I have been a real estate agent since I graduated from the university. In fact, I joined my first real estate company in the final year of my degree course. I have been dealing with Singapore properties since 2003 and Bangkok properties since 2013. Since my time in the local and overseas property market, many have asked me why the choice to focus on the Singapore and Bangkok property market.

I have marketed and sold properties in Singapore, Thailand, Malaysia, Cambodia, Japan, the UK and perhaps another one or two locations which I may have missed out. It was purely based on the fact that the agency that I was in was marketing a certain development in a certain country and I just went with the trend. It was also perhaps a trend to move swiftly from one location to another based on market sentiment. After a while, I made the choice to focus on the Singapore and Bangkok property market and tried to better understand these two markets. Here are my views of what has transpired all these while and what I think will happen moving forward.

The Singapore Dollar and Thai Baht have done well against the US Dollar over the last decade and should stay stable moving forward

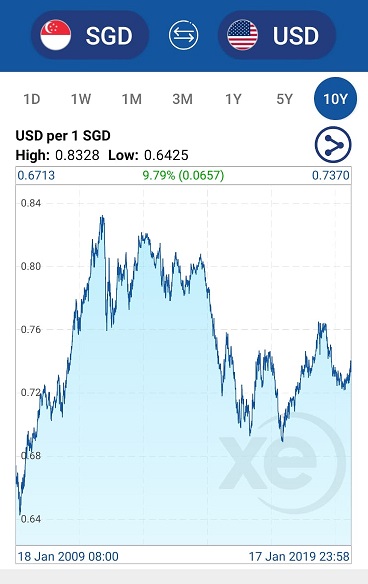

Singapore Dollar versus USD (10 years) (Source: XE Currency)

Thai Baht versus USD (10 years) (Source: XE Currency)

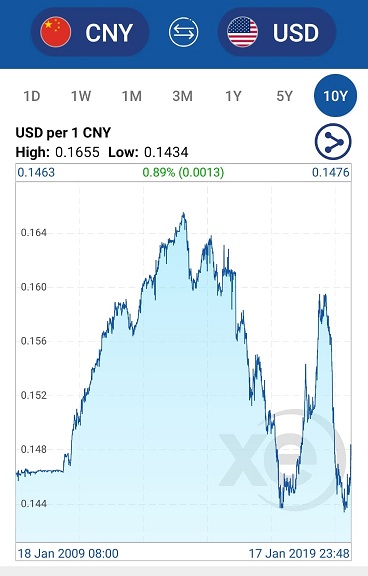

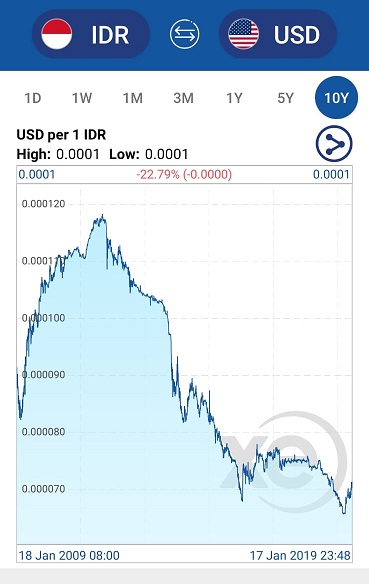

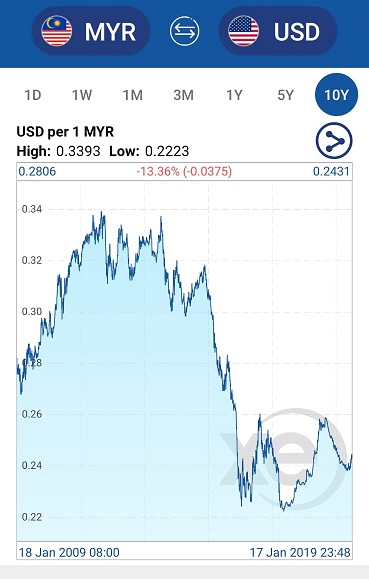

In the past decade, the Singapore Dollar and Thai Baht have appreciated against the US Dollar. Both currencies have seen appreciation rates of about 10 per cent, with the Thai Baht perhaps appreciating just a tad more than the Singapore Dollar. In contrast, other major and regional currencies have generally weakened against the US Dollar with a few like the Chinese Yuan and Cambodian Riel generally flat.

