I have always maintained that we need to stick to certain metrics when we invest. Let me explain.

When we invest in property, we have to determine the metrics that we are looking at. Once we determine this, we need to stick to it. For property, whether a property is a good investment, I will consider factors like location attributes which include proximity to city centre and the central business district, proximity to the nearest train station, proximity to amenities and the availability of a catchment area of tenants. I will also look at the price of the property in comparison with other properties in the area. This is why when the property agent tells me that the property he is selling will definitely make money because the next plot of land was sold for a higher price, I do not take that into account. Imagine how difficult things can become if every time you visit a showflat, you consider different factors. Every new launch that a buyer walks into, many buyers will feel like that new launch is a good investment. This is because the agents in the sales gallery are telling you the good things about that property. The rational investor should disregard this as noise and stick to his investment metric. Easier said than done. In sales, selling on emotion is much easier than selling on logic. This is because humans are inherently emotional creatures.

For stocks, this is actually even simpler. This is because a stock is just a ticker on a screen. Your monitor or mobile phone shows the stock as a ticker code. Imagine stock markets as traditional markets. Companies can choose to sell their goods, i.e., in this case, their stock, on a market. For example, if I were Tesla, I want to sell my stock to raise money. Buyers of my stock will give me money and I can use that money to expand the business. I can choose the market I want to list my stock for sale and for my stock to be traded on. If I want to do it in Singapore, I can do it on the SGX. In the US, there is a market called the NASDAQ. In the case of Tesla, it chose to list and have its stock traded on the NASDAQ. Therefore, it is listed on the NASDAQ as TSLA.

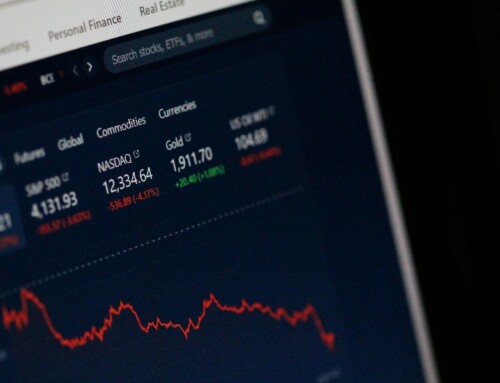

Imagine you looking at the ticker TSLA on your mobile phone. It is just four letters. In fact, you can just Google “Tesla stock price”. This is what you will see.

Tesla Stock Price

You do not see pictures of cars. You do not have an agent telling you all the good things about the company. In fact, the news online are people who are not connected to the company. In many cases, they see the CEO of Tesla, Elon Musk working with Donald Trump. They then see the stock price falling. They then equate the fact that the stock price is falling because of Elon Musk’s association with Donald Trump.

Let me explain the concept of causation. Just because something happens after an occurrence does not mean that that occurrence caused that something. For example, there is an increase in the rates of colon cancer among people under the age of 30. Then someone says that this is caused by the COVID-19 vaccine.

This does not actually make sense because you cannot say that but for the COVID-19 vaccine, the young people under the age of 30 would not have gotten colon cancer. There needs to be a clear link to the something that happened.

Let me move back to the metric when investing in stocks. The truth of the matter is that most investments in stocks by institutions are done by computers. Heard of the term robotrading? There are institutions that are trading on algorithms. Technical analysis allows such trading to be highly efficient. A computer is not affected by what is on YouTube or news platforms like CNBC, CNN or Bloomberg. The most logical and common metric when looking at stocks is the P/E ratio.

So what is the P/E ratio?

