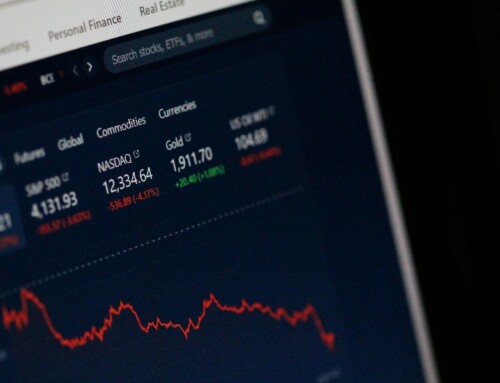

Unless you have been living under a rock, you would be aware that the US president Donald Trump imposed “reciprocal” tariffs to just about every country around the world. The goal is not clear. Are the tariffs a negotiating tactic or are they here to stay and no negotiation will be able to veer Trump off this course. This is the reason why the stock market is plunging. For context, this is the S&P 500 since Liberation Day on 2nd of April 2025.

For the past few trading sessions, the overall stock market in the US and over the world have been plunging. In essence, losing trillions of dollars in value over a matter of days.

Liberation Day was the day that Donald Trump announced his sweeping tariffs. As referenced earlier, this was on the 2nd of April 2025. What was he liberating the Americans from you might ask? Perhaps the Americans were liberated from being able to purchase goods from all over the world.

Why a stock market plunging is worrying for many Americans is multi-fold. The immediate concern are for those looking to retire. In the US, many Americans plan their retirements by using their monies in their 401(k) account to invest in stocks. Generally, the monies in this account can only be withdrawn, penalty-free, when the account holder reaches 59 1/2 years old. For those who are reaching this age, to see their stock portfolio plunge overnight is extremely worrying. This means that they will have less monies for their retirement.

The next immediate concern are rising prices. One can appreciate that Trump is trying to force manufacturing and production back to the US. However, if you tax imports like coffee, there is no way that Americans can immediately produce coffee once these tariffs kick in. What will happen is that coffee imports into the US will be hit with a tax. Hence, if you are a coffee importer in the US and you buy USD$100 worth of coffee from Vietnam, once that USD$100 worth of coffee reaching the US port, the US tax department will hand you a bill of USD$46 as the tariffs on Vietnamese products is 46%. This is an oversimplification of the process. There is usually a declaration procedure where the importer has to fill in a form before the bill comes but you get the point. To those Americans who think that prices are not going to rise, you are going to realise that what you think is not going to happen.

The tariffs are not really reciprocal

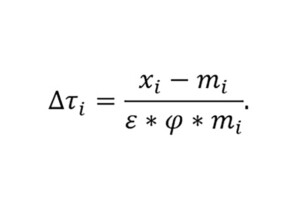

Trump mentioned that it cannot get any simpler than the US merely taxing others what others are taxing them. In fact, Trump mentioned that he is merely taxing the other party approximately half of what they impose on the US. However, this could not be further from the truth. This is what they came up with:

I will let CNBC explain this formula to you. I will not belabour the point.

The essential part of this formula is that it takes into account the trade deficit with a particular country and includes it in the tariff calculation. This is how Vietnam got hit with a tariff rate of 46%. For the record, Vietnam does not impose 92% tariffs on the US. It never has. However, Vietnam racks up large trade surpluses against the US. Hence, there is clearly a trade imbalance in favour of the Vietnamese. The US buys more goods from Vietnam as does Vietnam from the US.

Is it possible to have a perfect trade balance?

This is what Donald Trump wants. He wants there to be no trade imbalances. He equates trade imbalances with tariffs. If you sell more goods to us than we to you, you are imposing tariffs on our goods. However, it is not that simple. Trade imbalances are part and parcel of global trade. It is a principle and the bedrock of how goods and services flow around the world. Imagine a scenario where there are perfect trade balances. This is before the advent of money. Barter trade dictates that I give you what I have in exchange for what you have. Hence, in the past, before there was the concept of money, if I grew rice and my neighbour grew vegetables and I wanted vegetables and he wanted my rice, I could exchange some of my rice for his vegetables. This is only workable if both parties have what each other desire. In the case where I want his vegetables but he does not want my rice, I cannot barter trade with my neighbour. The only way to get vegetables would be to look for some other person who has vegetables and is willing to trade for my rice or I had to grow my own vegetables. This is where money comes in. Money is useful because it acts as a store of value. Therefore, I can sell my rice for money to someone who wants to buy it. The money, as a store of value, can be used to buy the vegetables that I want. What this means is that I can just focus on growing rice. If I keep growing it and trying to improve my growing practices, I will get better at growing it. I do not have to divert my resources to growing something that I am less good at. This is the basis of global trade. Every country focuses on what it is good at and we use money as a store of value to trade with each other.

What Trump wants is akin to a reversion to barter trade. You have something that I want and I am going to buy it from you. In exchange, you must buy something back from me with at least the same value of what I buy from you. Alternatively, since you have something that I want and you do not want to buy things from me or at least of the same value of what I am paying you, then I am not going to buy it from you. I am going to produce it in the US.

I have this analogy to him and his advisors. I go to my. hairdresser for a haircut every 6 weeks. I pay her money for the haircuts but she does not buy anything from me. I have a trade deficit with my hairdresser. That does not mean that I stop going to get my haircut and cut my hair by myself.

The concept of no trade imbalances against the US is impossible. This will never happen because globalisation and specialisation dictates that certain countries will buy more of certain goods and services from others and vice versa.

Can there be a way for countries like Vietnam to rectify the trade imbalances to go to a zero tariff rate with the US?

Of course Vietnam would want there to be no tariffs on the products they sell to the US. However, the reason why the US is buying products from Vietnam is because Vietnam is producing these products very cheaply or that certain produce grown in Vietnam is desirable to US consumers because of certain characteristics. For example, Nike makes its clothing in Vietnam because they are cheap. The reason why Americans buy products from Vietnam and China is because of price. They are cheap and generally of good quality. Even if the quality may not be as good as if the product was made in the US, the American consumer is ok with that because of the low price.

Can the US shift manufacturing back to the US and make the US a manufacturing superpower and yet keep prices low?

The strict answer to that is no. There is no way Trump can get factories to shift from places like Vietnam and China to the US and have these factories produce their products at the same cost as before. This is because the working conditions in Vietnam and China are so much worse compared to the conditions in the US. Running sweatshops are cheap. Workers are not unionised and hence you can work them to the ground. Long hours, low pay and little regulation may sound wrong to these workers but the truth of the matter is that consumerist countries like the US love products made in this manner because they are cheap. Look at US culture. It is a consumerist one. You look at TV shows and the rooms are filled with stuff. The US consumer loves shopping and the world loves producing goods for the US. If the US were to domicile all manufacturing, it is likely we will see products that are much higher than they are now. This is because there are proper labour laws in the US. Workers are unionised and hence if conditions are not ideal, workers go on strike or start negotiating for higher pay or better conditions. In the worst case scenario where we take the ends of the spectrum, imagine a dilapidated factory in Vietnam that employs extremely poor workers and even child labour (I am against such exploitation. I am just using this as an illustration). Now imagine a factory in the US. Do you see the same dilapidated factory with such impoverished workers or do you see the possibility that the workers in the US know their rights and are part of unions? There is no way you can produce an iPhone in the US at the same price as you once did in China. Trump is not going to be able to make American manufacturing great again because in most cases, the jobs are gone forever and will never come back.

Let us analyse the reason why the US runs so many trade deficits with so many countries around the world

One of the main factors driving the trade deficits is the strength of the US dollar. The US dollars strength causes its goods to feel relatively expensive by foreign countries. On the flip side, the people in the US holding US dollars will feel that products from outside of the US are comparatively cheap. The means that more people in the US are buying foreign products than foreign countries buying US products. The main reason why there is a constant strong demand for the US dollar is because of its role as the reserve currency in the world. The US must decide whether it can accept a scenario where the US dollar is no longer the reserve currency in the world and no longer enjoy such demand. In my personal opinion, the US will not want this to happen and it also cannot afford to do. Ceding the US dollar’s role as the reserve currency would mean that demand for its bonds and securities will not be as high as before.

It is because of this that the US runs trade deficits. So make no mistake that the trade deficits are not of the foreign country’s own making. The US dollar does contribute to this situation as well.

The question is whether there is any logic to this madness.

Now there could be. Trump’s advisors are likely to be steeped in economic knowledge as well. They would have made their calculations as well. They are likely to know that the tariffs would elicit a negative response in the stock market. It is unconceivable that they would not know this. So let us try to find some sense in what seems like a whole load of nonsense.

Imagine the scenario where the Vietnamese coffee exporter exports 100% of his coffee to the US. In that case, when the US government slaps a 46% tariff on the coffee, it is likely that his US importer will not want to pay an additional USD$46 on top of every USD$100 worth of coffee. In this case, if the Vietnamese coffee exporter only has one client and that is to that US importer, then the US importer not buying any coffee from him would be extremely detrimental to him. What he could do would be to lower the price he sells his coffee to the US importer. For example, instead of selling the same amount of coffee for USD$100, he could sell it for USD$70.

In this case, after the tariff, the coffee would cost:

$70 + (46% x $70) = USD$102.20

This would not make much of a difference and the US importer can leave the price relatively the same. In this case, the cost of the tax will be born solely by the Vietnamese coffee exporter. Instead of collecting USD$100 for that amount of coffee, he collects USD$70.

However, the truth is perhaps somewhere in between. The Vietnamese exporter is likely to have other parties he can sell his coffee to. In this case, he is likely to maybe reduce his price less than the USD$30 that would keep the eventual price somewhat similar to before the tariff. Say he lowers the price to $85.

In such a case, after the tariff, the coffee would cost:

$85 + (46% x $85) = USD$124.10

In such a scenario, it would be unlikely that the US coffee importer would agree to keep prices stable as he is paying approximately 24% more for the same amount of coffee post-tariff. He can then pass on the cost to the US consumer. Hence, coffee prices in the US are likely to increase.

I think there is some benefit to tariffs. Yes, free trade protagonists will argue that all tariffs are protectionist in nature and are bad for free trade. However, protectionist measures do help to shield certain local industries which otherwise would be decimated by the availability of cheap goods from countries like Vietnam and China. However, not everything needs to be produced in the US. Moreover, what industry are you trying to protect if that industry was never there in the first place?

Let us take a ridiculous example. Let’s say the US imports Mao Shan Wang durians from Malaysia. Imagine if the US sets a tariff of 24% on these durians. What is it trying to achieve? Can the US actually produce its own Mao Shan Wang durians from Malaysia? It does not have the climate and expertise to do so. Even if it did, it takes approximately 8 years for a tree to bear fruit. For these 8 years while the US is waiting for the newly planted trees to bear fruit, its consumers will have no choice but to continue buying Mao Shan Wang durians from Malaysia. This is exactly why Singapore welcomes so many products into our country. This is because we do not have the capacity to produce those products!

Trump is taking a broad brush approach. He levies a flat tariff for all goods coming into the US from a certain country. If he were concerned with the trade deficit, would it not be ideal to actually understand why there is a trade deficit? There are reasons for running one especially when there are goods from a certain country that cannot be produced in the US for legitimate reasons. Just like me not wanting to cut my own hair, Trump has to ask himself whether his US workers want certain jobs. Remember this fact: when China was producing low value products like shoes and clothes, there was a lot less clamour from the US than when China started producing its own chips that goes into smartphones. Remember the ban on Huawei? Was there ever a ban on shoes?

So what should the US have done?

When it comes to a policy that affects the global economy, the precision of a sniper is favoured over firing a bazooka. It should have identified industries it would have liked to protect and domicile. For example, it is possible and arguably ideal to domicile car production plants in the US. The same can be said for the production of computer chips. However, to levy a 46% levy on Vietnam is just pure wrong. Which of Vietnam’s industries do you desire to domicile in the US?

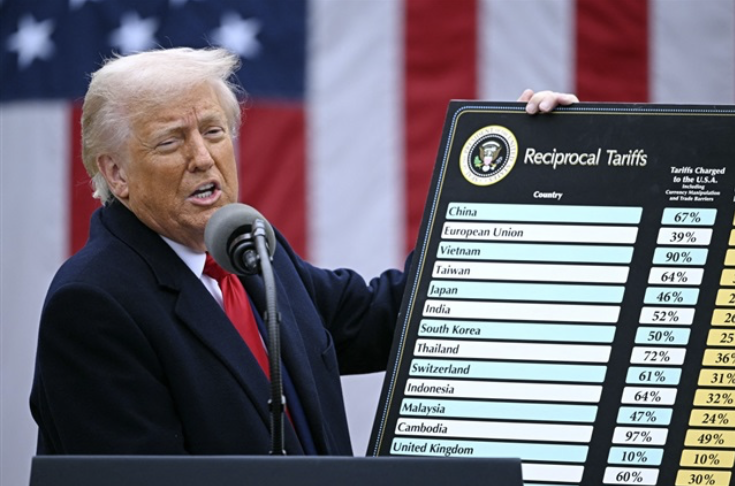

So why did Trump do it?

Perhaps it was to show off that big beautiful chart…

Well done Trump! It is a really well made chart.

Yours sincerely,

Daryl