British Pound versus USD (10 years) (Source: XE Currency)

Chinese Renminbi versus USD (10 years) (Source: XE Currency)

Euro versus USD (10 years) (Source: XE Currency)

Japanese Yen versus USD (10 years) (Source: XE Currency)

Hong Kong Dollar versus USD (10 years) (Source: XE Currency)

Indonesia Rupiah versus USD (10 years) (Source: XE Currency)

Malaysian Ringgit versus USD (10 years) (Source: XE Currency)

Vietnam Dong versus USD (10 years) (Source: XE Currency)

Cambodian Riel versus USD (10 years) (Source: XE Currency)

I have a client from Indonesia who purchased a property in Bangkok and Singapore and sold them at just slightly higher than what he bought them for. He bought the Bangkok property for THB 13.15 million and sold it for THB 13.85 million and he bought the Singapore property for SGD $2.5 million and sold it for $2.65 million. If we were to take the numbers at face value, we would see that he did not profit much from capital appreciation of the properties. However, when you consider the appreciation of the Thai Baht and Singapore Dollar against the Rupiah, the gains in terms of Rupiah are phenomenal.

Thai Baht versus Indonesian Rupiah (10 years)

Singapore Dollar versus Indonesian Rupiah (10 years)

Both the Thai Baht and Singapore Dollar appreciated more than 41 per cent against the Indonesian Rupiah and thus when the client converted the monies back to his home currency, his Bangkok and Singapore properties yielded him gains of almost 50 per cent.

The lesson to take away from this would be that cities like Bangkok and Singapore are not places whereby demand is derived solely locally. The overseas property investors tend to look at these cities as viable options to park their funds. Bangkok and, to a greater extent, Singapore do come across as the more economically stable cities to invest. In times of great turmoil across the world, the flow of wealth has started to turn to one of capital preservation and the Thai and Singapore economy are perhaps the two more stable places for funds to flow into. The Thai economy has reduced its reliance on tourism and its recent positive economic numbers were on the back on a broader-based economic expansion in sectors like agriculture and manufacturing.

A property is still a shelter first and an investment tool second. Singapore and Bangkok are one of the most livable cities in the region.

When I first broadened my horizon to marketing properties outside of Singapore, I did do my homework and travelled to various cities to have a better understanding of how the various markets worked. What I found out was that Bangkok, just like Singapore, is a very open society and a very open economy. More than that, it was a place whereby people genuinely wanted to live in. The main purpose of having a property is for shelter. The notion of property investment has become so pervasive in our society that we see bricks and mortar as a way to make money than a place to stay. Buyers should be asking whether buying that certain property would be a good home to whoever who lives in it before thinking about whether it will make money. In fact, the basic factors that make a property a good place to live, factors like a safe environment, good amenities nearby, good schools, good and efficient transportation, competent government, are factors that will make the property a good investment. This is the primary reason why I am not positive about the property markets in places like Cambodia, Laos or Myanmar. Yes, these high-risk countries offer the potential for supernormal profits if the area develops but I am not hopeful that there will be much progress for investors to see any significant capital gains in the next decade. Even places like Singapore take years just to add an additional train line to its rail network. I find it perplexing when I was told that in a decade Cambodia will develop a rail network that will be able to rival Bangkok’s. That was four years ago and to date, no work has been started. On top of that, security is a startling issue in places like Phnom Penh. Crime is very prevalent even in extremely central areas where business activity congregates.

When I travel to Bangkok, I do feel safe on the streets. Of course, I do mainly only travel around downtown Bangkok but never once did I feel that my security was threatened. When I speak to other foreigners or people who are living in Bangkok, they share the same sense of security living in the city. There will still be pockets of crime all over Bangkok and corruption is still a drain on the government although I do believe that this situation is improving. Bangkok will not be as safe and corrupt free as Singapore but I think when you compare it to other cities in South East Asia, Bangkok is very safe.

In the six years which I have been dealing with Bangkok properties, I have dealt with many clients who bought properties in Bangkok for retirement purposes. I have also sold properties to those who have been working in the city and would like to own their property rather than to rent one. This is in contrast to many other cities in the region whereby properties are seen as a pure investment tool. Placing monies in a developing country in hope that the area will develop and then you can sell it off for a profit does seem like a good plan. However, the truth is that the surrounding area is not going to develop for maybe another decade or two perhaps and even if it does, there may not be a prevalent resale market in place for you to sell off your property. There will just be more supply coming on board from other developers. My stand is that if you are willing to wait for decades for your property in Cambodia, Laos or Myanmar to appreciate, why not take the same wait on the property market in Singapore or perhaps central Bangkok? The odds that property prices will rise in 20 to 30 years should be just as good in Singapore than it is in these developing countries.

Investing in property is rather different from investing in stocks. The price of seemingly riskier stocks is much lower than plunging your monies in a property. You can diversify your portfolio of stocks to include a wide array of counters with different risk profiles. You cannot and should not do the same for property investment. You really need to know what you are getting yourself into and this is the reason why I have been sticking with the Singapore and Bangkok property market for such an extended period of time.

