There is a concept called contrarian investing. It is an investment style where investors go against the prevailing market trend. While it is simple to understand, it is very difficult, and in almost all cases, impossible to execute. The difficulty presents itself not from the concept itself but because it is against natural human instinct.

The fact that many in Singapore have made money from property does little to support the fact that Singaporeans are savvy investors. The reason many Singaporeans and foreigners made money in Singapore through property investments is because of the stability and competency of the Singapore government and the relative instability of other governments around the world. I genuinely do not think that it is due to the investment acumen of individual property investors in Singapore. Such investors were fortunate enough to be living in Singapore during the period when property prices increased. It was not like they scoured the whole world and concluded that investing in Singapore property would be a good way to make money. I have never heard a single individual make that analysis.

However, prices can never go up forever. On the contrary, prices never fall indefinitely. Even if it were trending in one direction, it would not be in a straight line. This is why contrarian investing as an investment strategy is applicable. Dips and spikes happen because of human nature. Human nature may not be the sole determinant of dips and spikes in the market but it is one of the reasons

Investing in a contrarian manner is counterintuitive. It is insanely difficult to do the exact opposite of what the majority of people are doing. In theory, it may make sense. However, it will not be something you can stomach when you get down to doing it.

The trick is identifying whether the current market is trending upwards or downwards. At first thought, the US stock market is weak. However, upon closer inspection, if we seek guidance from how the Dow Jones Industrial Average is performing, it is up 18.28% from a year ago.

Technology stocks are facing a correction. That is something that investors are freaking out about. The darling of the tech world Apple is facing headwinds and its share price is taking a battering. Or is it?

The stock price of Apple went up by almost 16.5% as compared to where it was a year ago.

Nvidia more than doubled in the last year.

Stock prices are not trending downwards, yet.

If we were contrarian in our investing philosophy, we would be shorting the market. Shorting a stock would mean “borrowing” the stock and selling it and then buying it back later at a lower price when the stock price has dropped.

When it comes to Singapore property, prices have similarly been trending upwards. In the second quarter of 2024, private property prices increased by 1.1 per cent. In the first quarter 2024, prices were up 1.4 per cent. In the last quarter of 2023, prices moved up by 2.8 per cent. Let me be clear, private property prices are still increasing albeit at a slower pace. This is inflation moderating. When prices fall, that phenomenon is called deflation. When buyers are hoping for deflation, they are not hoping for inflation to moderate. Instead, they do not want a single bit of inflation but instead want prices to deflate.

