Back in 2017, I posted a blog article on the good locations for property investment in Bangkok. Since then, which was six years ago, many other factors have come into play. This blog article is an update to that previous article. I intend to take stock of what I mentioned back in 2017 to determine whether the same applies in 2023 as well as to bring up some new locations which I believe may be worth considering if you are looking to invest in a property in Bangkok.

So what has changed and what can we take away from the last six years?

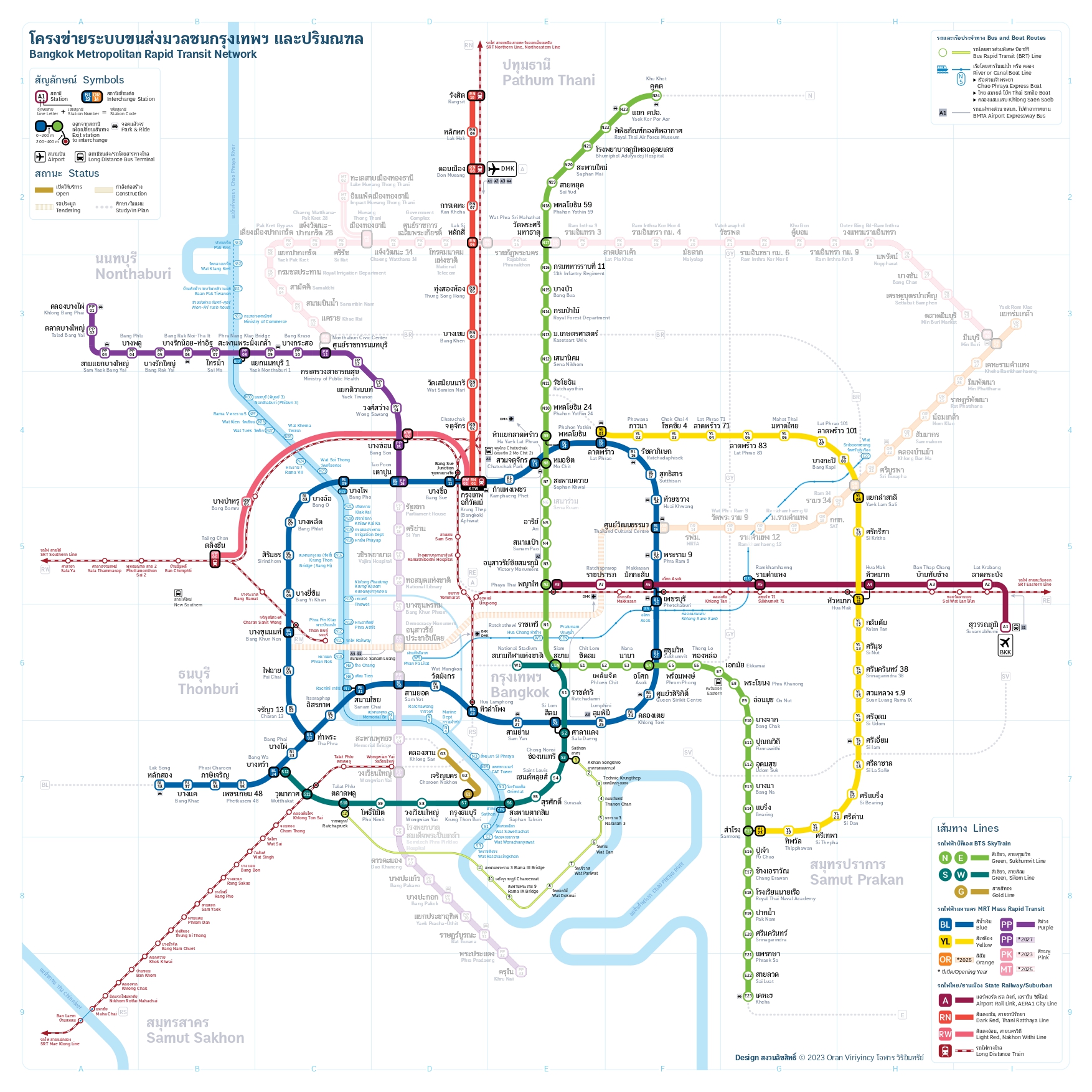

For starters, the Bangkok metro network has expanded greatly. There were extensions added to both ends of the main Sukhumvit line (in the map below, this would be the light green line). Additional train stations were built. Now the line does not end at Mo Chit and Samrong. Instead, it goes on further and ends at Khu Khot and Kheha. There is also a Yellow Line that provides access for residents in Lat Phrao to gain access to the Airport Rail Link via Hua Mak as well as access to the Bang Na area through Samrong. Also, the completed Red Line provides train access to those commuting to and from Don Mueang station. Don Mueang Airport is closer to the heart of Bangkok as compared to Suvarnabumhi. However, due to the lack of a train station, travellers tend to veer towards landing at Suvarnabhumi Airport. This is no longer an issue with the completion of the Red Line. The Blue MRT Line which brings commuters around the Sathorn and Silom financial district is now a closed loop. The Gold Line links commuters on the Dark Green Sukhumvit BTS Line to Icon Siam.

This is a copy of the current Bangkok Metropolitan Rapid Transit Network which I found off the internet (you can refer to the mark on the map for its source). The lines in bold are the lines that are currently operational. There are other lines which have been confirmed and are slated to be completed and those are the lines on the map that are not bold. The takeaway from this would be that the plan to expand the rail network did bear fruit. It is happening and construction to the rest of the proposed lines is in progress. While the government of the day may change, the general consensus is that Bangkok will need an extensive rail network. This is both to alleviate the notoriously horrendous traffic as well as to set Bangkok up as a business-friendly location for international companies. Moving forward, it is extremely likely that the proposed lines will bear fruit. Looking at the map below, this would greatly improve connectivity within the city.

