A summary of 2018…

The start of 2018 herald in a wave of optimism in the Singapore property market. For a good part of the first half of 2018, the key topic of discussion was en bloc sales. En bloc, which means altogether at the same time, was a practice where homeowners in a development, usually the older and dated ones, collectively sold their units as a whole to developers. Developers would then redevelop these properties and relaunch the new development in the primary market. In fact, there were successful en bloc deals being inked every month in the first half of 2018. Most notably, between the 1st of June till the 5th of July, the day the Singapore government announced the latest round of property cooling measures, there were six successful en bloc deals worth more than SGD$1 million. Since the announcement of the property cooling measures, more than 30 en bloc bids have failed to find a buyer. Only three en bloc sales have occurred since and two of the three sites have successfully clinched planning permissions to change their land use for hospitality, i.e. to develop hotels. It would be safe to say that the en bloc cycle and the euphoria that prices were going to skyrocket came to an end the very day that the cooling measures were announced. I personally started the year with a great deal of optimism for the Singapore property market on the back of a stable Singapore dollar and Singapore being seen as a safe haven when many parts of the world are facing some form of political and economic stability. However, I was also perplexed by the intense level of optimism that gripped the property scene at the start of 2018. I did comment on the en bloc fever previously earlier this year in an article entitled: The Singapore Property En bloc fever: Making sense of collective sales.

Low interest rates were also a precursor for a very conducive property buying environment. In fact, rates have been low for a decade due to expansionary monetary policies adopted by many central banks around the world. The US and Europe, having emerged from significantly tumultuous financial downturns, engaged in extremely accommodative monetary policies. Singapore, being an extremely open economy, was always a price taker and thus our rates were also accommodatively low despite the fact that our financial system was much stronger than The US and many parts of Europe. Many property analysts were critical of the Singapore governments intervention in the local property market but one of the fundamental purposes that our government exists is to smoothen out the peaks and troughs of the financial cycle. In fact, in such an open economy like Singapore’s, the government’s role in controlling large swings in the economy is even more essential. It is often said that when The US, China or Europe sneezes, Singapore will catch a cold. A good part of early 2018 saw interest rates for private property still at very accommodatively low rates of perhaps around 1.8 per cent. However, monetary tightening from the US Federal Reserve have seen rates in the US rise and as a result, Singapore’s home loan rates have risen as well. At the point of writing in December, the fixed rates for home loans from local banks stood at around 2.4 per cent. A double whammy of cooling measures as well as an increase in home loan rates has seen a significant slowdown in buying activity in both the primary and secondary market.

Despite this, there were some large deals that were clinched even after the cooling measures and these were sold to foreigners even though there is now a 25 per cent additional buyer’s stamp duty (ABSD) levied on them. Singapore is seen by many as a safe haven. When neighbouring countries like Malaysia and Indonesia are having political issues, Singapore’s leadership transition takes a less disruptive path. Being corruption-free, having a stable currency and having a welcoming stance to foreign investment has put Singapore as a very attractive place for investors across the globe to park their monies in. One of the favoured assets is property. Consider the Brexit mess in the UK, having to second guess President Trumps next move in the US and the Chinese government intervening in Hong Kong and suddenly Singapore seems like a very enticing proposition for foreigners looking for an investment outlet. So even though there are many reasons to be pessimistic about the property market because of what has been happening internally, external factors seem to suggest that Singapore as a safe haven for investment is now even more apparent to investors on the outside of the city-state.

The end of the year is upon us and suffice to say, 2018 has been a very good year in terms of sales in new project launch. Just like in my previous 2018 Bangkok Property Market Review, I will be running through my personal list of top new project launches in Singapore for 2018.

My top 5 new project launches (Rest of Central Region and Outside Central Region) in Singapore for 2018

As this is a countdown, let’s start with number 5.

Number 5:

The Tre Ver is a 99-year leasehold development located along Potong Pasir Avenue 1. It will consist of 729 units and is developed by UVD Projects, a joint venture of UOL Group and United Industrial Corporation (UIC). It will be developed on the site of the former Raintree Garden, a 175-unit privatised HUDC estate. The Tre Ver is not very near Potong Pasir MRT. It is about 800 metres from the MRT station and it will take about a 10-minute walk to get there. There are many condominiums closer to Potong Pasir MRT Station and thus proximity to the MRT station is not why buyers would buy The Tre Ver. The first reason to purchase a unit at The Tre Ver would be because the development faces the Kallang River. There is a jogging, walking and cycling path that flanks the river. In an increasingly built up Singapore, it is rather special to have a property that has a waterfront facing. Buyers should take a stroll along the river to appreciate the peace and serenity of the area. Potong Pasir has always had a laid back feel to the neighbourhood. Developments around Potong Pasir MRT Station have added a significant amount of hustle and bustle to the area but when you come to where The Tre Ver is, the peace and serenity that you get is a welcomed change. UOL and UIC are also very experienced developers and have completed many quality developments in Singapore, notably Nassim Park Residences and Alex Residences to name a few. UOL’s property portfolio includes malls like United Square and Novena Square. Both companies have been listed on the local bourse for a very long time.

