Not too long ago, the Singapore Stock Exchange (SGX) once harboured ambitions to usurp the Hong Kong Stock Exchange as Asia’s top stock exchange. Fast forward to today and it seems like the SGX is even further away from its lofty goal. Back in November 2017, Singapore’s homegrown technology company Razer chose Hong Kong over Singapore for its initial public offering (IPO). Hong Kong offered a much wider reach to investors and the interest in such an IPO was much higher in Hong Kong than Singapore. People in Hong Kong are fervent property investors. However, it looks like there are a good amount of people also interested in investing in stocks.

Remember the good old term don’t put all your eggs in one basket? It seems like the general Singapore population is keen to put most, if not all of their eggs in one basket. Property investment is usually touted as a sure fire way to financial freedom. Collecting rent and hoping for an en bloc sale from an overzealous developer was the safe and secure way to financial independence. Singapore as a land-scarce city would indefinitely see property prices head north. Even with the occasional dips in the market, property prices should eventually rise in the long run.

Let’s look at price growth:

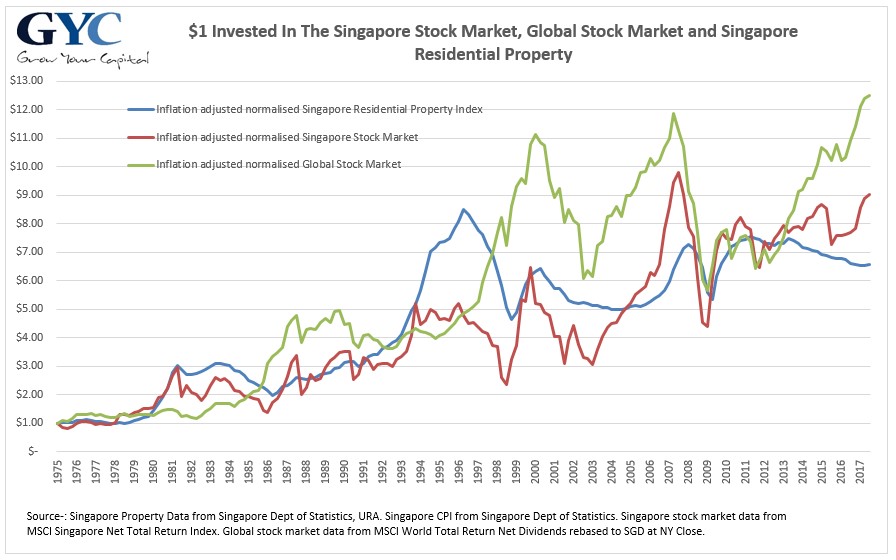

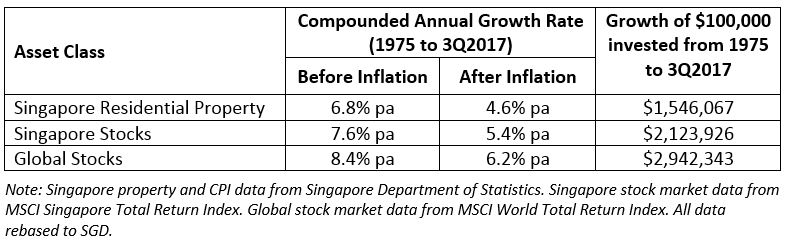

As a person who is enthusiastic about economics, the same can be said of most asset class. In fact, we call this inflation. Over time things get generally more expensive nominally. Wages will rise as well. So will stock prices. The Today paper had an article which compared the inflation-adjusted normalised Singapore Residential Property Index, inflation-adjusted normalised Singapore Stock Market and the inflation-adjusted normalised Global Stock Market and properties fared the worst of the three. This was the chart in the article. It was contributed by GYC Financial Advisory:

Even with the huge price growth in the property market since the 1970s, it still fared worse than the Singapore and Global Stock Market. This makes it even more perplexing that the current property market is experiencing a huge wave of optimism in anticipation of prices rising even further. Look back at property prices and the property market in 2013 to 2016. Prices were falling and market sentiment was extremely weak, yet buyers stayed away. In 2018, nothing much had changed fundamentally. Plans that were initiated by the government were put in motion before 2018. All of a sudden all these growth areas started looking extremely attractive. Developers launched units in non-core central regions around the SGD$2,000 per square foot range and yet achieved stellar sales results. In my opinion, the main reason for the exuberance is the wave of en bloc sales sweeping through the company. Developers needed to top up their land bank and the Government Land Sales (GLS) could not adequately supply them with the land that they needed. When developers bid aggressively for plots of land, buyers of Singapore properties took it that this was a sign that prices were going to rise and thus flocked in.

Let’s look at yield:

The true fact of the matter is that prices of rents are not increasing at the same rate as home prices. Moreover, it may take longer to rent the same property in that particular area once all the developments are completed. Take Commonwealth Towers as an example. Based on listings listed on Propertyguru, you can rent a one bedroom unit for $2,200 yet if you were to purchase a similar one bedroom unit, asking prices are in the $950,000 to $1,000,000 range. This works out to a gross yield of about 2.6-2.8%. If you were to consider the period which the property is vacant before a tenant moves in, the conservancy and sinking fund charges, the cost to furnish the property and the agent fees involved, the yield may be less than 2% per annum. There is a development, Alexis, not too far from Commonwealth Towers. Many years back, a one bedroom unit in Alexis could be rented out for more than $3,000 a month. Today, it has no reason to be priced higher than the $2,200 per month asking price for a one bedroom unit in Commonwealth Towers. There is a huge influx of units in the area and this has caused supply to shoot up without a corresponding increase in demand. When Queens Peak is completed, it will further add to supply and consequently, rents should soften further.

Consider this, there are stocks that do pay dividends. Dividends can range from anything from 1% to upwards of 7% per annum. For example, Mapletree Logistics (SGX: M44U) has returned about 7% yield for the last 5 years. Starhub and M1 have also been giving out regular yields for the longest periods. Yields have been north of 5% based on when the stock was purchased. REITs also provide healthy returns for investors. Compare this with the rent that you are collecting from your tenant when you rent out the property. There is a chance that you may need to chase your tenant to pay up his rent. Dividends are declared by a company and paid out on a fixed date. Dividends are almost nett returns before income taxes.

Let’s look at liquidity:

Stocks are extremely liquid if you are holding on to well-traded counters. If you purchase well-known companies like DBS, UOB, OCBC, Starhub, M1 or any of the major REITs or property developers, you can be assured that you can sell off your stock holding almost in an instant whenever the market is open. Commissions vary for buying and selling of stocks. Conversely, it takes time to sell off a property. It can take anything from 3 months to a year to sell a property depending on a number of factors.

Let’s look at taxes:

Singapore has no capital gains taxes if you are buying and selling stocks and properties in your own capacity and not as a trader. Dividends and rents are considered income taxes. However, the taxes that are to be paid when property buyers buy and sell properties is rather high. Depending on the buyer profile and the number of properties that he is holding, the stamp duty when buying can be as high as 18% of the purchase price. If the property is sold within the first 3 years of purchase, there will be stamp duties to be paid as well. These stamp duties can be as high as 12% of the selling price if the property is sold within the first year.

When I take a look at these factors, it does make a compelling case to invest in stocks rather than property but than that would be missing the point of my article. I have always advocated that things be done in moderation. If we were to think of building an investment portfolio, then it should include a healthy balance of both equities and property as well as other investment assets. It is true that the rich invest in property but the rich do not get rich solely through investing in property. They would have invested in a whole array of assets, not just property.

In the long run, property prices should rise and you should make money on most property investments in a land-scarce city like Singapore. However, stocks offer a very viable alternative and should be added to investors’ portfolios.

Perhaps with everyone’s help, we can get companies like Razer to consider listing on our SGX?

Yours Sincerely,

Daryl Lum