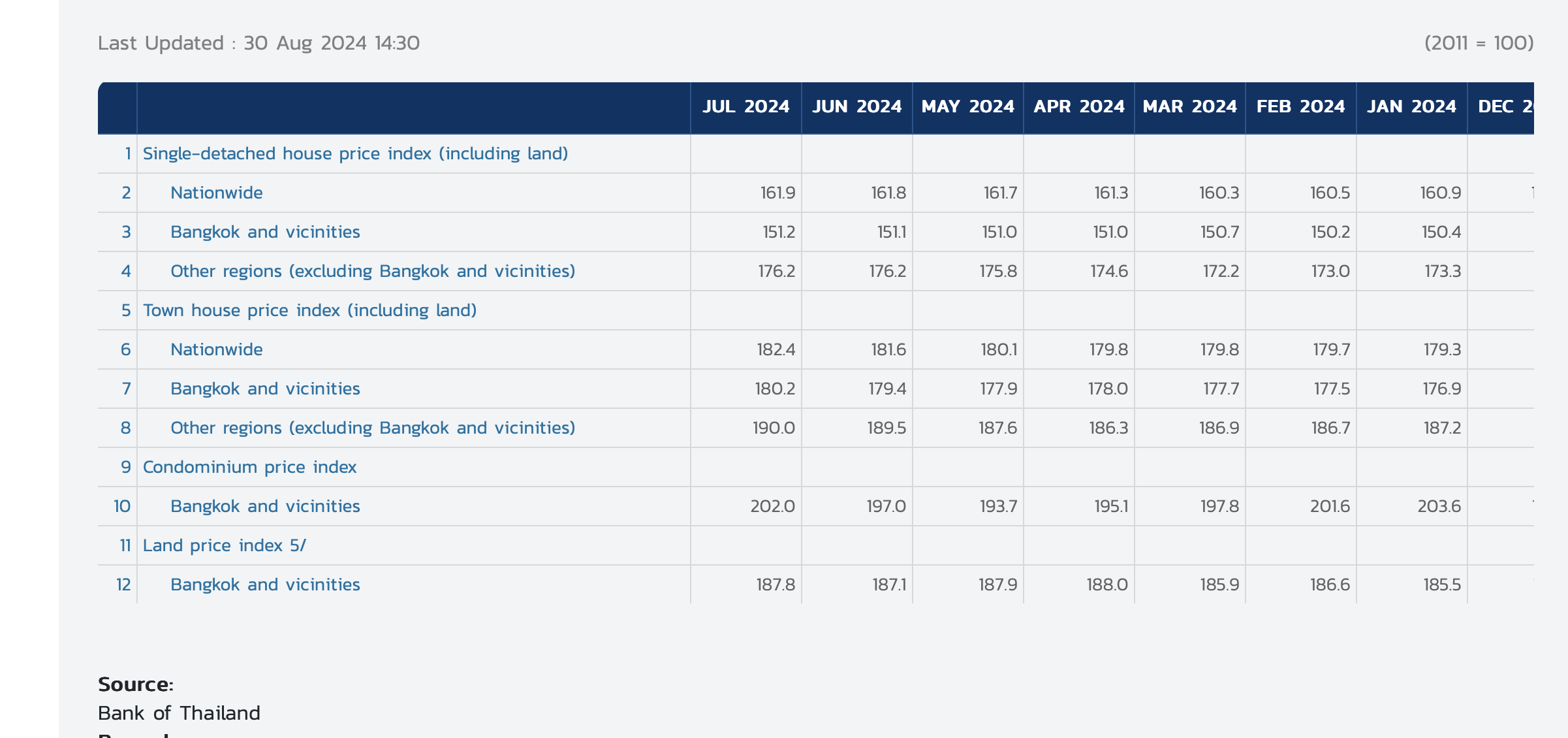

So then, properties in Singapore and even the stock market in the US is trending upwards. Whereas condominiums in Bangkok were trending downwards earlier this year.

Only in June and July 2024 did the Bangkok condominium price index see a pickup. For the first half of 2024, the Bangkok property market was deflating.

Let us be clear about one thing. Governments around the world need a good economy to remain in power. Therefore, it would be very difficult to see one particular asset class be in a deflationary cycle for an extended period of time. Japan’s deflationary spiral for the last three decades is the exception rather than the norm. Deflation is a difficult situation to be in. If people believe that prices will fall tomorrow, they will not buy today. Therefore, governments need a small amount of inflation to keep the economy running. Ideally about 2 per cent. This is why buying on the dips is something that you really have to be comfortable with. However, it is never easy to buy on the dips because there is always anticipation that tomorrow’s prices will be lower than today’s. By the time the data is released that there is a dip, most likely the market would have had some sort of recovery. Remember the time when it seemed like the US economy would never recover from the housing crisis? Mirror that to what the Chinese economy is currently experiencing. While it may seem like the Chinese will find it hard to recover from their current economic slowdown, this will pass faster than we expect it to. Similarly, while it may seem like Singapore property prices and the US stock market will continue to increase in value, the truth is that there will come a day where buyers just feel like prices are too high and unsustainable. It is sentiment and it is difficult to explain.

The question is, are you and I contrarian enough to use the tools and funds available to go against the existing market trend.

Yours sincerely,

Daryl