Secondly, Bangkok is coming out of a black swan event. The COVID-19 pandemic may not be repeated in many of our lifetimes ever again. The pandemic caused air travel to come to a standstill, tourist arrivals to plummet to negligible levels and a huge exodus of foreigners from Bangkok. The property market was greatly hit. Sales of Bangkok properties came to a standstill and rental rates fell sharply due to the lack of tenants. The key takeaway from this would be that foreign demand contributes a large proportion of the sales and rental demand in the Bangkok property market. Thus any external or internal shocks to the system would affect the market greatly. Were there a pandemic or if foreigners were disincentivised to travel to Bangkok, for example in the event of domestic upheaval, these would affect the Bangkok property market greatly.

Finally, the Thai government did not intervene in the Thai property market. While there were changes made to taxes for those holding property, there was no additional buying taxes levied on the purchase of Thai properties. Similarly, there are no additional selling taxes levied on what was already prevailing. There was also no change in any policies with regard to foreigners owning Thai properties. While there was a policy set in place to allow foreigners to own land, this was quickly set aside due to public backlash. The current policy still remains, foreigners are free to own condominiums in Thailand up to the prescribed limits. If the development is a freehold development, the maximum aggregate floor space which is foreign-owned cannot exceed 49%. For developments that have tenures that are leasehold, there is no such limit.

So where are prices currently?

There is no central government agency that effectively tracks and displays property prices. When I mean “effectively tracks and displays” I mean providing property buyers and sellers with the past transacted prices of individual units in the various developments. Property buyers and sellers are hence reduced to relying on various sources to gain insights into the Thai property market. Here is a market trend of Bangkok condominiums as provided by the Bank of Thailand.

