Article contributed by Paul Ho from icompareloan.com

DBS broke new ground when it launched the DBS Fixed Home Rate (FHR) package in 2015. The Fixed Home Rate FHR-12/24 is where the home loan package is pegged to the average of 12-month and 24-month Fixed deposit rate for deposits ranging from $1000 to $9999. Previously the FHR-12 and FHR-24 were at 0.25% & 0.55% respectively, making the FHR 12/24 at 0.4%. A home loan package with FHR-12/24 + 1% works out to be 1.40%. The FHR-12/24 is later replaced by the FHR-18 using the 18-month Fixed Deposit as the benchmark. The FHR-18 was at 0.6% when it was launched.

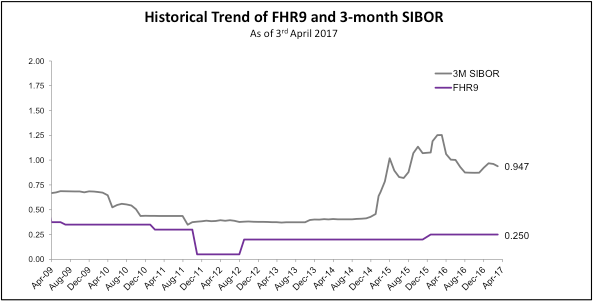

FHR-9 home loan packages were born on 3rd April 2017. FHR-9 is based on 9-month Fixed Deposit Rate. The FHR-9 is 0.25% (April 2017).

Paul Ho (iCompareLoan.com) 08 April 2017.

It is not known what prompted DBS to introduce the FHR-9 reference.

History of DBS Mortgage Loan product Innovation

Amongst all the banks, DBS’ product team has been well known for being at the forefront of product innovation. The products they have created included Interest Cap products, Fixed Home Rate (FHR), Mortgage Insurance Bundling with Mortgage Loans (though not well liked by some), Cash Rebate (for Refinancing) instead of Legal Subsidy, and perhaps Sibor Packages too. Though it is hard to trace who first created Sibor packages pegging their Mortgage Rates to Sibor. Other banks responded with Cost of Funds pegged (COF) packages but did not find wide acceptance.

Sibor stands for Singapore Interbank Offered Rate, was initially a back-end treasury terminology, it is the rate where banks lend to each other their excess funds, laymen and women should have nothing to do with it. DBS, by creating Mortgage Loan products tied to Sibor, made people suddenly made people aware of this term.

SOR stands for Swap Offered Rate, is also a back-end treasury terminology, this was created for banks to hedge their USD and SGD exposure and to swap interest rates. It is very complicated and when you get a mortgage loan, you should not have to worry about it, but now you have to because of mortgage rates pegged to this. You can read more about What is Sibor and SOR to understand more.

However, DBS did not manage to monopolise the Fixed Deposit Pegged market. UOB FDMR, OCBC FDMR, Standard Chartered Bank FDMR and Maybank FDMR are also well received by the public. FDMR stands for Fixed Deposit Mortgage Rate and is pegged to 36-months Fixed deposit for UOB, OCBC and Maybank, and pegged to 48-months for Standard Chartered Bank.

How high did DBS FHR-9 go when Sibor Went up?

Although FHR reference can be traced back to 8 to 10 years ago, the product package is only started in Nov 2015, so only time will tell how these Fixed Deposit Pegged Packages will perform.

How high did FHR-9 go when Sibor went up?

chart 1: 9-month Fixed Deposit Rate – Fixed Home Rate FHR-9 versus 3 month Sibor from Aug 2009 to April 2017, DBS

The FHR-9 is not very responsive to the movement of Sibor rate.

Between DBS FHR-18 and FHR-9, which is better?

The FHR-18 (18-month fixed deposit) is at 0.6% and the FHR-9 (9-month fixed deposit). You can refer to charts for FHR-18 here.

If for example a mortgage home loan rate is 1.5%: –

- FHR-18 + 0.9% = 1.5% (As FHR-18 is 0.6%)

- FHR-9 + 1.25% = 1.5% (As FHR-9 is 0.25%)

What this means is that DBS enjoys a bigger “margin” from pegging the rate to FHR-9 than it does pegging it to FHR-18. Although the lending still comes out of DBS, the way their treasury segregates these funds may be different. If DBS offers depositors of 9-month fixed deposits higher interest rates, homeowners could see increased rates.

However for new property or condominium launches, generally referred to as Building-under-construction (BUC), Sibor packages may be the other option.

If you are unsure, please check with a Mortgage broker who can help you with the financing of Buying a Home in Singapore.