This article is written to aid investors in making a more informed decision when investing in properties in Thailand. I wrote it based on data referenced from various sources and it includes my personal insight.

Thailand is one of the more popular destinations for property investment. It is at the heart of South-East Asia and is extremely welcoming to foreign investment. Its central location and investor-friendly policies make it an investment hotspot in the region. Let us first take a look at how 2017 and the preceding years were for the Thai economy and its property market.

Thai economy report card for 2017

Thailand’s economy did extremely well in 2017. Gross Domestic Product (GDP) grew by 3.3% in the first quarter, 3.7% in the second and 4.3% in the third quarter. At the point writing the GDP growth for the fourth quarter had yet to be released. These results were above most analysts estimates. Thailand’s economy is heavily export-dependent with exports accounting for more than two-thirds of GDP. The Thai baht has been relatively strong against the US dollar throughout the year at about 33 against the dollar. It surged more than 7% to be where it is currently. This, in recent history, is a moderate exchange rate for the Thai Baht. The recovery in global trade played a large part in the positive GDP numbers. Even though local demand was weak, global demand for Thai exports was strong. The expansion in GDP growth was in mainly in the agriculture, manufacturing and hotel and restaurants sectors. This broad-based GDP expansion bodes well for the Thai economy which has traditionally relied very heavily on tourism to boost its figures.

It would be good to point out that the Thai economy is very reliant on having a stable political system in place. The largest threat to the Thai economy, in my personal opinion, is the unstable political situation. An unstable government would result in relatively shorter-term policies for the country. Only a government confident of a relatively long period of rule would plan for longer-term infrastructure projects. Earlier in 2017, there were changes made to the Thai constitution cementing a place for the military in government. While this may seem to shift Thailand further away from democracy, it may actually turn out to be a blessing in disguise. The junta’s rule has brought about a period of sustained political stability in the country. The junta has plans to shift Thailand towards an economy driven by high-tech industries and innovation that will lead to the production of value-added products and services. While bureaucracy may pose a challenge to this, the relatively stable political environment makes this a probable target.

What will drive the Thai economy moving forward?

1) Government spending on big-ticket infrastructure projects

The Thai government plans to open a few large infrastructure projects for bidding. Most notably the southern Purple Line from Tao Poon to Rat Burana which has a contract value of about 130 billion baht. Such large infrastructure projects will benefit Thailand both in the short and long term. In the short term, jobs will be created and incomes will rise. In the long term, the value of properties along the new rail lines will increase, new townships will be formed and with improved infrastructure, Thailand will be a more attractive investment destination.

2) The rise of the Eastern Economic Corridor (EEC)

This is a plan to develop the eastern provinces of Thailand into a leading ASEAN economic zone. The EEC includes the three eastern provinces of Thailand, Chonburi, Rayong and Chachoengsao. The government hopes to turn these provinces into a hub for technological manufacturing and services with strong connectivity to the rest of ASEAN by land, sea and air. The project is expected to cost about US$43 billion.

3) China’s One Belt One Road initiative

This point cannot be stressed enough. The Singapore-Kunming Rail Link is integral to China’s One Belt One Road initiative. The Chinese are funding a large part of this elaborate and ambitious project to link China to the rest of South-East Asia. Thailand happens to be right in the middle of both Singapore and Kunming, making it integral to the success of the One Belt One Road initiative. In July 2017, the Thai Cabinet approved the 179 billion-baht first phase of a high-speed rail (HSR) project that will be funded by Thailand and built by China.

Thai property report card for 2017

Thailand’s housing market is weakening despite a stronger economy. Prices are still increasing albeit at a much slower pace. Land price increases are slowing throughout Thailand. The land price index rose by 1.59% in the 3rd quarter of 2017 as compared to the 7.9% increase the year before. Condominium prices rose a mere 0.35% in the same quarter as compared to an 8.2% rise in 2016. The slowdown in the price increase in 2017 is perhaps expected considering how large the increase in 2016 was. Property prices have risen very slowly since the 2008 global financial crisis. This in part largely due to Thailand’s prolonged political instability. In the period of 2008 to 2016, property prices rose by just 29.1% with the bulk of the price increase in the latter part of that period. It is still easy for foreigners to purchase property in Thailand with no additional stamp duties placed on foreigners. This is in stark contrast to places like Hong Kong and Singapore which have placed restrictively high stamp duties to deter foreign property buyers. Liquidity is still cheap with the Bank of Thailand keeping its benchmark interest rate at 1.5%. This low rate has stood since April 2015.