Source: Bank of Thailand

There is no determinable short-term trend at the moment. Demand for condominiums is seeing an uptick from both locals and foreigners as Bangkok gradually goes back to normal after the pandemic. However, one thing that can be gleaned from this data is that if someone purchased a condominium in 2011, that condominium would likely have increased in value in the region of 91.3%. This is from a simplistic application and plain reading of 2011 being the base year of comparison put against the price index of 191.3 in May 2023. My take to all property investors is to always take a long-term approach to investing in properties. This is especially when it comes to investing in a property in a foreign country. If you are willing to wait out the cycles, in the long-term, and by long-term I mean 10 years, it is highly likely that property prices will be higher than it is when you bought it. For sure inflation may have eroded the purchasing power of the currency which you are receiving when you sell that property. However, property as an asset class still remains a decent hedge against inflation.

So if these factors veer you towards wanting to purchase a property in Thailand and mainly Bangkok, the next thing to consider is location. While the index stated that there was a 91.3% price appreciation for condominiums in the 12 years since 2011, the price appreciation would not have been homogenous across the whole of Bangkok. There would have been properties that appreciated more than others. Location would have played a significant role in this and it is something that would-be property investors should prioritise.

So where then are the good locations to invest in Bangkok? I will be building on my 2017 article as the locations which I referenced back then still hold true. However, I will be adding new locations for consideration.

Once again, I will be dividing the areas into 3 categories:

- The Core Central Regions

- The City Fringes

- The Growth Areas

1. The Core Central Areas

This is essentially where the heart of Bangkok lies. It is where every tourist frequents. It is where luxury brands want to locate themselves. As a property investor, you must always be able to identify the primest location in the city. Where the affluent live and frequent. Where the most expensive per night prices are for hotels. It is from here that we work our way out to other areas and this should always be a point of comparison. This is not only true for Bangkok but any other city.

Attributes that come with such a location would be ease of connectivity to the rest of the city but as always, property prices in this area are going to be the most expensive you can find. This is extremely true of properties in the Core Central Areas of Bangkok.

There are some areas for consideration.

a) The area around Siam, Chidlom and Ploenchit

b) Wireless Road and the area around Lumpini Park

c) Nana and Asoke

d) Sathorn and Silom

a) The area around Siam, Chidlom and Ploenchit

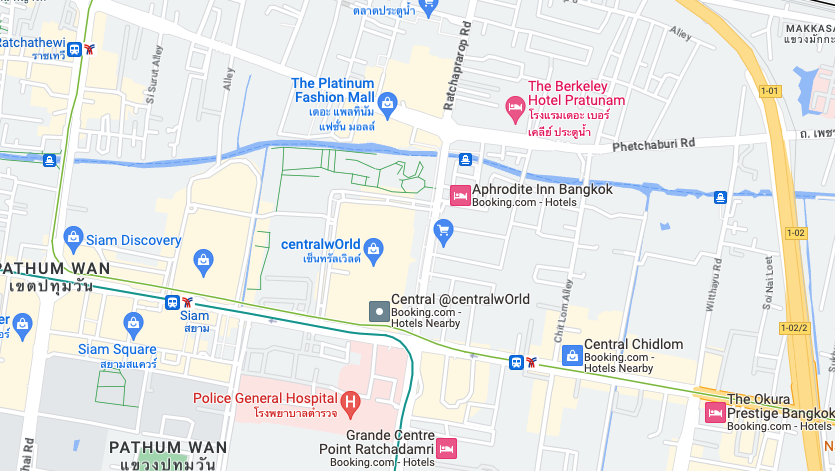

This is the main shopping belt. In Hong Kong’s context, this is the area around Central MTR. For Singapore, this would be Orchard Road. The bulk of the tenants here are expatriates in upper management positions and usually leases are corporate leases. There should be no lack of tenants if you are a landlord that prices his or her unit competitively. On the flip side, however, the rental yield is usually lower for properties in this area. The higher prices do not translate to proportionately higher rents and hence the returns on properties in this area are usually not as high as compared to other areas. That being said, land is extremely scarce in this area. This is an area with just about every amenity that you would want. The flipside of this would be that the traffic in this area is horrendous and it is common to be stuck in a traffic jam. Siam is also an interchange for the two green BTS lines and hence connectivity from the main shopping belt to the central business district of Sathorn and Silom is not an issue. If you have a high budget, looking for ultra-luxurious properties and are looking for capital preservation, properties in this area would suit you.

