An article by Elwyn Chan of Stirling Fort Capital.

The recent global markets selloff was triggered by increased uncertainties surrounding Fed’s policy stance. There have been conflicting viewpoints among Fed officials whether a rate hike is necessary in the upcoming FOMC meeting on 20-21 September. Each time a Fed official speaks, the probability of rate hike in the coming meetings fluctuated drastically, resulting in wild market swings.

As the Fed enters the “blackout period” ahead of its September meeting, we enjoy some respite from the Fed’s talking heads. We highlight the latest viewpoints of all voting members of the US Fed and their position in the dove/hawk camp.

The doves are appearing less dovish where even dove leader Yellen stating “the case for an increase in the federal funds rate has strengthened in recent months.” Also, Fed Vice Chair Fischer is firmly in the hawkish camp and claim that Yellen’s Jackson Hole speech was “consistent” with a possible rate hike in September and two rate hike this year.

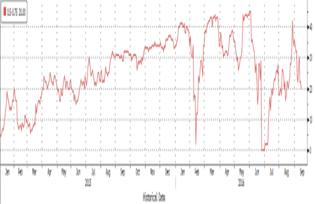

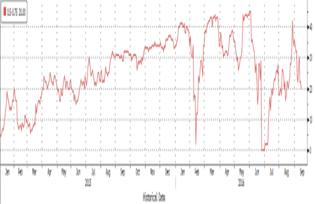

Ominously, the US 10 year yield has risen to a recent high of 1.75%, clearly breaking out of its downward one-year trend line. Therefore, a rate hike in the September Fed meeting remains a “live” possibility with the Fed funds futures pricing in a 20% possibility of a rate hike. This will be a tail risk to the financial markets if Fed chose to hike interest rate.

1-year chart of US 10-year Government Bond Yield

Source: Bloomberg

Fed funds futures implied possibility of a Fed rate hike to 0.5-0.75%

Source: Bloomberg

| The Dove Camp

Below are the Fed doves and their recent comments reflected a less dovish stance.

| Janet Yellen, Fed Chair |

In her assessment of the economy during Jackson Hole symposium, Yellen stated that“the case for an increase in the federal funds rate has strengthened in recent months.” This implied that there will be at least one rate hike by the end of the year.

|

| William Dudley |

Dudley is a close ally of Yellen and his views are closely watched by the market. Last month, he commented that a rate hike in September is “possible” with the economy in “OK shape”.

|

| Eric Rosengren |

Rosengren recently shifted his view towards a more hawkish policy stance by warning that waiting too long to raise interest rates could overheat the U.S. economy and risk financial stability.

|

| Lael Brainard |

Brainard is the last Fed official to speak before the September FOMC meeting and signalled that there is zero rush to hike rates. She was more concerned about undershooting inflation and that weak demand from abroad will weigh on US economy.

|

| Daniel Tarullo |

Tarullo wants to see more evidence of sustained inflation closer to the Fed’s 2% target. He also emphasized that the Fed is “not running a hot economy.”

|

| Jerome Powell |

Powell argues for a “very gradual” path for any interest rate hike with inflation below target. To support a rate hike, he needs to see strong growth in employment and demand, 2% inflation and an absence of obvious “global risk events.”

|

The Hawk Camp

Below are the Fed hawks and their recent comments emphasized their hawkishness.

| Stanley Fischer , Fed Vice Chair |

Fischer is widely influential among the central bankers and mentor Ben Bernanke and Mario Draghi as thesis advisor. He recognised that the economy is very close to full employment. He also commented that Yellen’s Jackson Hole speech was “consistent” with more than one rate hike this year, and a September rate hike is a possibility.

|

| Loretta Mester |

Mester expects the US economy to strengthen in the second half of 2016 with inflation moving in the right direction. With regards to the September meeting, she commented that it is a “live” one with a compelling case for a rate hike.

|

| James Bullard |

Bullard is a vocal Fed official with fluctuating views between hawkish and dovish. He favours a second rate hike in the September meeting.

|

| Esther George |

George is a well-known hawk who is worried that excessively low interest rates can pave the way for financial instability. She believes it is time to raise interest rates in the September meeting. Similar to Rosengren, she also voiced out concerns regarding the valuation in some asset markets such as the commercial real estate.

|

|

Best regards

Elwyn Chan, CAIA

————————————–

CEO, Stirling Fort Capital Pte Ltd

391A Orchard Road #08-07 Ngee Ann City Tower A S238873

www.stirlingfortcapital.com

(A Registered Fund Management Company with MAS)

– Director, Stirling Fort ASEAN Real Estate Fund I SPC

– Director, Catalyst Stirling Fort Pharma Fund SPC