There seems to be a slight disconnect between the Thai economy and property prices. The Thai economy is doing well but the increase in property prices have not done correspondingly well. One of the main reasons I can think of is the apparent oversupply in the past few years.

What will drive the Thai property market moving forward?

For investing in Thailand, I can only meaningfully recommend purchasing a property in Central Bangkok. Thus my reference to the Thai property market in the reasons spelt out below is more in reference specifically to the Bangkok property market.

1) The relatively low property prices

Prime property in Bangkok is still relatively cheap as compared to many places. Bangkok is a thriving metropolis with good infrastructures like a good rail network and an accommodating government when it comes to foreign investment. Buyers from mainland China, Hong Kong and Singapore find prime properties in Bangkok extremely affordable when compared to properties back home. The cost of purchasing, holding and disposing of a Thai property is also relatively low.

2) Infrasture improvement

The Thai government is spending heavily on infrastructure improvement. For example, in August 2016, the MRT Purple Line or the Chalong Ratchadham Line was opened. The Purple Line serves travellers between the northwest suburbs of Bangkok in Nonthaburi Province and the southern area of Thonburi in Rat Burana District. In August 2017, the Purple Line was linked to the Blue Line from Bang Sue Station to Tao Poon Station. Such infrastructure improvement served to raise property prices of the properties along the Purple Line. Similarly, initiatives like the EEC would only serve to bring more jobs and wealth to the people and companies involved in the project.

3) Good developers

Large developers like Sansiri, AP Thai and Ananda are actively wooing foreign buyers as well as the wealthy locals with their prime products. I have to say that the quality of developments in Bangkok is very good. Internationally and locally these companies have a reputation to uphold. Companies like Sansiri have gone one step further and developed guarded and gated communities and projects like T77 at On Nut have proved extremely popular. The quality of the developments by the larger developers in Bangkok has gone up many notches. There is a clear effort to create a sustainable community around their developments. Large developers like Ananda Development and AP (Thailand) have entered into joint ventures with large foreign companies Mitsui Fudosan and Mitsubishi Estate respectively. The bulk of the foreign companies coming into Bangkok to jointly develop residential and commercial properties are from Japan and China.

4) Strong interest from foreign buyers

Foreign buying interest has grown over the last two years. The high-end property market in downtown Bangkok is largely driven by foreign demand. After the global financial crisis in 2008, foreign buying interest was anaemic in the preceding years. However, in 2016 and 2017, buying interest from buyers from Mainland China, Hong Kong and Japan was very strong. For example, about 40% of the high-end luxury development, Four Seasons Private Residences Bangkok, was sold to foreign buyers. The going price for these properties is about THB410,000 per square metre. The average price of a 1,008 square metre penthouse is in the region of THB373 million while an average 2-bedroom unit with sizes ranging from 115 to 138 square metres would cost about THB35 million. Even though this is expensive to most Thais, this is an attractive proposition for buyers from Hong Kong when compared to their property market. Another reason for the renewed interest is the vast improvement in the quality of the developments on offer.

5) One Belt One Road Initiative

This point cannot be stressed enough. China’s elaborate and ambitious plan to build a new silk road will serve to spur economic growth along the rail network. Bangkok is poised to reap a large part of the spillover benefits. It is strategically located right in the middle of Singapore and Kunming, the two ends of the rail network. The location for the high-speed rail (HSR) station in Bangkok is at Bang Sue. There are already efforts to connect the area around Bang Sue to central Bangkok. The Purple Line which was launched in 2016 links this area to downtown Bangkok. Developments are starting to spring up in this area. One example is Chewathai Interchange which is right at the doorstep of Taopoon station.

