The outbreak of COVID-19 around the world has caused many severe business disruptions as countries close their borders to try to limit the spread of the virus. In recent weeks, the negativity surrounding the global economy as a result of the virus has decimated stock markets across the world. It is no longer a question of whether there will be a recession but rather a question of how severe the upcoming recession will be. Many economists have remarked that this upcoming recession will be deeper than the 2008 financial crisis. I tend to concur with this notion as it seems like a perfect storm had been brewing and the virus seemed to have exacerbated the situation.

This is not something that can be resolved with fiscal or monetary policies

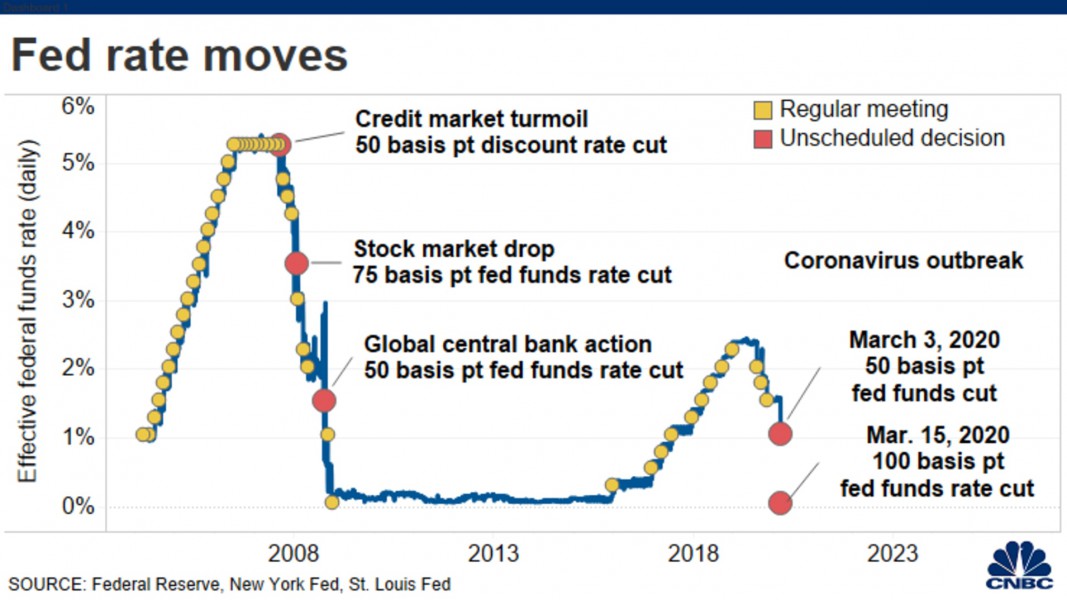

The onset of the 2008 financial crisis sparked off an interest rate race to zero. With monetary easing, the United States’ (U.S.) Federal Reserve (The Fed) lowered the borrowing costs of businesses and households to incentivise spending and investment. This time around, the COVID-19 virus caused The Fed to slash its fed funds rate to zero at an even quicker rate than the 2008 financial crisis. The irony of this was that stock markets around the world, the US stock market included, sold off sharply. The problem the world is facing is a virus and unless a vaccine is found or containment and quarantine efforts are effective, business activity is going to be subdued. No amount of cheap money is going to entice businesses to take on risk in today’s environment. In fact, when The Fed made its move to cut rates to zero, the U.S. stock markets responded by plunging even further.

Fed rate moves (Source: CNBC)

The recovery was led by the consumer and the consumer is afraid to go out and spend

Post-2008, the U.S. and most parts of the world experienced an unprecedented 11-year bull run when it came to equities and property prices. The bull run started on the 9th of March 2009 and during that time, major indices in the U.S. increased by about 400 per cent. Even without the coronavirus outbreak, the bull run was showing signs of slowing down or halting. Trade tensions between the U.S. and China were starting to escalate into a full-blown trade war and this only resulted in affecting consumer confidence as tariffs were levied on a whole array of goods. With the United Kingdom (U.K.) officially pulling out of the European Union (E.U.), many were wondering about the viability and effectiveness of the trading bloc especially with many of their economies stagnating for the greater part of the last decade. With the U.K. officially out of the bloc, Europe’s growth was estimated to be at a standstill rate of just about zero. In fact, for the most part, Germany has been powering Europe’s economy. Now with COVID-19 affecting much of Europe, we can expect negative growth rates in Europe for the next few quarters.

