What has always perplexed me is the fallacy that investors outside a falling property market will usually remark that the investors are not savvy. The reason parties are losing monies in certain property markets is due to miscalculation and miscalculation is a result of poor financial sense and probably a lack of financial education. Today, property markets in China and Hong Kong are taking a beating. Morgan Stanley expects home prices in Hong Kong to continue to fall for another two years. Mainland China is currently in a 23-month home price slump. The interesting take that certain investors have on Singapore prices is that Singapore property prices will continue their upward trajectory because of the measures that are in place. Buyers are savvy and well-educated. They are financially prudent and know how to limit their financial commitment to a home mortgage.

Hey wait a minute… are the people in Hong Kong truly less savvy and well-educated? Are they less well-versed in financial instruments and investments? The last I checked I think Hong Kong’s education system is one of the best in the region. Over 80% of its population have secondary and higher education. Are the Chinese not highly educated and is Shanghai not a financial hub as well? Is the Hong Kong stock exchange not about 10 times that of Singapore’s in terms of market capitalisation? Is it actually true that the investors in Hong Kong and Mainland China are less financially savvy?

In short, it is in my personal humble opinion that the property market correction, and to a certain extent, crash, that is happening in Hong Kong and Mainland China is not because of a lack of intelligence in those markets. Instead, as much as we favour the discipline of economics to explain market cycles, we cannot belabour this with economics alone. The truth is that human behaviour, the fear of missing out, the allure of chasing future profits, the feeling of being right with the decision to go all in, all conjured to what is now a mountain of mess and debt that is Country Garden and Evergrande.

Humans are not logical creatures. Not all the time and definitely not always in times that we need to be. The feeling that the property market is undefeatable, no matter the scenario and having decades of data to back this up is difficult to explain. That was what happened. In Hong Kong, where 50-year leases are the norm, buyers were buying properties for mainly two reasons. Firstly, they did not want to be faced with higher prices in the future. Hence a purchase now would prevent them from purchasing a similar property at a higher price in future. Secondly, they saw property as a safe investments. Their view was backed up with the recent data from the past couple of decades showing that property prices have continued to increase. It was a way of not only preserving wealth but the perceived ideal manner in which wealth appreciation can take place. The mantra that was going around was to work and save up to purchase a property and then ride out the appreciation.

In my mind, if the majority of a population has the idea that property investment is the best way to riches, then that economy is in a very dangerous situation. This is because wealth creation can occur in so many situations. It can occur in inventions, in business and in investments. Let me explain.

Wealth creation in inventions

This is, in my view, the pinnacle of wealth creation. This is where someone creates a product or even a whole product class that revolutionises how we do certain things. An example of this would be the iPhone. It was a product which changed the way we used smartphones. Another example would be creating microchips. Think of companies like TSMC and Intel. They invent and reinvent products that are used in the computers, smartphones and even the vehicles which we use on a daily basis. Then think of PayPal, Venmo or even products like Impossible and beyond meat. The wealth creation here is immense. However, examples of this are few and far between.

Wealth creation in business

The most common entity would be companies. This is someone, or a group of people, coming together and creating an entity and providing goods and services. Think of someone who starts a cafe or a restaurant. Alternatively, someone who starts a company providing legal, accounting or HR related services. There is very little innovation in the product or service that is provided. However, a well run business would have a proper system and team in place. If the entity is something that can accept investments, like a company that can issue shares to investors, then the owners of this business would avail themselves to external funding for expansion and possibly a viable exit strategy from the business should they decide to retire one day.

Wealth creation in investments

This is the most docile manner of wealth creation when compared to the previous two examples. It involves using money, preferably savings and not funded by debt, to purchase assets like stocks or property. Of course there are other options like putting monies in a saving plan, managed funds, bonds and similar form of investments. The difference is whether they are managed by money managers or self-managed. This is where property investment falls squarely into. A property investor purchases a property, and this is usually funded by debt, waits for the appreciation, sells it for a hopefully a higher price in the future. Of course he also receives rental income if he rents out the property.

My point is that property investment is not a category of wealth creation but a subset of a category of wealth creation. However, many have equated investing with merely buying property. Even worse, many have equated wealth creation with merely buying property.

So why is this a bad thing?

Well in truth it is not if the property market is a less mature one with prices still within reach of the average population. In many cases, if the enthusiasm in buying of property is high enough, this rise in property investment can persist even when prices are out of the reach of the average population. This enthusiasm is fuelled by the collective thinking that property prices will always continue to rise and that property investment is infallible. Out comes the chart of how despite ups and downs in the market, in the long run, property prices are always on an upward trend.

Something like this chart.

As you can see there are ups and downs but in the long run, prices were higher than they were before.

Let us zoom out of that graph to see what this graph represents.