6) The buying interest from Mainland Chinese

Traditionally Hong Kong buyers have been the top foreign investors in Thai properties. However, the mainland Chinese are set to take over this top spot despite the capital controls set by the Chinese government. Developers like Sansiri, the second-biggest Thai developer by trailing 12-month revenue, is adding offices in Shanghai, Guangzhou and Shenzhen to try to woo more Chinese to invest in their Thai property projects. This is in addition to their already set up office in Beijing. Mainland Chinese see Bangkok as an affordable property market as compared to back home. Prime Bangkok properties are a mere fraction of what it would cost them in places like Beijing, Shanghai and Shenzhen. Sales from mainland Chinese in 2017 is set to double to about USD$106 million from a year ago and is projected to hit $140 million in 2018. This is in addition to the already strong interest from Hong Kong, Singapore and Japanese buyers. According to Baidu, in 2016, Thailand ranked as the 7th country where Mainland Chinese searched for real estate investments. In South East Asia, Thailand property ranked second behind Malaysia. The Chinese investors mainly bought properties priced THB10 million and below and bought in downtown Bangkok or midtown areas with easy access to mass transit stations. Chinese tourism numbers increased eight-fold from about 1.1 million in 2010 to about 8.8 million in 2016. Thus while Malaysia has traditionally been a property investment hotspot for the Chinese, Thailand and namely Bangkok, is still a relatively new market for them. This interest is expected to grow as more Chinese visit Thailand.

The current Thai property situation

1) There is an oversupply in newly completed midtown or suburban properties but not in downtown properties

In Bangkok, there is a clear distinction between the mass market developments and prime residential properties. The mass market condominiums are located in the midtown or suburban areas. These properties are usually for the local market and are priced significantly cheaper. Then there are prime residential properties. The buyers of these properties are usually the upper-middle-class locals and foreigners. These properties are located in downtown Bangkok. These properties are considerably more expensive than mass-market developments and are usually sold overseas in markets such as China, Hong Kong and Singapore. Then there is the ultra-luxury segment with projects like 98 Wireless by Sansiri. These properties are for high net-worth individuals across the world. The difference in quality and finishing from the different segments is extremely obvious.

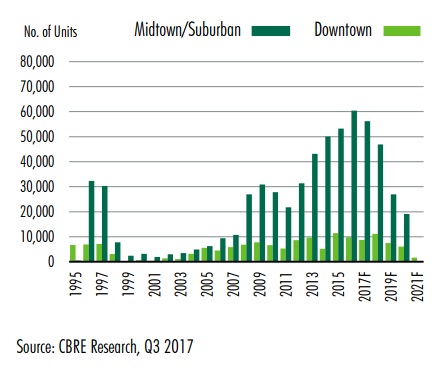

Newly Completed Bangkok Condominiums (Source CBRE Research, Q3 2017)

When investors speak of any oversupply in the Thai property market, it would be wise to understand that that statement was made in reference to the market as a whole. Breaking down the market into midtown/suburban and downtown paints a vastly different story. The downtown supply of newly completed Bangkok condominiums is relatively flat and will taper off in the coming years. As of Q3 2017, there were 30,480 under construction units and 77.2% of this future supply has already been sold. There is actually a very small number of completed but yet unsold units in the downtown area. When you link this tapering off of supply with an ever-growing Chinese interest in the Bangkok property market, you may understand why per square meter prices in prime areas have been increasing steadily over the past few years.

2) A shift in the average asking prices of future units in downtown

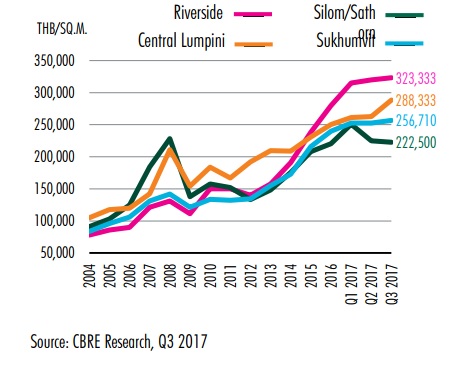

Average Asking Prices of Future Units in Downtown (High-End and above) (Source CBRE Research, Q3 2017)

Traditionally popular areas like Silom and Sathorn have fallen behind properties along the Riverside in terms of price per square metre. This in part could be down to the fact that there are many ultra-high-end developments built along the Chao Phraya River and thus such developments, with their ultra-luxurious premium finishes, tend to cost a lot more. There seems to be a trend moving away from the traditionally premium area of Silom and Sathorn. One of the main reasons for this shift could be that such places, even though very centrally located, are not desirable for living due to Bangkok’s notorious traffic jams and overcrowded streets. As connectivity improves, people do not mind staying a little further from where they work or the city centre as travelling to these places is extremely convenient.