b) Wireless Road and the area around Lumpini Park

Wireless Road is where the wealthy live. It is by far the most expensive and exclusive area in Bangkok. It is also where the US ambassador’s residence is located. This is Bangkok’s version of 5th Avenue, New York. The name Wireless Road was because this was where the first radio station was. It was chosen due to its central location. This was how the name Wireless Road came about. Coincidentally, the cables are buried underground along Wireless Road. Geographically and historically, this is the most central area in Bangkok. Similarly, if you have a high budget, looking for ultra-luxurious properties and are looking for capital preservation, this is an area for your consideration.

c) Nana and Asoke

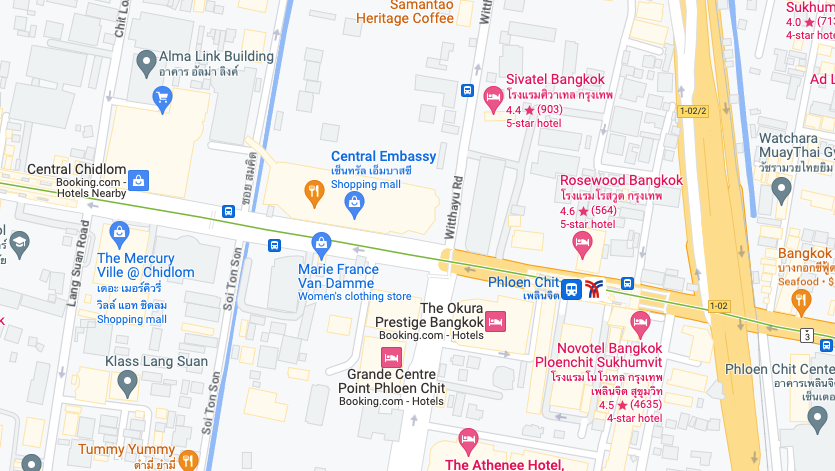

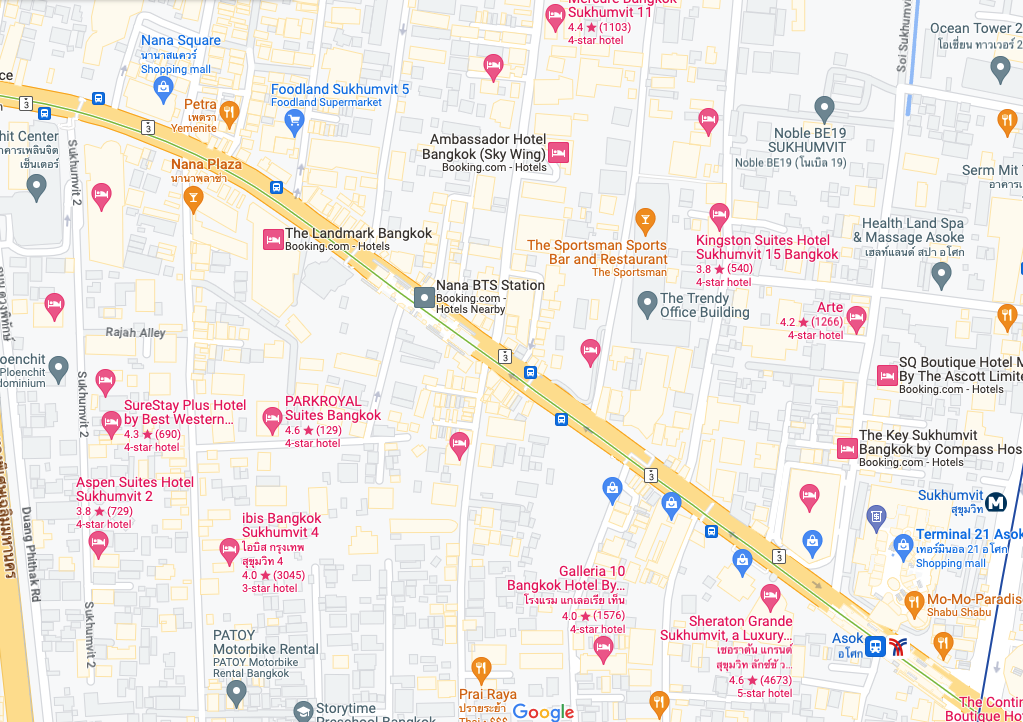

The key draw for Asoke is its connectivity. It is a mere 3 to 4 BTS stations to Chidlom and Siam. Yet it also connects to the MRT. This is the largest draw for properties in and around BTS Asoke. While I mention Asoke, it is important to distinguish that this refers specifically to the area around BTS Asoke and not the whole stretch leading towards Makkasan Station. Asoke is Bangkok’s version of Tsim Sah Tsui or Singapore’s City Hall. The MRT leads up to Petchaburi which leads to Makkasan Station on the Airport Rail Link. This will bring you to Suvarnabumhi Airport. Continue further up north and you will hit Rama 9 and Thailand Cultural Centre. The MRT also leads to the central business district in Silom and Sathorn down south. The downside for this area would be that there are certain streets which are notorious red light districts. A sound understanding of this area is needed to navigate away from such streets. Properties in this area are also likely to be highly sought after. Rental demand is constantly high. I personally have a property that is very close to BTS Asoke and I have never had an issue renting it out. In fact my current tenant moved in the very day my last tenant left. Due to its proximity to the red light districts, this area is not popular with families but instead tenants are usually single expatriates. If you are looking for strong rental demand, decent rental yields, go for 1 bedroom apartments. It fits the demographics of the tenants looking for properties in this area.