My earlier in-depth review of The Tre Ver: My review of The Tre Ver and Riverfront Residences

Number 4:

Stirling Residences is a 99-year leasehold condominium located along Stirling Road. The developers, Logan Property and Nanshan Group won the bid for the plot of land in a government land sales tender. Their top bid of $1.003 billion made this the first fully residential site in Singapore to cross the billion dollar mark. This bullish bid in May 2017 helped fuel the euphoria and positive property market sentiment in the subsequent months ahead. Location wise Stirling Residences is very close to Queenstown MRT. It is located just behind another condominium, Queens. Walking to Queenstown MRT Station would take about 3 minutes and the distance is about 270 metres. Since it is located just off the main road, noise from the main Commonwealth Avenue road and the MRT train tracks do not disturb residents of Stirling Residences like they would the condominiums along the main road. It takes about 10 minutes via train ride to get to Raffles Place MRT Station. If you add the walking time and time it takes to wait for the train it would take you about 20 minutes to get from Stirling Residences to Raffles Place MRT Station.

My earlier in-depth review of Stirling Residences: My review of Stirling Residences and Margaret Ville

Number 3:

Jade Scape is built on the site of the former Shunfu Ville. Shunfu Ville was a privatised HUDC estate and this particular en bloc deal was perhaps one of the first deals in this latest en bloc cycle. Location wise, it is very close to Marymount MRT and in terms of walking convenience to the station, Jade Scape is most probably the closest condominium. There are a market and amenities just across Shunfu Road and if you pick the right units, you can get very good unblocked views. Being a large development, facilities are very adequate. The developer, Qingjian, has been developing in Singapore for a good number of years and some of their previous developments, Bellewoods and Bellewaters, received awards from the Building and Construction Authority (BCA) commending them for their high workmanship quality standards. I am one to believe that Jade Scape would be well developed as well. In terms of future supply in the area, there is no other available plot of land in the vicinity which the government can release and if developers are interested to develop in this area, they would have to purchase an existing development for redevelopment. Thus there should not be many possibilities of future supply in the area after Jade Scape which should bode well for investors who are looking for rental returns.

My earlier in-depth review of Jade Scape: My review of JadeScape

Number 2:

This was very hotly anticipated. Parc Esta was perhaps the best performing development post cooling measures. There is a certain draw when it comes to properties in the east and interest was very strong for this particular launch. This development sits on the site of the former privatised HUDC, Eunosville. MCL Land acquired the site for $756 million, then the second highest price paid for a HUDC estate. It is replacing the 330-unit Eunosville with a 1,399-unit development, Parc Esta. This location is superb and all you need to do to get to Eunos MRT Station is to cross a road. Amenities are bountiful as there is a wet market, food centre, clinics, convenience stores, supermarkets all around the vicinity. The availability of food options is mind-boggling in this area. Price wise I do think that based on prices being transacted for new project launches, Parc Esta’s starting pricing of just above $1,500 per square foot or median price of just under $1,700 per square foot does seem acceptable considering the location.

My earlier in-depth review of Parc Esta: My review of Parc Esta

Number 1:

In truth, this was a toss-up between Park Colonial and Parc Esta. Park Colonial is a 99-year leasehold project located along Woodleigh Lane. It is located right next to Woodleigh MRT and is developed by CEL Unique Development, a joint venture between Chip Eng Seng, Heeton Holdings and KSH Holdings. The development will have 805 units and is expected to be completed in 2022. Just across the road will be The Woodleigh Mall which will be linked to Woodleigh MRT Station. Prices at The Woodleigh Residences which is linked to The Woodleigh Mall are going for in excess of $2,000 per square foot. Park Colonial also has easy access to the entrance of the MRT station, in fact, it is located right next to it but prices at Park Colonial’s median prices are around $1,750 per square foot and there were some units that were sold at per square foot prices that are less than $1,400. I personally do not think that prices at The Woodleigh Residences are worth about 20 per cent more than Park Colonial and this is perhaps the reason why a paltry 28 units were sold during the initial launch. Moreover, I do think that where The Woodleigh Residences is located, there should be congestion issues as there are many HDB flats being built on that side of the road. Park Colonial has the benefit of being on the more peaceful side, still have easy access to The Woodleigh Mall and have the benefit of having its prices benchmarked to The Woodleigh Residences which, in my opinion, may not be an advantage to be located right in an integrated development due to congestion issues. Another reason why Park Colonial pips Parc Esta would be the fact that Woodleigh is a new residential estate. Everything is organised and there is going to be a large integrated mall with a bus interchange and easy access to Woodleigh MRT on the North-East Line. Moreover, if you are buying to rent, developments in Woodleigh do not have to compete with the HDB flats in the vicinity as all the HDB flats are newly built. Residents in those HDB flats will have to fulfil their 5-year minimum occupation period before they can seek approval from HDB to rent out their flats.