3) A lack of financing options for foreign buyers

Bank financing is still difficult (not impossible) for foreign buyers. There are offshore banks like UOB and Bank of China that provide loans to foreign buyers. Ready financing is usually a precursor to a market upswing. Thus it is really impressive that the Thai property market is staging a strong comeback despite the limited financing options. This is something that is sorely lacking and needed in the Thai property market.

4) Developers need to purchase existing properties for redevelopment if they want to build in downtown Bangkok

There is a lack of available land in downtown Bangkok. If a developer would like to develop in downtown Bangkok, they would more often than not, need to buy up an existing development, demolish it and rebuild a new development on that cleared land. This is in stark contrast to places like Phnom Penh or Ho Chi Minh where developers are selling properties that are built on vacant land, promising infrastructure and future economic growth. Bangkok as a city is already developed. It has a very extensive rail network and is a bustling metropolis. Good freehold land is extremely rare in downtown Bangkok.

Question and Answer:

So do I think it is a good time to buy Bangkok properties?

The simple answer is yes. I have been in the Bangkok property market since 2012. The market was relatively flat in 2015 and early part of 2016 but is staging a very strong revival in late 2016 and 2017. Recently the interest from The Mainland Chinese and Hong Kong buyers are extremely strong.

What type of properties should you buy?

I am a firm believer in the Silom and Sathorn area. That is downtown Bangkok and their Central Business District (CBD). One of the reasons why the price per square meter has lagged as compared to other areas is because there are very few ultra-premium developments in the area. The finishing of a development plays a major factor in determining its pricing. Bangkok is trying to decentralise the CBD. They are developing the area around Asoke to become another CBD. When this starts to take shape, it will alleviate the overcrowding around Silom and Sathorn. I am also a believer in places just at the city fringe like Thong Lo, Ekkamai and On Nut. Such places are just at the edge of the city fringe where there is less of the notorious traffic jam and there is less overcrowding. Developments like The Monument Thong Lo are extremely premium and cater to the luxury market segment. The expatriate community is very prevalent in these areas because of the livability of the area. Community townships like the T77 township developed by Sansiri are also worth considering. It is good to see large developer developing a township. It shows that they are not only interested in building for profits but do plan for a self-sustaining community and do take the effort to conceptualise and develop a mini city by itself. I personally do not believe in the investment value of any Thai property outside of central Bangkok. Properties in places like Phuket are only good as a retirement home. There is little to no resale market for such properties.

Which developer should you buy from?

You should always buy from an established developer. Before the title is transferred to you upon completion of the property, the only thing that you have as proof of your stake in an uncompleted development is the sales and purchase agreement with the developer. There are Thai laws protecting property investors but then the hassle to seek recourse in the event that the developer does not fulfil his end of the deal is really unwanted. The top developers usually charge a premium of about 10 to 20 percent over a small developer in the same area but the quality of their developments is usually much higher. Top Thai developers include Sansiri, AP (Thailand) and Ananda Development. My personal advice is always to pay a little more to get quality. A one bedroom development by a top developer in a good location can still be found for about USD$200,000. This is an extremely attractive price compared to properties in Hong Kong, China and Singapore. I do not think that buying a development from an unknown developer for 10 to 20 percent less is work the risk. Moreover, the larger developers usually have better customer service for their overseas clients as that is their focus.

So what is my prediction for 2018?

Barring any major financial crisis or political event, Thai property prices should increase moderately by about 1-2%. Downtown condominiums should see strong buying interest from Mainland Chinese and Hong Kong. Due to a lack of supply, expect prices in this segment to grow at a faster pace than overall Thai property prices.

I am relatively positive about Bangkok’s prospect as an investment destination. I think the main concerns about property investment in Bangkok are the lack of easy financing options and the possibility of political instability.

Yours Sincerely,

Sources:

1) CBRE

2) Bloomberg

3) South China Morning Post

Other useful articles to help you in your investment decision:

A compelling case to invest in Bangkok

Things to take note when investing in an overseas property

The good locations for property investment in Bangkok

Guide to buying a property in Thailand