Central banks may have played almost all their cards a little too early

In the wake of the COVID-19 outbreak, central banks across the world have been quick to cut interest rates to try to lower borrowing costs. Rates across Europe and the U.S. have gone back to their historic lows. In a move to mirror the U.S.’s race to the bottom, the Bank of England cut its rates to 0.25 per cent. The Fed declared that they will buy an unlimited amount of bonds to back the U.S. economy. In short, this is quantitative easing infinity. Something that is unprecedented. Despite the urgency of the situation, I cannot help but think that central banks across the world have played their cards a bit too quickly. The worst is yet to come for most countries especially the U.S. and public attitudes seem to reflect this. Now that The Fed has set rates at zero and has announced that they will engage in unlimited quantitative easing, there is not much more that they can do.

The US and China are not having an amicable relationship

In trying times, the world could do better with a more coordinated response from the two largest economies in the world. The trade war prior to the outbreak of COVID-19 set the stage for a frothy relationship between the U.S. and China and this relationship never recovered. In fact, on a number of occasions, the U.S. President Donald Trump labelled the virus as a Chinese virus and a prominent Chinese official promoted a conspiracy theory that the U.S. military brought the virus to China. One could not help but wonder whether the global response would be more coordinated if these two countries worked together to tackle the issue rather than trading barbs at one another.

The oil crisis has added further pressure

The fallout of the alliance between OPEC and Russia which had been restraining global oil production to keep prices stable came at a very unwelcoming time for oil companies. The U.S. oil prices crashed to 4-year low levels on the announcement that there was no agreement to cap production and thus members were free to produce as much oil as they deem fit. Falling oil prices may be a boon for many businesses like airlines and freight companies but the COVID-19 situation was about a shock to the demand side of most industries as consumers stayed home. Falling oil prices will cause many industries like the shale oil industry in the US to shutter, thus exacerbating the loss in consumer confidence as more jobs are lost.

Pharmaceutical companies are not incentivised to develop a vaccine

Even though a vaccine has been mooted in many corners of the world, pharmaceutical companies are not incentivised to develop something that can be used for a short period of time. pharmaceutical companies are usually backed by investors who want to see a good return on their investment by developing drugs to control ailments for a long period of time rather than a one-time vaccine. Many pharmaceutical companies are also listed on stock exchanges and it would not be in the best interest for profit-seeking shareholders to divert attention away from perhaps research on finding drugs to treat diabetes or Alzheimers to a vaccine for COVID-19. Even when a vaccine is developed, the pharmaceutical firm that developed it would have a moral obligation to make it readily available at low cost to the general public. If the vaccine was priced to profit, these firms may face public backlash. This is perhaps the reason why till now no firm has worked on a vaccine for SARS and I do think that pharmaceutical firms are not devoting their full efforts into developing a vaccine as they are not incentivised to do so.

This downturn will reverberate long after mankind has defeated COVID-19

Estimates come from analysts who have gone through business school or financial education. Their figures are based on historical data from analysing past market performances but they do not truly understand a pandemic. This is why the stock market can rally as countries declare more infections and deaths. Singapore’s economy contracted by 2.2 per cent in the first quarter of 2020, much more than just about all analysts’ estimates. Infections will only get worse and many more may succumb to the virus. What is puzzling is that the most powerful man in the world would like to have the U.S. reopened by Easter. To me, this shows that there are elected world leaders who are placing their country’s economic health ahead of the well-being of citizens. Even as Singapore seeks to keep a foothold on infections and deaths, the truth is that we are a very open economy and the wellbeing of our trading partners is paramount to the wellbeing of our own, be it our economy or the health of our residents. The closure of borders is unprecedented and after COVID-19 has passed, it would have affected business relationships, people’s wellbeing, jobs would have been lost, industries altered. It will take a long time for countries to reopen their borders to the type of free-flowing trade that has dominated the global economy in the last decade.

In every downturn, there will be many buying opportunities in the equities and property market in Singapore and around the world. I do not think that we are even at the halfway mark in terms of our battle with COVID-19 and although there are many proponents of Warren Buffet’s “be greedy when others are fearful” mantra, I do think that the recovery will be much slower than the swift fall of markets across the globe and thus entry points will present themselves in time but for now, let’s pray for good health for everyone across the world.