The Chinese government is aiming to achieve a soft-landing in its economy by bringing down corporate leverage via innovative reforms such as the debt-for-equity swap (DES) policy. The reform is similar to “soft lending” where bad loans are exchange for equity. We believe the DES policy is able to reduce the amount of non-performing loans (NPLs) in China and prevent an economic hard landing in China.

We share three thoughts on the DES policy:

- Features of DES

- The market likes DES

– Success of DES may determine if China will avoid a hard landing

- Features of DES

A fund is set up and managed by a trust company under the executor bank. Monies are raised from third party investors with wealth management products (WMPs) expected to provide bulk of the fund raising. The fund then buys the bad loans from the creditor bank and exchanged it for equity stakes in the company. The equity stakes is held for five years, after which they will be purchased by the companies with pricing to be determined at that time.

In the first round of DES swap, China Construction Bank (CCB) was appointed as a facilitator with DES conducted on Yunnan Tin Group (YTG) and Wuhan Iron and Steel Group Corp. In the case of YTG, theRM$10bn swap was conducted on 16 October. The fund was managed by a trust company under CCB with the majority of the monies from WMPs sold at an expected return of 5-15% p.a. The fund bought over the loan at face value and swap it into equity of YTG’s five subsidiaries.

YTG is major state-owned enterprise (SOE) in Yunnan and controls more than 45% of China’s tin products market. With the swap, its debt-to-asset level was reduced by 15% to 65% level. In the last three years, YTG made cumulative losses of some RM$6bn. YTG has projected sales and net profit of minimum RM$81.9bn and RM$2.3bn respectively in 2020. Failure to meet this target will result in YTG having to repurchase the equity back from the investor.

- The market likes DES

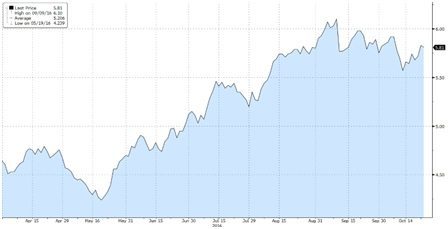

In March this year, DES policy was discussed in the annual meeting of parliament in Beijing. Premier Li Keqiang singled out DES policy as a means to “progressively reduce corporate leverage”. The market appears to favour DES policy as a way for banks to solve its NPL problems. Since the end of March, the Chinese banks have rallied strongly with Industrial and Commercial Bank of China (ICBC) and CCB rising 10.8% and 17.5% respectively outperforming the -1.0% decline in Shanghai Composite Index.

YTD Chart of China Construction Bank (since End-March 2016)

Source: Bloomberg

3. Success of DES may determine if China will avoid a hard landing

China has a high debt-to-GDP ratio of 246.8% as of 2015. This may result in a hard landing in the China economy if the corporate sector deleverage and spend less on capex.

DES policy is an indirect form of bank recapitalization as bad loans are replaced. Previously, Chinese banks are reluctant to recognize NPLs due to the realization of losses. So, NPLs are rolled over ad-infinitum, which market observers opine as inefficient. Banks cannot increase their loan book as they are carrying unrecognized NPLs. With the DES policy, banks dispose their NPLs and release the capital that was previously set aside for the bad loans. This frees them up to extend loans to good borrowers and replenish their loan book with higher quality loans.

In the late 1990s, DES was used in China. The government created asset management companies such as Huarong and Cinda to take over the bad debts of SOEs. YTG was one of the beneficiary of DES conducted in 1998 where Huarong and Cinda fully exited their investment in 2015 with large profits. Thus, investors are hoping that history will repeat itself and reap similar windfall.

However, caution needs to be exercised as the time horizon and economic cycles are different then. The holding period of 17 years is far longer than the proposed 5 years period for YTG to turnaround. Also, the economic conditions were different; China was going through a commodity boom with rapid economic growth compared to the current mature economic conditions.

In conclusion, the DES reform is a keenly anticipated reform. Although it is still early days, we believe that the success of DES reform may help China to avoid a hard landing.

Best regards

Elwyn Chan, CAIA

————————————–

CEO, Stirling Fort Capital Pte Ltd

391A Orchard Road #08-07 Ngee Ann City Tower A S238873

(A Registered Fund Management Company with MAS)

– Director, Stirling Fort ASEAN Real Estate Fund I SPC

– Director, Catalyst Stirling Fort Pharma Fund SPC

– Director, Stirling Fort Asia Income PLUS Fund