In short, en bloc means all together or all at the same time.

In Singapore, when you mention en bloc, it most probably refers to all the owners in a development coming together to sell the whole development at one go. The recent en bloc sales of Pacific Mansion for SGD$980 million, Tampines Court for SGD$970 million and Amber Park for SGD$907 million are eye-catching, to say the least. It seems like the Singapore property market is going through a strong revival as developers start to get aggressive in acquiring land. The last wave of en bloc frenzy occurred in 2007 and subsequently, prices peaked in 2008 before dipping due to the Global Financial Crisis. Had the crisis not hit, property prices might have continued on their upward trajectory. Let us look at the characteristics of this current en bloc wave and see how it is different from previous cycles.

1) Property cooling measures are still firmly in place

This further enhances the stand that this property revival is extremely strong. Most analysts were clamouring for a reduction in the property cooling measures to liven what was a weak property market. However, this property revival occurred despite the rather prohibitive cooling measures that are in place.

2) Developers seem to be agnostic towards the tenure of the land

Instead, developers seem to be focusing on the location and future potential of the area rather than whether a plot of land is freehold or not. Developments like Tampines Court, Eunosville, Shunfu Ville, Rio Casa and Serangoon Ville seem to suggest that the interest in 99-year leasehold developments is strong among developers. That being said, two of the largest en blocs in this cycle, Pacific Mansion and Amber Park are sitting on freehold land.

2) Borrowing costs are still relatively low

Cheap financing is still available. It has been about a decade since we’ve seen mortgage rates above 3%. In fact, it has been about a decade where private borrowing rates have been cheaper than HDB mortgage rates. Consequently, developers have access to cheap financing as well.

To displace a development is a huge thing. Not only is it a huge financial commitment to the developer which is buying the development, it is also a huge change for the families who have lived there for many years. So what are the pros and cons of en bloc sales?

The positives

1) Clear out an ageing development to make way for a new one.

There are many developments which are ageing and for these developments, maintenance costs will start to increase gradually. The maintenance cost may eventually become too expensive for some homeowners. Certain structural issues may start to crop up and things like upgrading the lift system may cost a large sum of money and in some cases, the monies accumulated from the sinking fund over the years may still be insufficient to rectify these issues.

2) Rejuvenates the area

Certain buildings as they age may look dated. This is especially so if the development is surrounded by modern buildings. As the landscape of Singapore changes and progresses, there may be certain older developments which may look out of place. An en bloc sale helps to clear out these older developments to make way for a new, modern development.

3) More efficient land use

Buildings that were built in the 70s, 80s or even the 90s may be built with lower plot ratios. Over time, the Urban Redevelopment Authority (URA) would revise the plot ratio upwards. This means that on the same plot of land, developers can build more Gross Floor Area (GFA). Essentially, developers can build more units on the same plot of land. In the past, you could see open air carparks but these days, carparks are usually multi-storeyed or underground. Certain facilities are also integrated into the building structure rather than left in the open in a bid to make use of space more efficiently.

4) Changing homeowner habits

In the past, developments had facilities like squash courts, huge sauna rooms and golf putting greens. Today, such facilities are not popular as homeowners’ habits have evolved. In certain developments, their squash courts have not been used for a very long time. Over time, such facilities receive less care and maintenance. Clearing out these developments with dated facilities will make space for new developments with facilities that are trending.

5) Stimulates the economy

Homeowners that receive monies via en bloc will become wealthier. They may not buy another property if the property that was sold en bloc was an investment property. They may also buy a smaller property with a part of the monies received and still have monies left. This newfound wealth may find its way into the Singapore economy through consumer spending.

The negatives

1) Loss of heritage and unique architecture

The en bloc sale of Pearl Bank Apartments is the first step to the eventual tearing down of what was once Singapore’s tallest residential building. Also, the development has a unique horseshoe-shaped architecture. There are many other iconic buildings which have already been torn down and there will be others that will be torn down in the future. This is something which will happen when monetary consideration is made the primary factor in deciding whether to keep or sell a property. The government has a part to play as well in conserving buildings with certain heritage value and also to keep the supply of land adequate via government land sales (GLS) so that developers do not have to go into the private market via en bloc to obtain land.