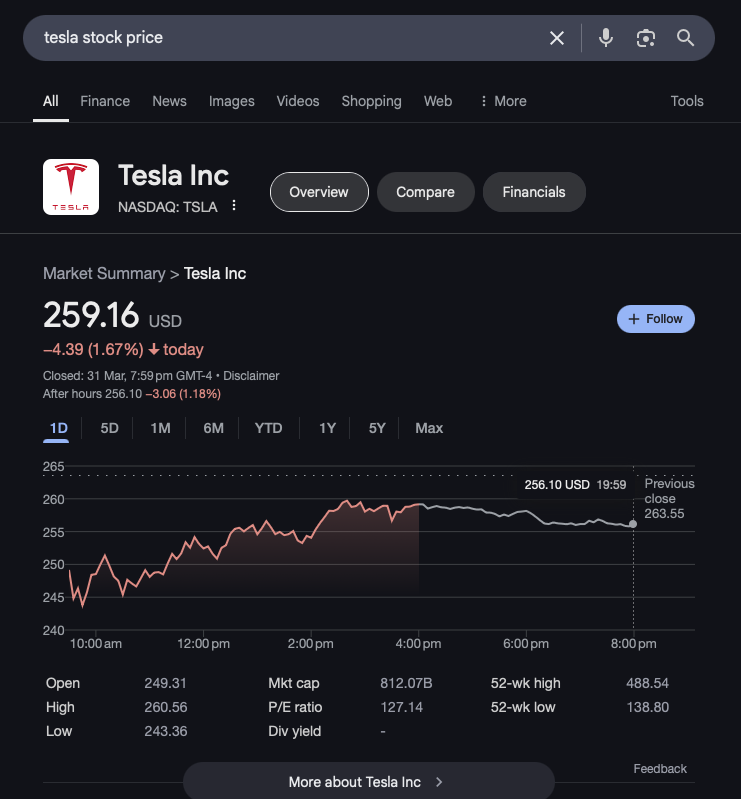

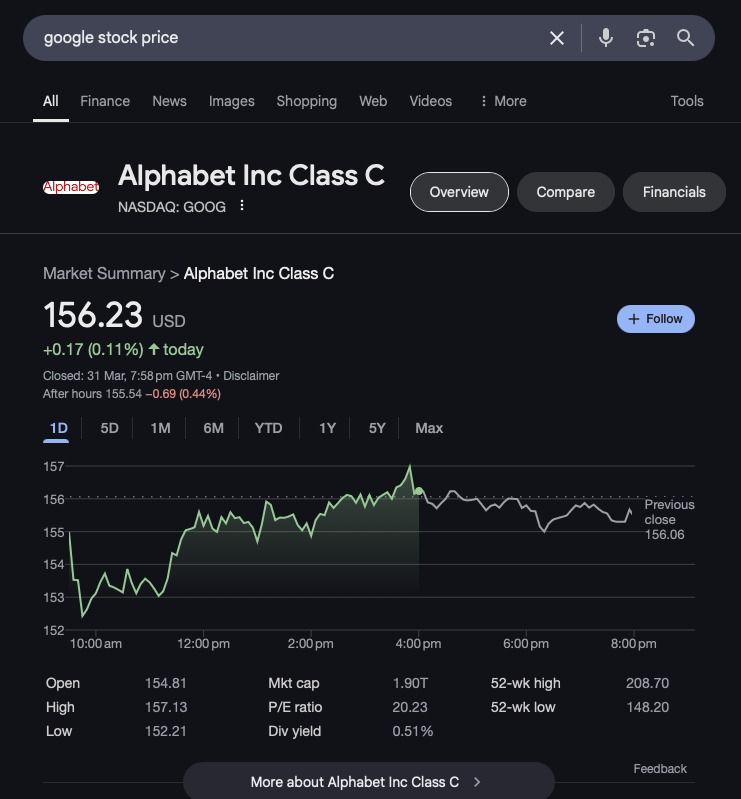

For this we need to go back to how stocks are priced. Just because Tesla is now trading at USD$259.16 and Google is trading at USD$156.23 does not mean that Tesla is more expensive than Google. Apple is trading at USD$222.13. It also does not mean that Apple is more expensive than Google.

Google Stock Price

Apple stock price

The prices are just prices of 1 stock. The company can split the stock. i.e., divide one stock into multiple stock. Apple can say that it would like to divide 1 stock into 222 stocks. So whoever is holding 1 stock would, after the stock, hold 222 stock. We therefore need a metric to see everything on a level playing field. This is where the P/E ratio comes in. What this does is take the current price of the stock against the earnings of that one stock. The P stands for Price and E stands for Earnings per Share. To get earnings per share, you take the earnings and divide it by the number of shares (stock) issued. In the case of Apple, the P/E ratio is 35.31. This means that for that one Apple stock that you are holding, the price is 35.31 times of the earnings of that one stock. E, being the denominator, would mean that if the E were a larger number, the P/E ratio would be lower. And of course if the E were a smaller number, then the P/E ratio would be a larger number. A lower P/E ratio would mean that the current trading price is a lower multiple of its earning and hence a cheaper stock. It is not always the case where we only look at the P/E ratio. I may decide to buy a stock with a higher P/E ratio if that stock is in an industry with more innovation and growth. For example, I may decide that Apple, being a tech company, has more growth than companies in the banking industry.

