Fourth Avenue Residences is the first new project launch for 2019 and will be open for public preview on the first weekend of the year. This would be a good barometer for property observers as to how the property market will pan out for the year.

Details about the development

Fourth Avenue Residences is a 99-year leasehold development by Allgreen Properties. The developer won the plot of land through a government land sale exercise and paid $553 million or $1,540 per square foot per plot ratio (psf ppr) for the site. This was the third site which Allgreen Properties acquired along Bukit Timah Road within five days. It had previously acquired Royalville and Crystal Tower for $477.94 million and $180.65 million respectively. Allgreen Properties is part of Robert Kuok’s, the richest man in Malaysia, group of businesses. The site was under the reserve list of the first-half 2017 Government Land Sales (GLS) programme and was triggered with a minimum bid of $448.8 million. The site on which Fourth Avenue Residences sits on is just next to Sixth Avenue MRT and has a site area of 18,532.2 square meters or 199,480.6 square feet. It will consist of 476 units and is expected to be completed and obtain its Temporary Occupation Permit (T.O.P.) in December 2022. There will be 164 1-bedroom units, 38 2-bedroom units, 118 2-bedroom premium units, 64 3-bedroom units, 68 3-bedroom + study units and 24 4-bedroom + study units.

Where is the development located?

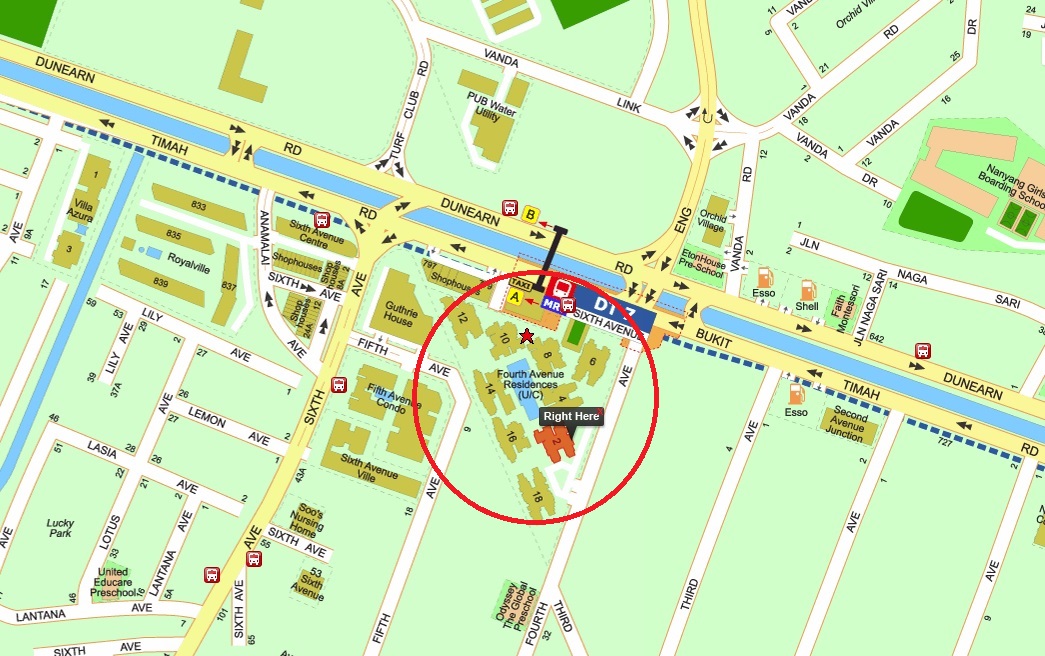

Fourth Avenue Residences Location Map

Fourth Avenue Residences is located just next to Sixth Avenue MRT Station. There is no condominium that can be nearer to the MRT station. Exit A of Sixth Avenue MRT Station is located just next to the development and there are a taxi stand and some shophouses as well. Bukit Timah is one of Singapore’s most upscale neighbourhood and this area consists of mainly private residential housing. Fourth Avenue Residences is very close to Hwa Chong Institution, Nanyang Girl’s High School, National Junior College and Raffles Girls’ Primary School.