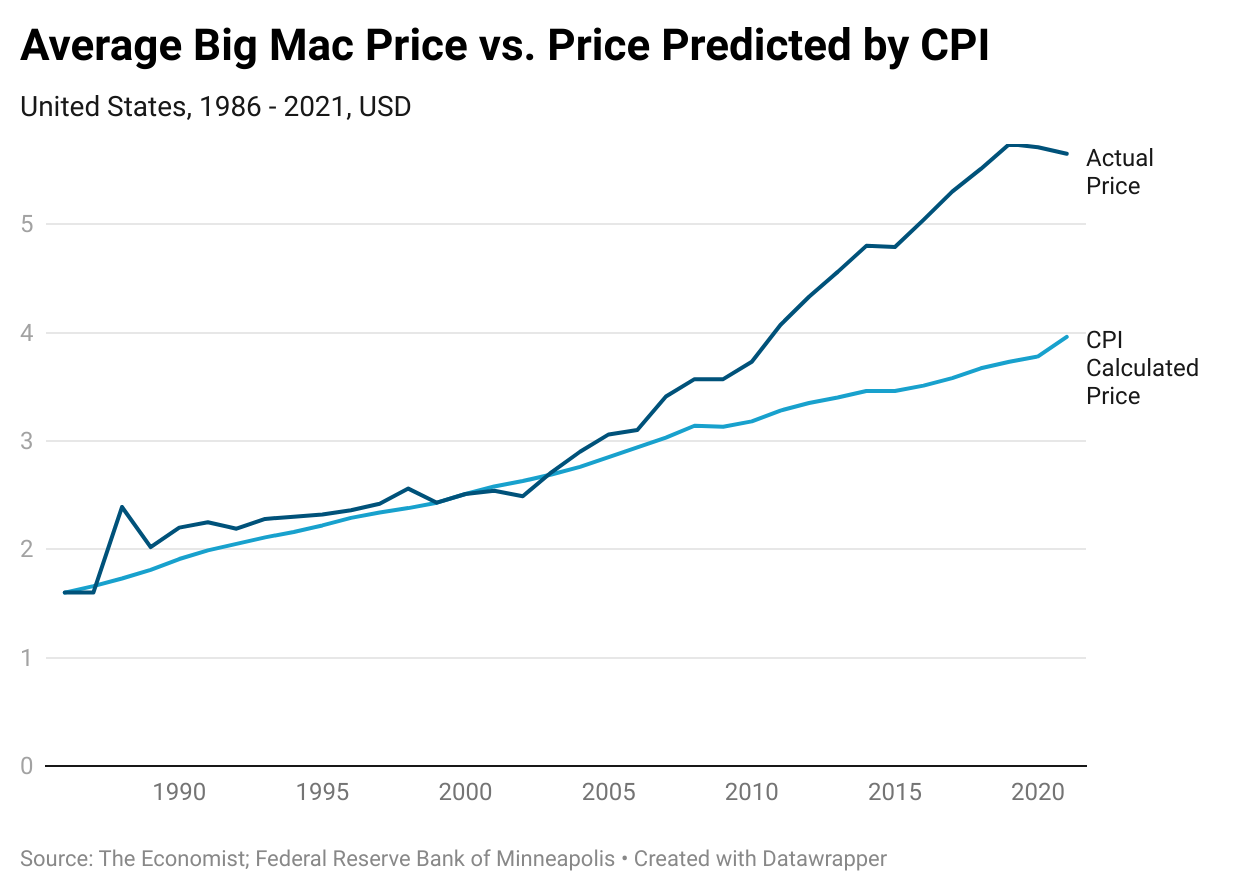

In essence, when someone remarks to a savvy investor that in the long run, property prices are always increasing and are more expensive than before, the savvy investor should be able to identify that that remark is merely referring to inflation. It is inflation which makes all things more expensive over time. Property prices always increasing over time should not be the basis of why property investment is the best investment. If that were true then investing in Big Macs would be a similarly good investment. Well if you could somehow preserve the Big Macs and sell it at a later date.

If we truly want to be savvy investors, we must be aware that the pitfalls of other markets may one day be possible pitfalls of ours. We must also be aware of the first signs of possible cracks in the property market. Perhaps the developers can see something that market observers fail to take notice of because all but one submitted a public tender for the site at Marina View. Why the hesitation if the property market is evergreen? Analysts may remark that the government is looking to preserve the market value of the land in the area in its decision to reject the low bid. However, the truth of the matter is that even the Singapore government did not expect there to be a solitary low bid from IOI Property Group. This was a land in Marina View, right in the heart of Singapore’s Central Business District. There is a Greater Southern Waterfront master plan that would rejuvenate the area from Pasir Panjang up to Marina East. All these would have meant that this plot of land in Marina View should have been earmarked as a development to look out for. Instead, interest in this particular land sale petered out rather quickly.

The truth of the matter is that we have been in an eternal property market bull cycle for the better part of almost two decades. Singapore has yet to see a major recession like the one we experienced during the Asian Financial Crisis in 1997 or the SARS pandemic in 2002. Hence we have a generation of workers who were always faced with a tight job market where there were more jobs than workers. Great credit has to be given to the Singapore government for ensuring that the job market remains healthy. Hence the fearless attitude when entering the property market. More young buyers are taking on debt to enter the private property market. A 28-year-old buying a one-bedroom condominium for $1.4 million could only happen if there was great confidence in the job and property market as well as a safety net in her parents if she could not afford the instalments. However, we must recognise that the property markets that were once seemingly infallible are indeed falling. Perhaps the key would be humility. To recognise that investors in the Singapore property market are no more intelligent and financially savvy than the ones in Hong Kong and China.

Singapore’s property market cannot be infallible. Nothing is.

2024 should be a slow year for property. It should be and it would be healthy for all of us to take a breather. It has been some bull run. It would be ideal to not have a correction in the size of what is happening in the Hong Kong and Chinese property market. All we need is some common sense from everyone.

Yours sincerely,

Daryl