Local demand should weaken but foreign demand should increase

2019 will be a turbulent year fraught with a great deal of uncertainty. As the global economy heads for an anticipated slowdown, the US and China trade war will only exacerbate matters. Throw in Brexit which, in my opinion, is going to be an extremely horrible outcome for the British people, and you should have a perfect storm for a global slowdown.

In Singapore, local demand from should weaken as buying fatigue starts to set in. This coupled with the fact that there is no corresponding slowdown in supply as more than 60 new project launches are coming on board in 2019, should see property prices soften. However, Singapore is sticking out like a sore thumb as a stable, safe haven for the rich of the world to park their funds in. Yes, the stamp duties are extremely restrictive but then the strength of the Singapore dollar is a very huge draw for the wealthy to be looking at Singapore. London as a financial centre is under threat due to Brexit and Hong Kong’s ability to continue as an autonomously governed area is increasingly under threat from Beijing’s interference. Singapore is an independent city-state, with a stable government and business-friendly policies. This is the reason why Singapore will continue to attract an inflow of wealth from around the world. When wealthy foreigners look at investing in Singapore properties, they will most probably be looking at properties in the core central region. For a long time, price increases in the outside central region and the rest of central region have outpaced the core central region. I do think that prices in the core central region have a good chance of narrowing this gap in the next year. The wealthy will most probably purchase one large purchase rather than multiple smaller purchases.

In Bangkok, the situation is also similar. 2017 and 2018 saw a huge buying frenzy and the price increase was perhaps higher than what we saw in Singapore for the same time period. Demand from the locals was very high and the Thai government stepped in and placed loan to value restrictions on locals purchasing multiple properties. This should slow down the demand and curb some excessive risk-taking by the Thais. Foreign demand, however, is extremely strong. The buying interest from the Chinese is increasing as the date for the opening of the Grand Bangsue Station draws closer. Bangkok is central to China’s One Belt, One Road initiative and the Grand Bangsue Station has three planned routes that lead up to Kunming, China as well as connects down south eventually to Singapore. The Chinese have the financial clout to make this initiative a reality and are taking over the Japanese in funding major infrastructure projects in Bangkok. Buying interest from the Chinese is still healthy. Price growth should moderate though. The past few years have seen significant price increases in the market. The Thai Baht has been the best performing currency against the US Dollar in South East Asia for the last decade and this strength should continue especially if the proposed elections in March are concluded smoothly. It is wise to note that the estimated 4.1 per cent GDP growth in 2018 was driven by strong domestic demand stemming from an upswing in private consumption and investment. Despite what many foreigners would like to think, local Thais do invest heavily in Bangkok properties and there are many local developers, in fact, many of the larger Thai developers, who do not actively market their products overseas as the demand from the locals is sufficient.

Prices should moderate

Despite my relatively positive take on both the Singapore and Bangkok property markets, my positivity stems from the fact that there is relative turmoil in the Eurozone, the US and a slowdown in the Chinese economy. I do believe that property prices are relatively high and they are due for a correction. That being said, I do not foresee a large correction as Singapore and Bangkok are seen as safe havens in relation to the rest of the region and possibly the world, especially when you look at Singapore. I do agree that there is an oversupply in both markets and supply has gotten ahead of demand. I would expect prices of new project launches and the resale markets in both Singapore and Bangkok to come down a little. More so in Singapore where developers have a deadline of 5 years from the date of land acquisition to sell out all their units or be faced with a huge tax bill. I do think that there is buyer fatigue in both property markets and prices are due for some moderation.

Geopolitical matters play a huge role in shaping both Singapore and Thailand’s economy

Not many people are aware that Thailand is actually the 8th largest economy in Asia with a GDP of USD$455.22 billion in 2017. Its economy is heavily dependent on exports which make up two-thirds of its GDP. Singapore’s exports make up just over half of its GDP. Both countries are heavily dependent on trade and thus any global economic slowdown would adversely affect the economies of these countries and sentiment in the respective property markets should suffer. The World Bank recently trimmed Thailand’s 2019 GDP growth to 3.8 per cent from 3.9 on the back of the elevated trade tensions between the US and China.

I really cannot guarantee that the property markets in either Singapore or Bangkok will rise or fall. As a real estate agent, I do notice that it is getting very difficult to rent out properties in Singapore, especially if the property is not near a train station. This coupled with the fact that there is going to be more than 60 new project launches in 2019 does pose a very big question of whether demand can keep up with upcoming supply. As for Bangkok, I do get locals wanting to live in condominiums rather than landed properties. They value the convenience of having facilities and having someone to manage the property for them. Even so, risk-taking was deemed to be excessive and the recent government loan to value limits are meant to curb buying from the locals. Due to these reasons, I expect overall prices to be soft in both markets. However, because of the perception of Singapore and Bangkok being safe havens for investors, The correction is not expected to be too significant.

Yours sincerely,

Daryl Lum