Sixth Avenue MRT Station, being on the Downtown Line, offers easy connectivity to the city centre. If you are heading to Raffles Place MRT Station, which is where the Central Business District of Singapore is located, it will take you approximately 14 minutes and cost $1.39. You will have to make changes to get onto separate train lines to get to Raffles Place MRT.

Sixth Avenue MRT to Raffles Place MRT

If you are travelling from Sixth Avenue MRT Station to Orchard Road MRT Station, it would take you 8 minutes and it would cost $1.22. You would need to make a change from the Downtown Line to the North-South Line at Newton MRT Station.

Sixth Avenue MRT to Orchard Road MRT

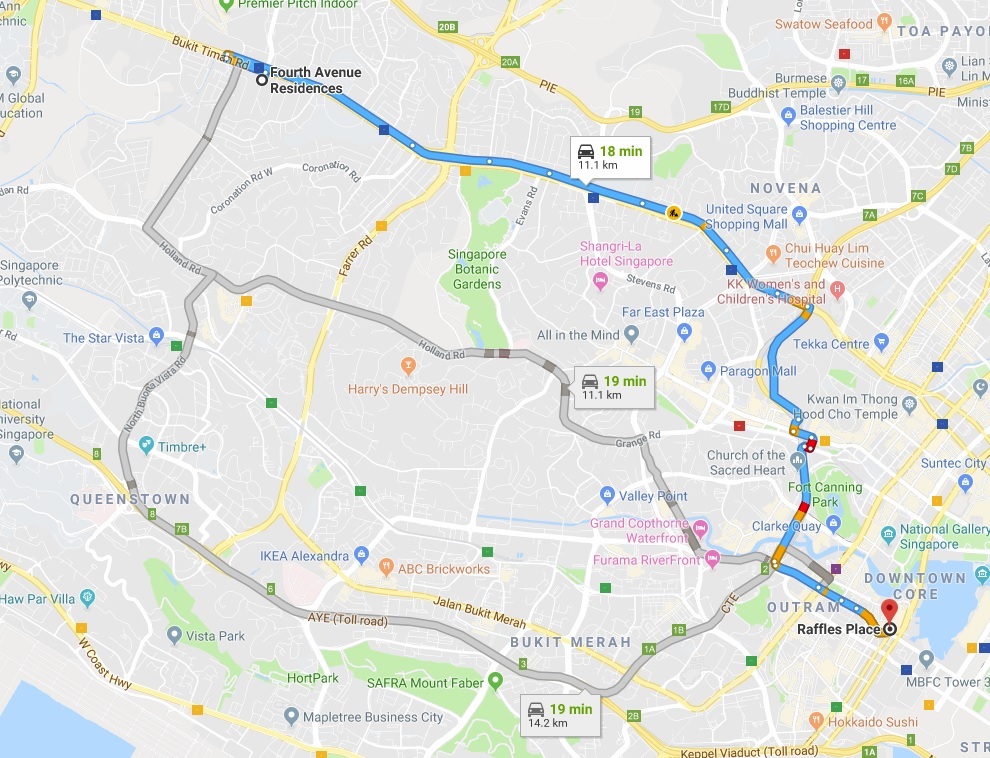

If you are driving to Raffles Place MRT Station, it will take you about 18 minutes and the total distance travelled would be about 11.1 kilometres according to Google Maps. My query was made in the evening so do factor in some additional travel time if you are driving during morning peak hours.

The drive from Forth Avenue Residences to Raffles Place MRT

If you are driving from Forth Avenue Residences to Orchard MRT, it will take you 11 minutes and the distance travelled would be about 7.5 kilometres. Once again, do factor in some additional travel time during morning peak hours.

The selling points of the development

The main selling point about the development is the location. In the huge deluge of new project launches in recent times, a project like this stands out. The MRT station is literally next to the condominium and it makes it really convenient for residents to get around. If you were to take a look at the MRT map, you would notice that the Downtown Line intersects the Circle Line, the North-South Line, the North-East Line and the East-West Line. This makes getting on various train lines much easier and the Downtown Line leads commuters right into Singapore’s Central Business District.