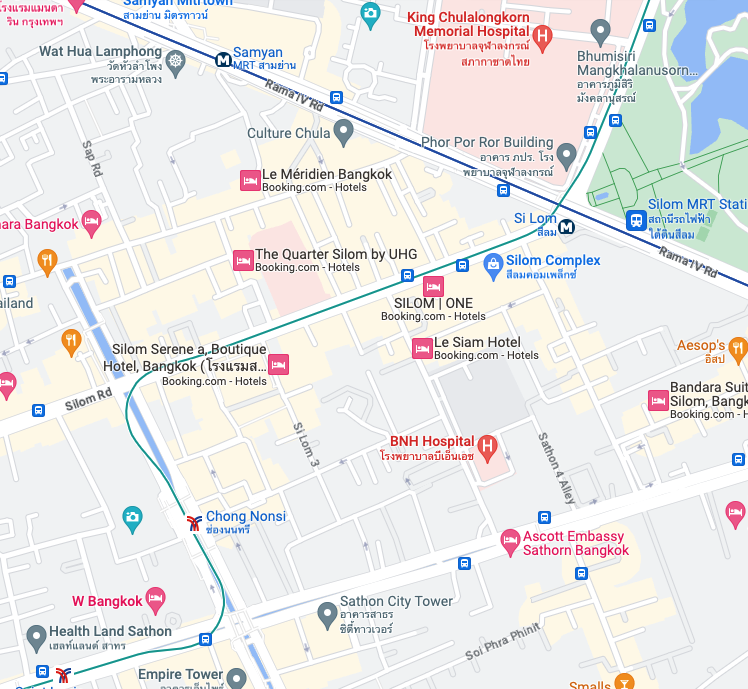

d) Sathorn and Silom

This is the traditional central business district (CBD) of Bangkok. By traditional I mean where the major banks, multinational corporations and most major businesses situate their head office. Bangkok’s CBD has gradually dissipated and now there is less of a concentration of such large company offices in this area. That being said, this is still prime CBD. This is where the Maharnakorn is situated. There are also many high-end hotels scattered around this area. On a weekday, the streets are filled with mostly office commuters. Property demand in this area is strong and the tenant mix should be slightly less affluent as compared to those looking for properties in the Chidlom and Ploenchit area. The tenants are still likely to be working in this area. The jam in Silom is horrendous. In fact, I would say that during peak hours walking might be faster than taking a taxi. If you are looking for decent yields, this is an area to go for. Of course, purchase price plays a role in the rental yield and I find that there are some developments in this area which are surprisingly affordable in comparison with the rest of the other 3 areas previously mentioned.

2. The City Fringes

This area is generally just out of the Core Central Regions. There is a higher mix of locals as compared to foreigners. The traffic congestion in these areas is also much less compared to the Core Central Regions. It is in these areas where you will more commonly see huge hypermarts like Big C and Tesco. Personally, if I were to live in Bangkok, these are some of the areas which I would consider over the Core Central Regions.

The areas for consideration are:

a) Phrom Phong, Thong Lor, Ekkamai

b) On Nut, Phra Khanong

c) Rama 9

d) Phaya Thai

e) The Riverside

f) Lat Phrao

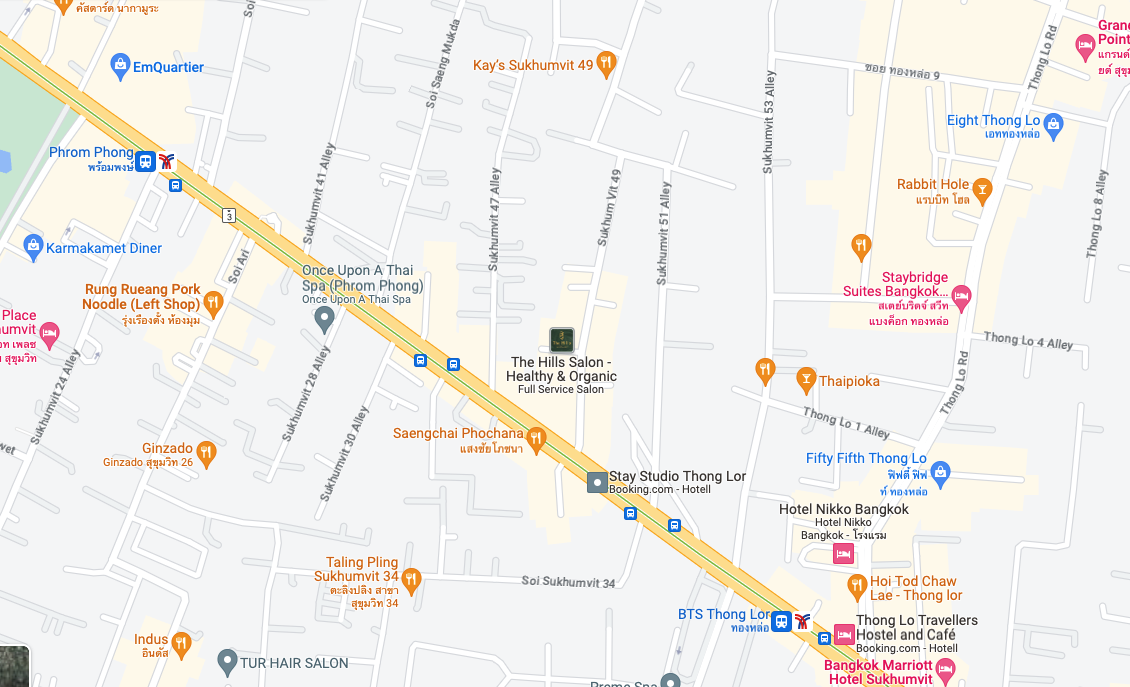

a) Phrom Phong, Thong Lor, Ekkamai

Personally, if I had to pick a place to live long-term this would be it. BTS Phrom Phong is one BTS station away from BTS Asoke. Hence this is really on the fringe of what I deemed as the Core Central Regions. Thong Lor is an area that is littered with large houses owned by local Thais. This is still along the main Sukhumvit Road. Do note that Sukhumvit Road is one of the longest roads in the world and extends all the way to the Cambodian border. It is generally lower Sukhumvit that is worth considering. This area is still considered lower Sukhumvit while not having most of the inconveniences like the congestion. If you are looking for the local nightlife scene, the area around Thong Lor Soi 10 is littered with famous clubs and restaurants. Cafe hopping is also a popular activity for those who are familiar with this area. While the area around BTS Phrom Phong has upscale malls like EM Quartier, prime Thong Lor seems to be deeper along Thong Lor Road (Sukhumvit 55 Alley) which is away from BTS Thong Lor. There is a very strong Japanese expatriate community in this area. Condominiums in this area are usually very upscale and may in some cases even rival those in Phrom Phong when it comes to pricing. The