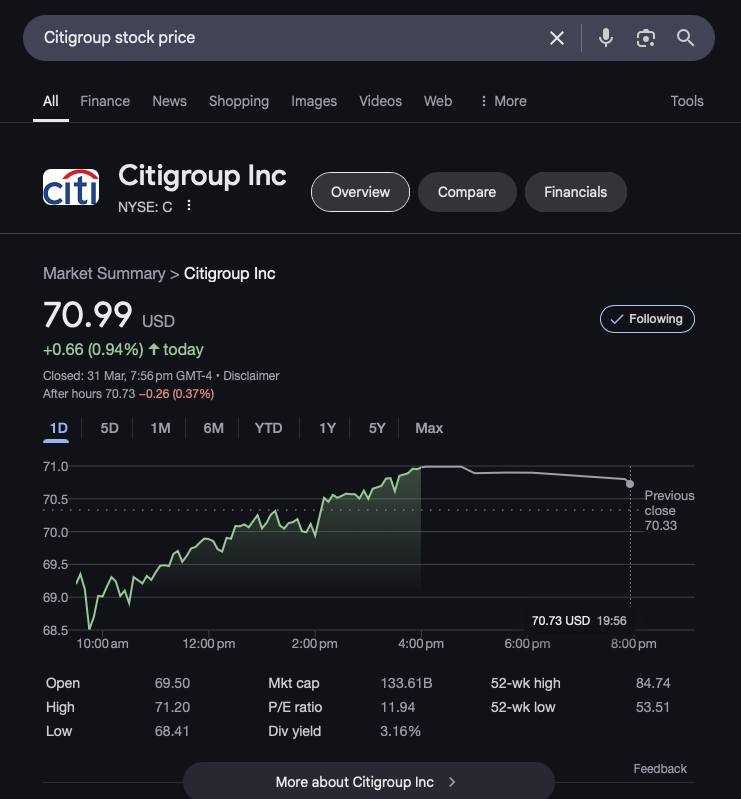

Citigroup stock price

Therefore, Citigroup is trading with a P/E ratio of 11.94 but I might be more interested in Apple at current prices because of the industry or sector that Apple is currently in. Please note that this is hypothetical. I am not saying that I am currently choosing tech over banking as a sector.

With the knowledge of P/E ratio at hand, let us look back at Tesla’s current stock price in comparison with Apple’s. Apple’s P/E ratio is 35.31. In comparison, Tesla’s P/E ratio is 127.14. On all metrics, this is a very over priced stock. Google is trading with a P/E ratio of 20.23 and Amazon is at 34.43. The reason for the sell off of Tesla stock is because their reported earnings are falling. If earnings are falling, the denominator in the P/E ratio is getting smaller. This results in a larger P/E ratio. Traders who trade through numbers will immediately see this and determine that this is a good time to stop holding the stock. In fact, they may even consider shorting the stock (i.e. “betting” that the stock will fall by selling the stock and buying it back later). Now is there any reason to still hold Tesla with a P/E ratio of 127.14? Apparently the market does not think there are many reasons to do so. The reasons are most likely that Tesla is no longer the market leader in electric vehicles (EVs). Players like BYD have broken into Tesla’s lead. In fact, Teslas are no longer the world’s leading manufacturer of EVs. Other traditional car manufacturers like Toyota, Honda, Kia, Hyundai, Mercedes, BMW are also catching up in the EV space. Also, when someone buys an EV, he most likely does not change his EV every other year. This is called the replacement cycle. I believe this replacement cycle for EVs is not as frequent as compared to the replacement cycle when it comes to replacing mobile phones. If everyone who wants a Tesla already has a Tesla, then buying activity is likely to drop.

Is there some glimmer of hope when it comes to Tesla? I do think that as crazy as it sounds, Tesla may be able to pull off the robotaxi plan. If so, that would mean that Tesla would have a monopoly over autonomous ride hailing services. Tesla is the only EV maker to execute autonomous driving. It can constantly improve its autonomous driving capabilities because every Tesla EV and subsequently robotaxi is collecting data.

Think about it. Elon Musk, the CEO of Tesla is close to the US president Donald Trump. This sentence in itself is a positive thing. In fact, Tesla’s stock did rise the moment Donald Trump won the elections. Now that there is unhappiness at what Elon Musk is doing and that Tesla stock is dropping hence it must be caused by his association with Donald Trump?

If only markets were that irrational. We would have much wider swings with more opportunities to take advantage of this irrationality.