The MRT Map

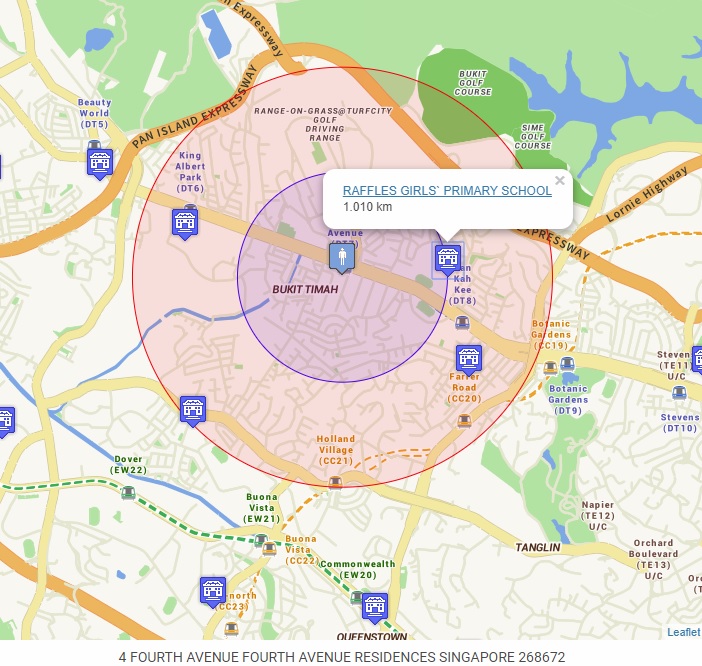

The next selling point would be the proximity to good schools. Fourth Avenue Residences is located close to top schools like Hwa Chong Institution, Nanyang Girls’ High School, National Junior College and Raffles Girls’ Primary School. I believe that Raffles Girls’ Primary School should be within a 1-kilometre radius of certain units in Fourth Avenue Residences. Residents in Block 6 of the development should be within the boundary. Currently, I do not have the postal code for block 6 and can only measure the distance from block 4 to Raffles Girls’ Primary School.

Distance of Fourth Avenue Residences to Raffles Girls’ Primary School

The other selling point would be that the development is located in a very good neighbourhood. The Bukit Timah neighbourhood is predominantly a large private estate of condominiums and landed properties. Condominiums line the main Bukit Timah Road and landed properties are usually located within the connecting roads. This makes the neighbourhood less congested and the residents who live in this area are usually from the more affluent sections of Singapore society. This area is also very popular with foreign tenants.

Possible bad points about the development

This is a 99-year leasehold development surrounded by many freehold options. However, this is mitigated by the proximity to the MRT station. The plot of land is triangular in shape as well but then this is the only plot of land right next to Sixth Avenue MRT Station that was up for grabs.

My thoughts about the development

Location wise, this is really one of the best locations you can find for a new condo launch. Despite it being a 99-year leasehold development in an area where developments are predominantly freehold, demand for such a development should be strong due to its locational qualities.