tenant mix in this area is likely to be Japanese expatriates and families. You probably stand the highest chance of getting a responsible tenant that is working in an MNC if you are a landlord in this area. Hence, if your budget allows for the higher property prices in this area and you want such tenant profiles, this area is perhaps the best you can go for.

b) On Nut, Phra Khanong

If Phrom Phong, Thong Lor and Ekkamai are a bit too pricey, then On Nut can be considered the best “bang for your buck” area. It is one of the most livable areas in Bangkok. Coming out of BTS On Nut leads you to a huge Lotus Tesco and it sets the stage for what this area is all about. It is a lot more affordable because this is an area that is very popular with the locals and for good reason. It is located with easy access to Lower Sukhumvit and yet prices in this area for just about all amenities are much cheaper. Over the past 5 years, this area has grown popular with the foreign expatriate community. For those who subscribe to the logic of sacrificing a bit of location for a lot lower prices then this is it. Rental demand for properties in this area is very strong because more are thinking in such a manner. Due to property prices also being lower, the rental yield for properties in this area is very strong.

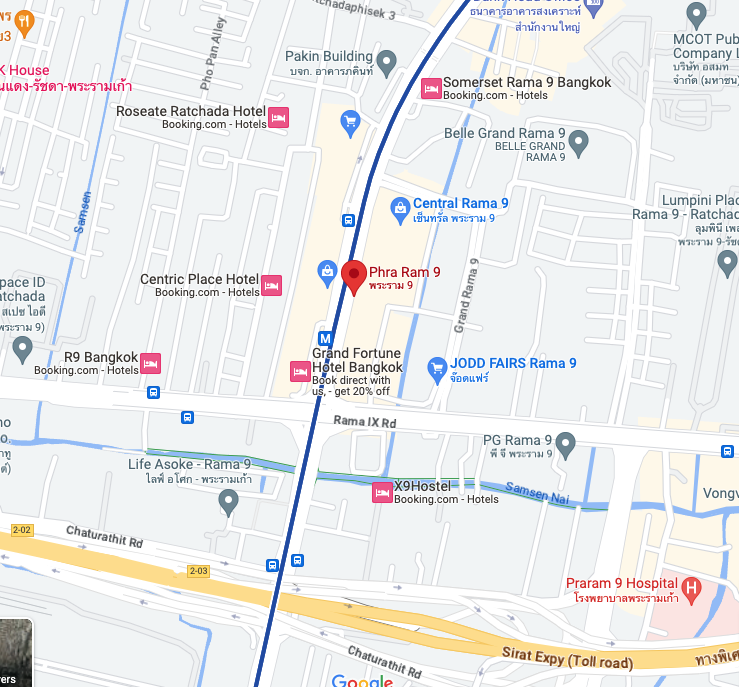

c) Rama 9

This area encompasses a few MRT stations. