I have not done a review on a new launch in Singapore for some time. I find prices have gone far ahead of fundamentals. Not that you cannot purchase property at this juncture. However, if prices are high, you will need to purchase a property with unique selling points (USP). This USP cannot be conjured up when there is none. Things that were previously deemed unique may not be so now. An example of this would be when I bought my first car approximately 20 years ago. Back then, motorised windows were not standard options on all vehicles. Yes, we had manually wound windows. Hence, when my vehicle came with motorised windows on the front doors, it was advertised as a selling point. Similarly, in today’s day and age, condominiums come with a wide array of facilities. Hence, buyers are very seldom drawn to specific facilities within a particular development. Cycle through all the latest new condominium launches in Singapore and you will see that most of the facilities are by and large similar.

Location is not as poignant a selling point as before. With the proliferation of MRT stations across the island, many developments are “minutes walk to MRT”. The question is usually “how many minutes, really?” but many buyers do not ask that question. They take it as gospel truth that the number postulated on the brochure is accurate. There has to be a standard of measure. In most cases, flip out your phone and use Google Maps. If you use Google Maps consistently to determine how far a development is to the train station, then this consistency will provide you with a proper yardstick. Simple as it sounds but I do not believe that many buyers actually do this.

So what is a true USP?

Let’s focus on the word unique.

Unique stands for one of its kind. Unlike anything else.

As such, I find it hard to fathom how being 5 to 10 mins from the MRT station is unique. The term USP is a misnomer to begin with because there is almost nothing that one development has that is one of its kind. I mention this because I am trying to highlight how the various developments are so similar in their offerings. Basically new developments in Singapore are generally the same in terms of their facilities, layout and overall unit types.

So when is a development unique? Well, if we apply a strict definition of the word unique, then never. For those that come very close to being unique, one thing stands out. Integrated developments.

So what are integrated developments?

They are property developments where there is a residential component built in conjunction with a retail mall, a transport hub, possibly other amenities like a hawker centre and/or community centre. You like above and come down to a shopping mall, an MRT station, bus interchange and more.

The upcoming Parktown Residence is one such example. It is an integrated development located in Tampines. The condominium is named Parktown Residence, the retail mall below it is named Parktown. There is a transport hub below as well. There is an MRT station and an air-conditioned bus interchange. There is also a community club, a community plaza and a hawker centre. Oh and it is kind of linked to Tampines Boulevard Park.

How many of such integrated developments exist in Singapore? We speak of integrated developments being a residential and commercial development integrated with a transport hub. There are nine. They are:

- The Centris

- Hillion Residences

- North Park Residences

- Sengkang Grand Residences

- Compass Heights

- Pasir Ris 8

- Bedok Residences

- Park Town Residence

Details about the development

Parktown Residence is a 99-year leasehold development. The 99-year lease started from 9 October 2023. The total land area of Parktown Residence is 50,680 square meters. This makes it the largest integrated development out of the nine listed above. There will be a total of 1,193 units. Parktown Residence is jointly developed by CapitaLand Development, UOL Group Limited and Singapore Land Group Limited. Back in 2024, this consortium obtained this plot of land with a top bid that crossed the $1 billion mark. In fact, their bid was an eye-watering SGD$1.206 billion.

Here is the unit mix of Parktown Residence

1-Bedroom + Study, 43 and 47 square meters, 73 units

2-Bedroom, 55 square meters, 160 units

2-Bedroom Premium, 63 and 67 square meters, 292 units

2-Bedroom + Study, 71 square meters, 134 units

3-Bedroom, 86, 87 and 88 square meters, 135 units

3-Bedroom Premium, 98, 99 and 100 square meters, 158 units

3-Bedroom Premium + Study, 108, 109 and 110 square meters, 115 units

4-Bedroom, 124, 125 and 126 square meters, 57 units

4-Bedroom Premium, 138 and 139 square meters, 47 units

5-Bedroom, 156 square meters, 22 units

Where is the development located?

Parktown Residence is located along Tampines Street 62.

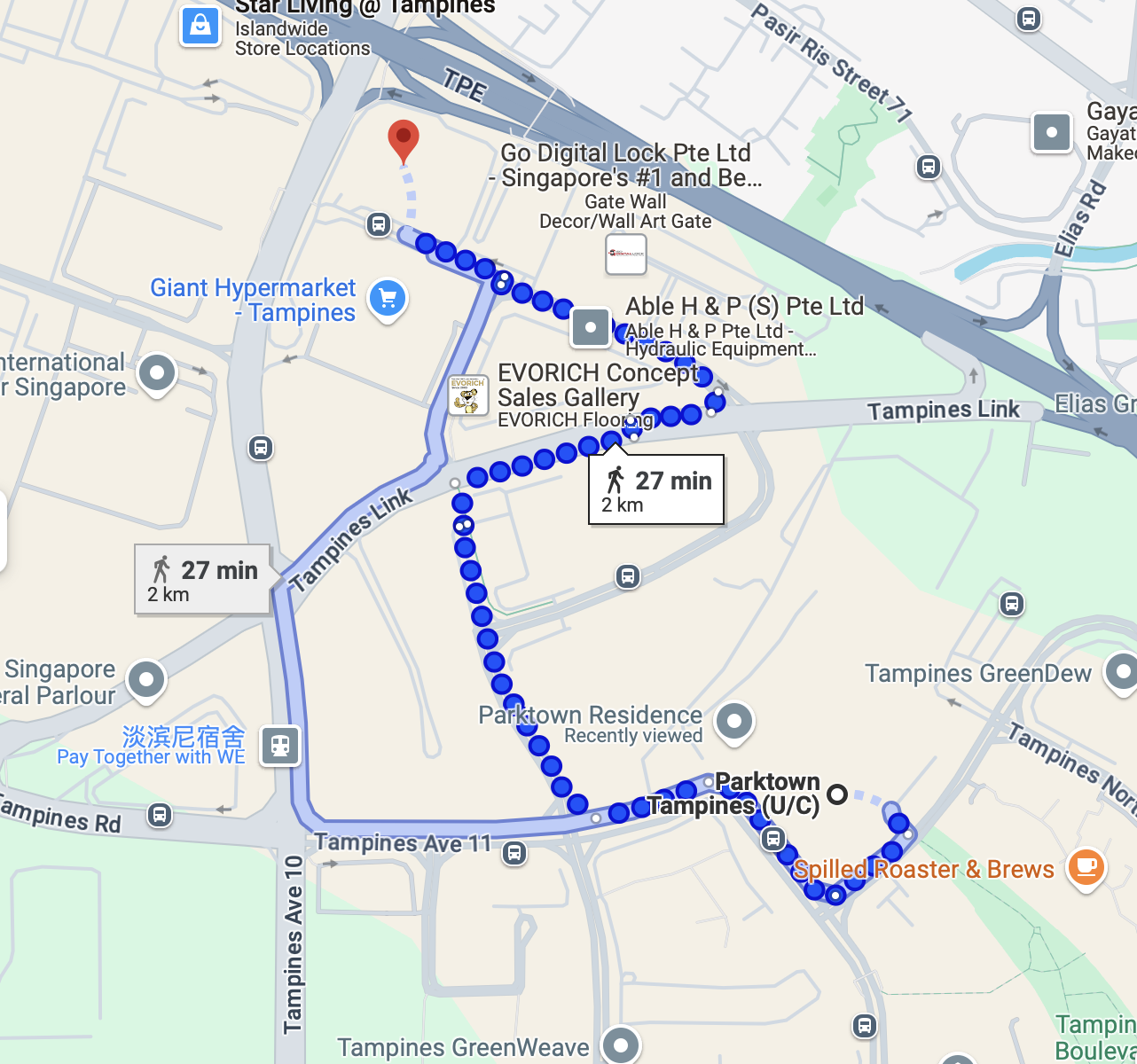

Parktown Residence Location Map

It is located close to Tampines Ikea.

Close to Tampines Ikea

Tampines is quite large so I believe this would serve as a point of reference. The Tampines North Interchange is a temporary one. Once Parktown Residence is completed, there will be an interchange located within the integrated development.

I would usually put up the walking time to the nearest MRT station and shopping mall. However, since Parktown Residence is going to be an integrated development, the MRT station and the shopping mall is located right below the development.

The MRT that is located within the integrated development is Tampines North MRT Station. It is the sixth station on the Cross Island Line. The Cross Island Line will run from the east to the west of Singapore. It will go through locations like Loyang, Pasir Ris, Hougang, Serangoon North, Ang Mo Kio, Sin Ming, Bukit Timah, Clementi and West Coast. It is slated to be the longest MRT line in Singapore with about 27 stations. It should opening in phases with Phase 1 going from Aviation Park to Bright Hill opening at around 2030. Eventually the Cross Island Line should be fully completed around 2040.

A point of interest might be how long it would take to walk to Tampines Ikea. In the vicinity is Courts and Giant as well. It would take approximately 27 minutes to walk to Ikea from Parktown Residence. The total distance would be 2 kilometres.

Who is this development for?

I’ve decided to ask this question in my reviews moving forward. This question is actually very important because who this development is for will also determine who you can possibly sell this property to in the future. How many times have I encountered a property owner and he comments, “I want to sell my property to a rich Indonesian!”. When I ask him where his property is located, he answers, “Woodlands!”. Really? You really think wealthy individuals will look at your overpriced property in Woodlands? Especially when they can buy property not only in Singapore but literally the whole world. Well, this development, Parktown Residence, is mainly for HDB upgraders. People who live in Tampines generally, from my conversations with the people I know who live in Tampines, want to continue living in Tampines. Tampines is an area that is littered with amenities. However, if this property is for HDB upgraders, then it bears considering that people who live in the HDB properties nearby are able to afford to upgrade.

When I mean afford, it does not mean that a property seller sells his HDB for a certain price and he can purchase a resale Parktown Residence for the exact same price. What I mean is whether the HDB upgrader has the cash on hand to make that leap. Let’s face it, our property market is living off leverage. Without housing loans, most, if not almost all buyers will not be able to afford to buy private properties.

A 2-bedroom unit, at launch would average at about $1.628 million. This is an estimation after taking the per square foot pricing to hover around $2,400 and multiplying it by 63 square meters (678.126 square feet).

A buyer will need to fork out 25% downpayment on that property assuming it is his first property. The cash component is 5%. The figures are as such:

5% cash = $81,400

20% CPF = $325,600

If you break it down this way, you will realise that the cash component is not prohibitively high. The thought of maintaining that loan over the span of up to 30 years seldom crossed any buyers’ mind. This is because we live in a property market where our primary property is seen not only as a place to live but as a form of investment that will be disposed of once the property has risen in value. In fact, many see their primary property as an investment first and a home second. This is what global inflation has done to the property market. Can the property market continue its upward trajectory? No one really knows.

So what are the transacted prices of HDB properties around Parktown? Currently, the highest price for a 4 room flat is $820,000. These buyers would have bought their flats for probably less than $500,000. This means that if they were to sell their flats, they would obtain in excess of $250,000 after accounting for CPF plus accrued interest.

Now you understand why the HDB upgraders are so essential to developments in the heartlands? It is not only important. It is essential. HDB upgraders free up cash when they upgrade from the flats that they obtained through the Build to Order (BTO) scheme.

So let’s consider a situation 5 years from now. Let’s say you as a buyer purchase a 2-bedroom in Parktown Residence. Now you want to sell it. What are the numbers you will need to crunch and can a HDB upgrader still afford it?

A 2-bedroom unit, at launch would average at about $1.628 million. This is an estimation after taking the per square foot pricing to hover around $2,400 and multiplying it by 63 square meters (678.126 square feet). This is the same calculation from above. Going at a conservative rate of a 2% increase in price over 5 years, This works out to be $1,797,444.

A buyer will need to fork out 25% downpayment on that property assuming it is his first property. The cash component is 5%. The figures are as such:

5% cash = $89,872

20% CPF = $359,488

Not much of a difference is it?

For the sake of this discussion, I know some are going to comment that this is not a fair comparison because going from a 4-room HDB to a 2-bedroom unit at Parktown Residence means losing one bedroom. I am just making this assumption that this is the typical “upgrade” route. Even though moving to something smaller is not something I would personally embark on. However, this is the feasible “upgrade” that I would think individuals could make because a 3-bedroom might be prohibitively high in terms of the loan quantum.

The selling points of the development

I’ve mentioned this at the beginning of this article. It is the fact that it is an integrated development. Oh and the largest integrated development out of the 9 integrated developments in Singapore.

Possible bad points of the development

The sheer size of the development. Imagine having to compete with so many landlords and sellers. The competition in the resale and rental market will be intensely fierce. This is why selecting a good unit if you have the opportunity to do so is so important.

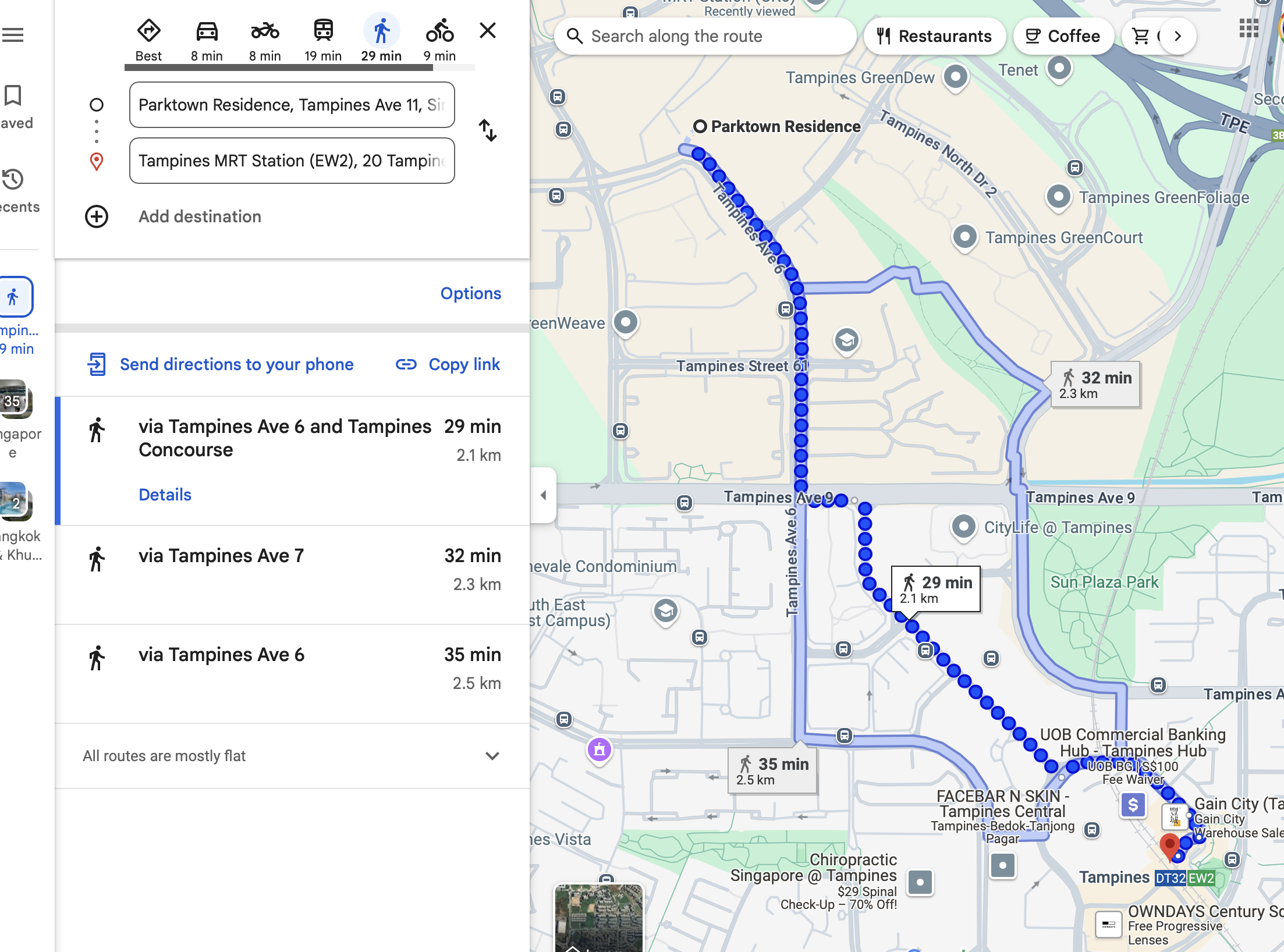

The Cross Island Line is also not up yet. You would have to wait till possibly 2040 for the whole line to be operational. It is also not exactly near Tampines MRT Station and Tampines Mall. It is approximately 2.1 kilometres away. Walking would take 29 minutes according to Google Maps.

I would think that the true benefits of the Cross Island Line would only be felt when it is fully operational. This is something that buyers need to consider when deciding to invest in Parktown Residence. I still find it peculiar when someone tells me that he won’t hold the property for long and hence the 30-year loan is inconsequential but then when the developer sells him a point that will only happen in the distant future, he does not reconcile that with his prior statement.

Also, another point to note is that there will be two executive condominiums (ECs) nearby. Aurelle of Tampines and Tenet. In the future, buyers have more choices when it comes to units in the vicinity. If they find the resale prices at Parktown too prohibitively high, they can always consider the resale units at these ECs. The prices should be lower as the buyers of these properties would have bought them at a lower per square foot pricing.

Parktown Residence

Pricing 3.5/5

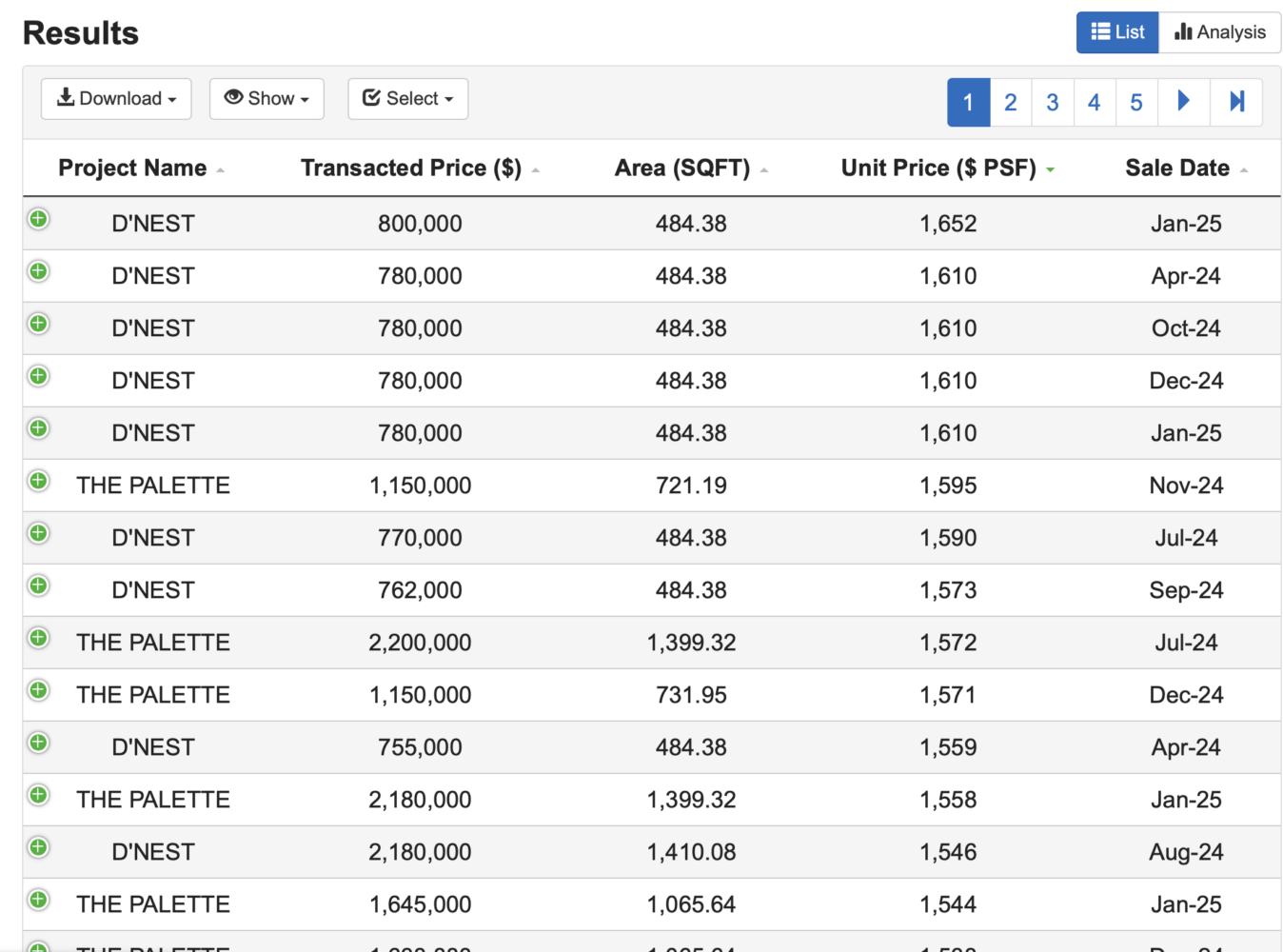

Indicative prices are around $2,400 per square foot. I do not have any nearby completed condominium development to compare this to. The closest ones are located in the cluster along Pasir Ris Grove. The premium on the launch price at ParkTown Residence is 50%. This means that if you were to enter the resale market and purchase a unit at D’Nest, the price per square foot is about $1,600. The premium on a new unit at ParkTown Residence is 50% as the indicative per square foot pricing is $2,400. Of course you would have to weigh the fact that you are getting a new property on a fresh lease and a condominium in an integrated development.

Location 4/5

For now, this is not higher than it could be because the train line is not up. Yes, granted that this will be the longest MRT line and it will be crossing Singapore from east to west but that is what the current east-west MRT line is already doing. What is to say that there will not be a long and more well connected train line in the future?

The main consideration for Parktown is the fact that it is sitting in an integrated development.

I have decided to not comment about quality moving forward. This is because quality is dependent on the actual completed product and my only way of rating an uncompleted development based on past developments. However, in this case, this is a joint development of three developers. It would be difficult to assess the product based off their portfolios. Moving forward, I believe that developers will typically jointly develop due to the high cost of land acquisition as well as gradual reduction of risk appetite in the market.

Yours sincerely,

Daryl Lum