My earlier in-depth review of Park Colonial: My review of Park Colonial

In truth, I am rather agnostic in my selection between Park Colonial and Parc Esta. I truly believe that in today’s property market where prices are high, location does play a significant part in determining whether a property can be rented or resold at a profit in the future. Buyers have commented that they felt that prices at developments like Parc Esta are a little on the high side but they have to remember that developments like Parc Esta are unique as there can be no nearer development to the MRT station. It then comes down to the decision of whether the price is something reasonable in today’s market.

My top new project launch (Core Central Region) in Singapore for 2018

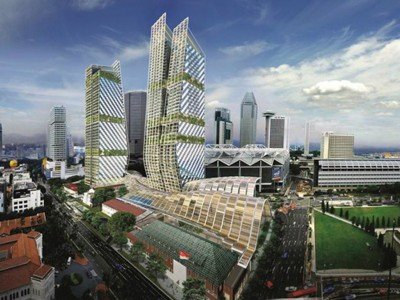

Sometime in September, South Bridge Residences made headlines for having 10 units sold in a fortnight, including the 6,728 square feet super penthouse for SGD$26 million. The buyer is a foreigner who paid SGD$3,864 per square foot for the completed unit. The 99-year leasehold development is located along Beach Road, right next to Suntec City and Raffles Hotel and diagonally across Raffles City. It consists of 190 luxurious residential units within a huge mixed development with about 500,000 square feet of grade A office space and a 5-star hotel, JW Marriot Hotel. Esplanade MRT Station is linked to the development and you can use the underpass network to navigate to the various landmarks in the area. Perhaps what is unique about this particular location would be the extremely central location. A close comparison to something with a similar concept would be Duo Residences which is along North Bridge Road. However, South Bridge Residences has the advantage of being linked to Suntec via a link bridge and an underpass and it the grade A office space complements the offices that are already operating in the vicinity in Suntec. Development wise I do think that the attention to detail coupled with the fact that this is a City Developments Limited (CDL) project means that buyers are getting a quality development from one of Singapore’s top developers. Singapore is often seen as a safe haven for investments and this is an offering for the super-rich of the world if they are looking to invest in Singapore property.

Looking ahead to 2019…

Local demand for Singapore property should be weaker in the early part of 2019 as compared to a frantic first half of 2018. Interest rates are slated to continue their upward momentum albeit not at the same pace as was previously expected. As mentioned previously, Singapore has always been tracking the market when it comes to interest rates and the US Federal Reserve’s admission that things may not be so rosy as previously thought does put paid to their initial plan of normalising interest rates at a quicker pace. Mortgage rates should probably rise and even though the rate of increase may be slower than anticipated, property homebuyers and current property owners should still be prepared to fork out more for their instalments. Prudence should be in order for 2019 as we face an uncertain global economy.

I do think that the full impact of the trade war between the two largest economies, The US and China, have not been felt. Such an impact can only be felt after a few financial periods when trade restrictions take a toll on companies’ balance sheets. This should present itself in the latter part of 2019 and I do think that the numbers that will come out from these two economies will not be pretty. Brexit is also something to take note come 29th March 2019 as the UK official leaves the European Union (EU). Leaving the single market is going to severely impact The UK’s ability to attract and hold on to investors and if Brexit negotiations with the EU do not go well, there should be a great deal of uncertainty for the economies of nations in the European Union and The UK.

How this would impact Singapore’s economy and consequently the Singapore property market is unclear. On one hand, a weaker global economy would result in poorer sentiment and even perhaps layoffs for some companies. On the other hand, the weak sentiment and uncertainty in the UK and the EU coupled with the fact that our neighbouring countries Malaysia and Indonesia have their own political instabilities to manage, make stable Singapore a very attractive for investors. Moreover, the continued intervention by the Chinese government in the governing of Hong Kong has made many Chinese investors look elsewhere for property investment. This is why even though Singapore has extremely restrictive additional buyer’s stamp duties for foreigners of 25 per cent, overseas buyers have been snapping up Singapore properties and the super-wealthy of the world has been targetting Singapore’s luxury condominium segment.

My take is that barring a significant recession, property prices should either hold firm or dip slightly. Rents will continue to remain weak as more condominiums come onto the market. Developments that have good locational attributes will still sell well so long as developers price their offerings reasonably. The Singapore Dollar has always been a safe haven for many around the world and this perception is going to strengthen even more in 2019. Those that are looking for a significant market correction in the Singapore property market should always be aware of this fact.

Yours Sincerely,

p.s. I am a licensed real estate agent in Singapore since 2003. My views and reviews are my personal independent views and are a result of my dealings with various developers and the various stakeholders in the Singapore property market. I blog about the Bangkok and Singapore property market in my own personal capacity.

Some of my other articles about Singapore property

How to select a good unit at a new project launch

The good locations for property investment in Singapore.

Things to take note of when visiting the sales gallery of a new project launch

Buying a property at a new project launch: The procedures and what to expect.

New property cooling measures: What are they and what this means moving forward?

Why the latest round of cooling measures is necessary

Are Singapore property prices too high?

The Singapore Property En bloc fever: Making sense of collective sales

How interest rates affect the property market

Understanding The Law Society Conditions of Sale 1999 and 2012

Can an HDB flat be a good investment?

Here is my review of the Bangkok Property Market