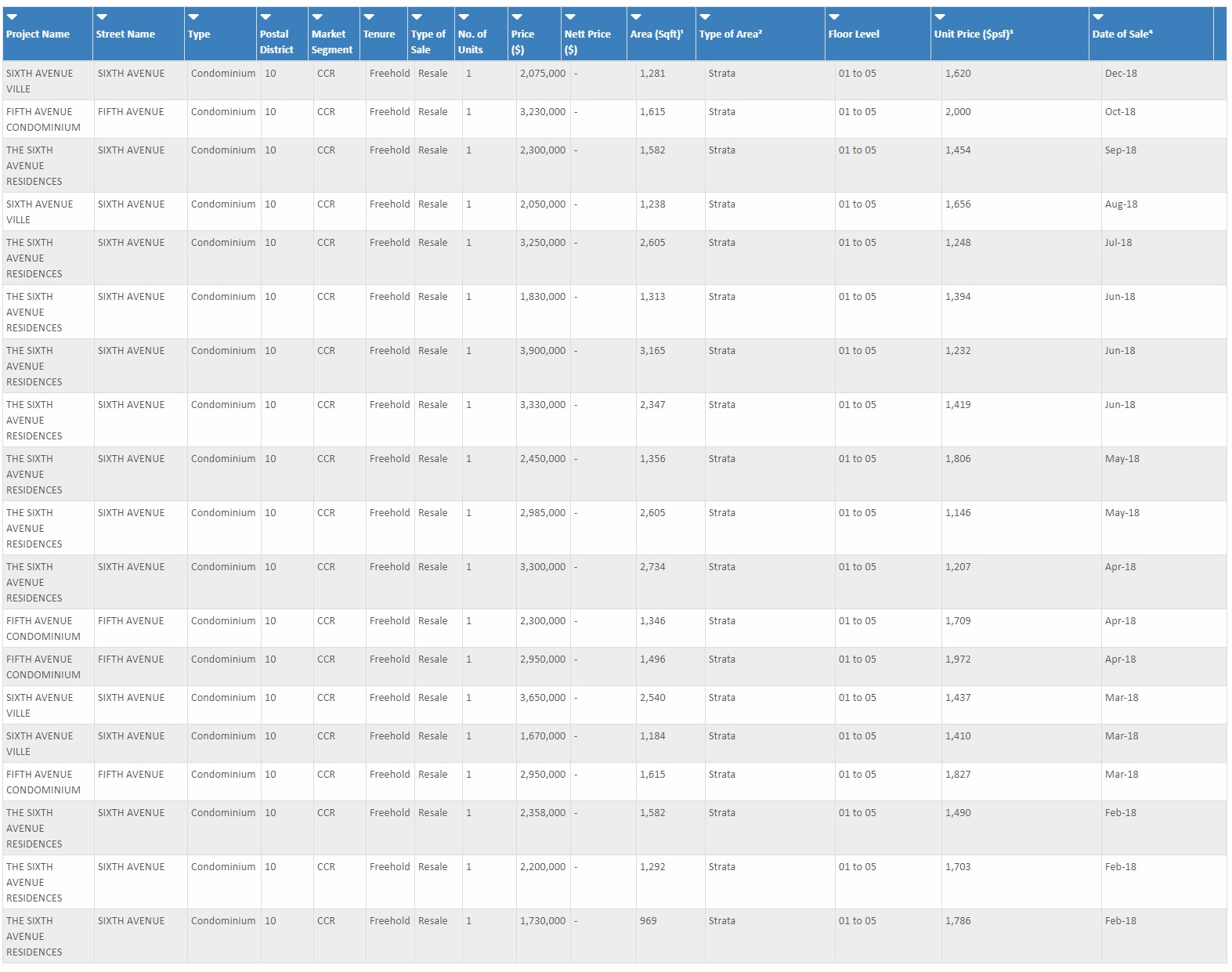

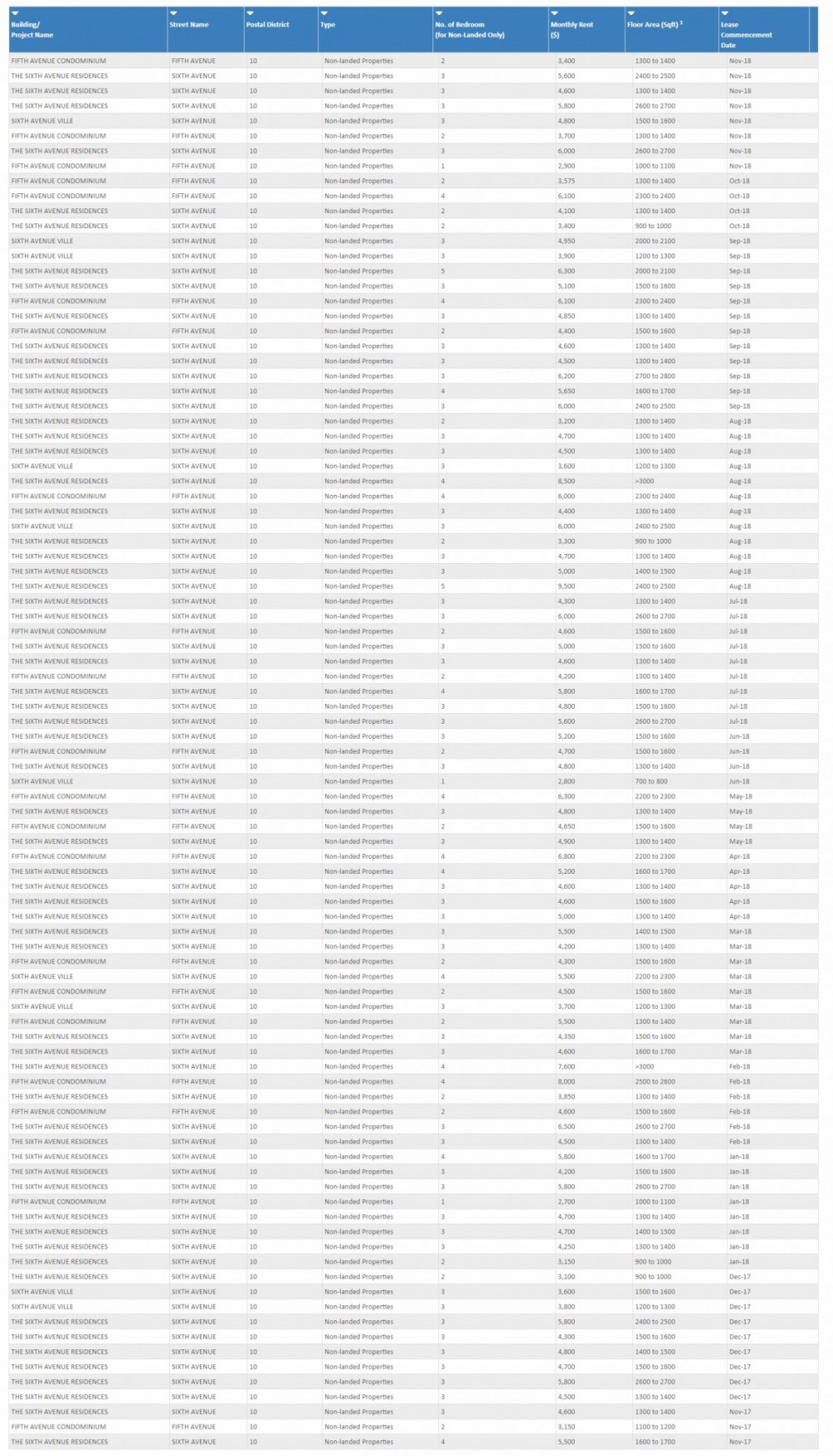

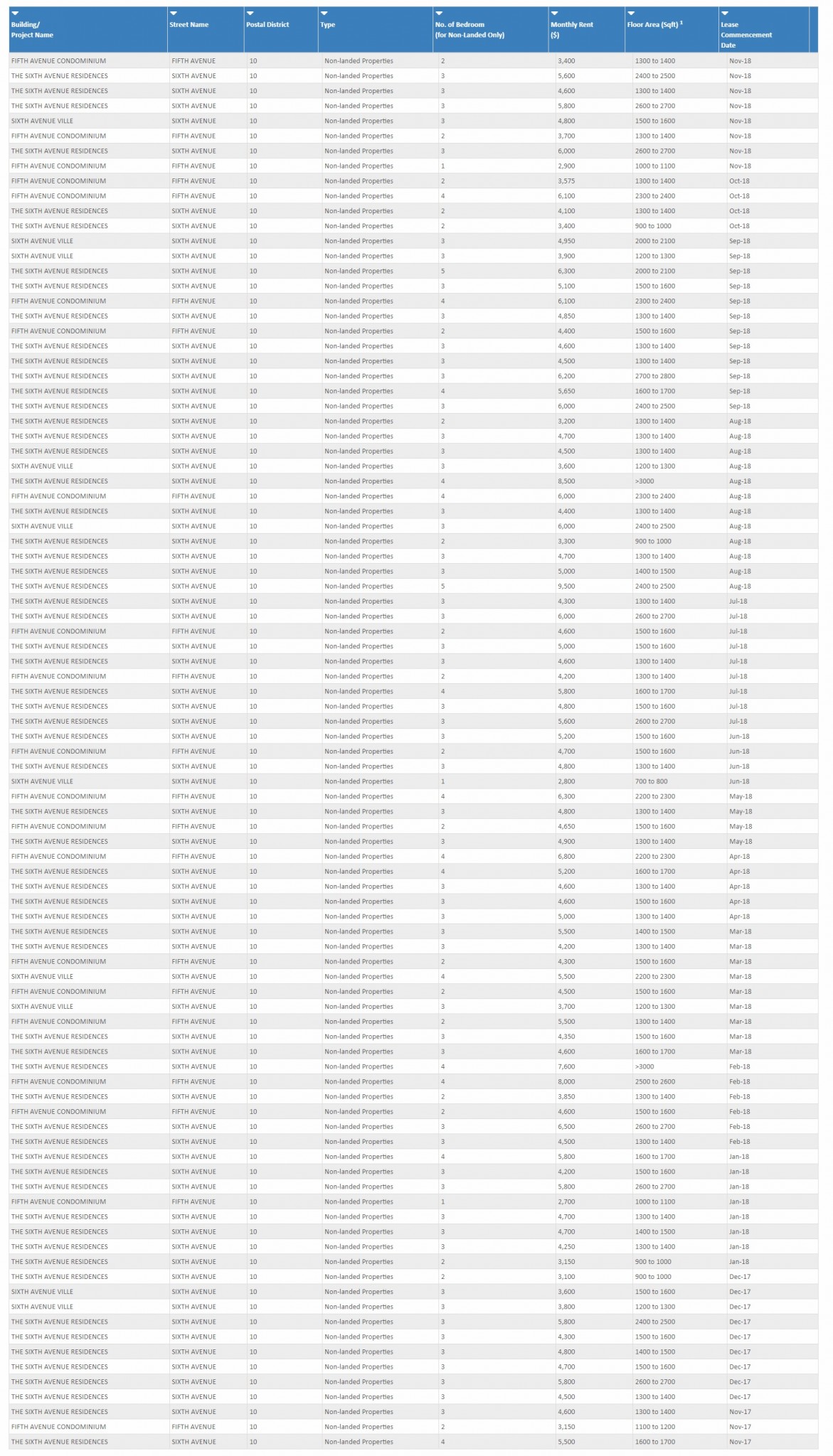

Price-wise, the development should be launched at just over $2,000 per square foot. In fact, the indicative launch prices have the 1-bedroom starting from $1,050,000, 2-bedroom from $1,403,000, 2-bedroom premium from $1,506,000, 3-bedroom from $2,081,000, 3-bedroom + study from $2,340,000 and 4-bedroom + study from $3,387,000. Looking at the past 1 year of transactions from Fifth Avenue Condominium and Sixth Avenue Ville, which are the two nearest condominiums to Fourth Avenue Residences as well as The Sixth Avenue Residences which is deeper within Sixth Avenue, there are prices which have hit $2,000 per square foot. Fifth Avenue Condo is a 20-year-old condominium and had a unit that was transacted at $2,000 per square foot in October 2018, post-July 2018 cooling measures. Most transactions in Fifth Avenue Condo and Sixth Avenue Ville, also another 20-year-old condominium, are hovering close to $2,000 per square foot. These developments are dated, have less comprehensive facilities than Fourth Avenue Residences and is further away from the Sixth Avenue MRT Station. The Sixth Avenue Residences is located rather far away from Sixth Avenue MRT Station and has transacted prices hovering close to the $2,000 mark as well. I am not saying that Fourth Avenue Residences going for prices south of $2,000 per square foot is cheap. It is definitely more expensive than neighbouring developments. However, the locational attributes of Fourth Avenue Residences make it difficult for us to compare it to neighbouring developments. Prices are definitely on the high side and buyers should select units carefully to put them in better stead for the future. I have previously mentioned in a prior blog article that buyers should learn to select good units at new project launches.

