Residential Property Price Index in the 1st quarter of 2021.

1st Quarter 2021 real estate statistics (Source: URA)

There is currently much talk about more cooling measures coming onboard to try to counter the rise in property prices. If you were to identify the last period that the property price index fell for an extended period of time, i.e. 2013 to 2017, that was the result of several rounds of property cooling measures by the Singapore government. The key now is not to identify when there is a recession but instead identify the policies by the Singapore government that may support, boost or damper property prices.

2) More property buyers are focused on property as an investment tool rather than for their own use

It is rare to see property buyers sounding out requirements like, “the common rooms should be able to fit a queen sized bed each”, or that the property should come with a helper’s room as the family has a domestic helper. The main motivation for buying a property for quite a large proportion of property buyers is that they can cash out of the property at a later date for a tidy profit. This is why there is so much focus on the Masterplan of certain areas. The potential transformation story of certain areas to become the next satellite business district has pushed property prices up significantly. Some prices around the Paya Lebar areas have even crossed the $2,000 per square foot mark for 99-year leasehold developments (Park Place Residences and Parc Esta). Buyers today are more receptive to living in places which they are less familiar with. As they are more mobile, the pool of potential buyers for each particular area is also widened. It does help that Singapore’s transportation network is getting more comprehensive over time.

3) Incomes have risen

I say this with a caveat. Even though incomes have risen across the board, they have not risen as much as asset prices. Property prices are increasing at a much faster pace as compared to incomes but this is a phenomenon that is not unique to Singapore. In many global cities, due to the huge swathes of government stimulus asset prices inevitably will rise. I do not envision that the situation in Singapore will become like that of Hong Kong where a large proportion of their educated population find it difficult to afford their own property. However, Singapore getting just close to such a scenario will not be ideal as well. With million dollar HDB prices getting increasingly common (there were a total of 82 of such transactions in 2020 compared with 64 in 2019 despite the COVID-19 pandemic), we can never be sure that property prices will stay affordable always.

4) Family units have changed

Despite the government’s efforts to raise the birth rates, family sizes have been shrinking. Due to the affluence of a more educated workforce, incomes are higher and many households may chose to have their own private space instead of living with their parents. There is common mindset of young couples purchasing a Build-To-Order (BTO) flat from HDB, selling it off for a tidy profit after fulfilling the Minimum Occupation Period (MOP) and using the profits to place a downpayment for a condominium development to ride the property price wave. It has worked for many buyers before and some are basing their plans on past market performances.

My take on all this is that property prices in the next 20 years will not see the same growth as compared to the previous 20 years. The private property price index in Q1 2021 was at 162.2 when the index in Q1 2001 was at 91.1. This represents a 78% price increase in the last 2 decades. Yet if we compare the private property price index growth in the previous 2 decades, i.e. Q1 2001 at 91.1 versus Q1 1981 at 32.2, that represents a 183% price increase in the same period of time. Moving forward, it would be prudent for buyers to understand that price increases and the story to financial riches may not be exactly the same as what it was before. The profits that can be eeked out in the property market for the next two decades should be less than the 78% price increase in the 2 decades that just preceded us. If you couple that with the large amount of stamp duties and the weak rental yield, buyers may not be making as large a profit as they may they they could.

My advise to property buyers would be to go back to the basics of why people bought a certain property. Identify properties that fit your family’s needs and not just because you think the property will make you money in the future. The holding period for you to make a profit on your property purchase should be longer than before moving forward. You should be comfortable both physically and financially with the property that you are buying.

Yours sincerely,

Daryl Lum