2) Prices of future properties will be pushed higher

To displace homeowners, developers have to dangle an enticing price for them to sell their properties. Usually, the price is extremely attractive, way more what the seller could have gotten in the open market. As developers are profit driven, the prices which they will launch the new project will not be cheap. Eventually, this premium that they paid to the displaced homeowners will be included in the price of the new properties which they will develop and sell to homebuyers. Also, displaced homeowners usually look for replacement properties in the same area. The surrounding properties will also start to price their properties higher after learning about the en bloc in their area. En bloc owners may also pay over and above market rate just to secure a replacement property. Recently a 5-room HDB resale flat on a high floor in Geylang was sold for $910,000. The buyers were a Singaporean couple who recently sold their property in an en bloc sale. The HDB flat was sold after it was listed for two days. This may be a source of unhappiness for first-time homebuyers who may not have the financial means to compete with people who have received monies from en bloc sales.

3) Reduces spending power in the economy

Consequently, from the previous point, prices will go higher and for most homebuyers, they are not recipients of en bloc sale monies. Most buyers fund their property purchases from their income and thus higher property prices will cause them to spend a larger proportion of their income on their property purchase. This reduces their disposable income and in turn, reduces consumer spending. If this reduction is too great, it could negatively affect the economy.

4) Inculcate a “property is a sure-win investment” mindset

To many people in Singapore, there is a mindset that the best form of investment is property investment. It is seen as a “sure-win” thing that if you place monies in a property, you will make money. The en bloc enthusiasm and media coverage are further enhancing this mindset. As people see en bloc sales recipients get millions of dollars in payouts, they too aspire to be just like those people. They then channel all their efforts and resources to buying properties in the hope of making money. Even as we try to encourage innovation and business risk-taking, the payouts from en bloc sales seem to be so much more for so much less effort. This disincentivises business owners from taking on more risk and expanding their business. I have met countless business owners who speak not of how they can innovate, improve and expand their business but instead are in business to accumulate wealth to buy more properties to rent out and wait for en bloc. Students in business school are taught how to innovate and are told to take on more risk in business. However, when they return home and see their parents or relatives receive millions of dollars because of an en bloc sale, they may find that property investment is a more worthwhile money making avenue to pursue. In my opinion, in the long-term, this is unhealthy for Singapore as a business hub.

Even though it is easy for us to be swept aside by the current en bloc enthusiasm, it is still mindful to note that property investment should be based on fundamentals and not because you want to buy a property in hope that it will be sold en bloc. Basic characteristics like near an MRT Station, amenities and future growth potential are things that developers will also identify when they look for properties to purchase en bloc. You should buy a property based on fundamentals and if an en bloc sale happens, that is a bonus to you. When in doubt, contact an experienced property agent for advice.

Happy property hunting!

Yours Sincerely,

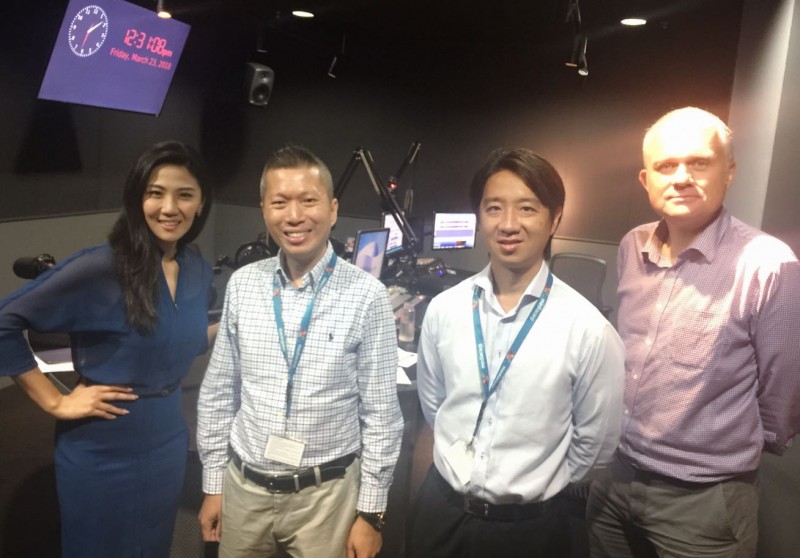

p.s. I was asked to share my views on The ABF Podcast on Channel NewsAsia. The podcast can be heard at https://www.channelnewsasia.com/news/podcasts/the-abf-podcast or https://youtu.be/PWdEOgt3g4c