URA Resale Transactions

Based on URA Rental Transactions in the last year, the median rent for a 2-bedroom unit at Fifth Avenue Condominium is $4,400. This is for a very large unit and the 2-bedroom units at Forth Avenue Residences are going to be smaller. However, if we take this median rent and assume that a 2-bedroom premium unit is purchased at $1,550,000 then this works out to be 3.4 per cent rental yield.

I do think that if buyers select the right units during the launch, it would put them in a good position to rent and resell in the future. Location wise, this is somewhat like another project which I heavily favoured in 2018, Parc Esta. If buyers are looking to purchase next to Sixth Avenue MRT Station, this is the closest they can get.

I do like the fact that Allgreen Properties had also acquired Royalville and Crystal Tower which are located along Bukit Timah Road. Coupled with previous developments launched by Allgreen, The Cascadia in 2007 and Bukit Regency in 1998, Fourth Avenue Residences will be one of five developments that Allgreen developed in the Bukit Timah area.

Fourth Avenue Residences

Fourth Avenue Residences

Pricing 2.5/5

This is going to be rather expensive. Fourth Avenue Residences will come at a premium over what is in the vicinity as it is brand new and right next to the MRT Station.

Location 4.5/5

A huge deluge of new project launches is coming onto the market in 2019. That number should be around 60. In such a crowded arena, the developments with standout locations are the ones to target. As mentioned previously, this is right next to Sixth Avenue MRT Station which has easy access to the city centre and intersects four other train lines, making commuting extremely easy. The development is also very close to Orchard Road and driving to Singapore’s main shopping belt should not take more than 15 minutes barring any heavy traffic. This should be one of the launches with the best location in 2019.

Quality 4/5

Allgreen Properties is a very experienced developer headed by property tycoon Robert Kuok. Its past projects include Amber Point, Binjai Crest, One Devonshire, Yong An Park, Suites at Orchard and Viva among many others. Having previously also developed The Cascadia and Bukit Regency in the Bukit Timah area, Fourth Avenue Residences will be their third development in the area with another two coming soon after.

Yours Sincerely,

p.s. Disclaimer: I am a licensed real estate salesperson at the point of writing this review. My real estate agency is the marketing agency for Fourth Avenue Residences. Buyers can approach me to purchase Fourth Avenue Residences and I will earn a commission from the developer. My reason for writing this review is to share my personal view about the developments not as a real estate salesperson but in the neutral context of a buyer and hopefully share some insight to help buyers make a more informed buying decision.

My other Singapore Property Reviews

My review of The Avenir by Hong Leong Holdings and GuocoLand

My review of One Holland Village Residences by Far East Organisation

My review of Neu at Novena and Fyve Derbyshire by Roxy Pacific Holdings

My review of Midwood by Hong Leong Holdings

My review of Royalgreen and Juniper Hill by Allgreen Properties

My review of Sky Everton by Sustained Land

My review of Sengkang Grand Residences by Capitaland and City Developments Limited

My review of One Pearl Bank by Capitaland

My review of The Antares by FSKH Development

My review of Parc Clematis by SingHaiyi Group

My review of Piermont Grand by City Developments Limited

My review of Parc Komo by CEL development

My review of Riviere by Frasers Property

My review of Avenue South Residence

My review of 1953 by Oxley Holdings

My review of Uptown @ Farrer

My review of The Florence Residences

My review of Treasure at Tampines

My review of Fourth Avenue Residences

My review of The Woodleigh Residences

My review of Kent Ridge Hill Residences

My review of Arena Residences

My review of Whistler Grand and Twin Vew

My review of Mayfair Gardens and Daintree Residence

My review of Parc Esta

My review of Jui Residences

My review of The Jovell

My review of JadeScape

My review of Stirling Residences and Margaret Ville

My review of The Tre Ver and Riverfront Residences

My review of Park Colonial

My review of Affinity at Serangoon and The Garden Residences

Other related articles:

My 2018 Singapore Property Market Review

How to select a good unit at a new project launch

Are Singapore property prices too high?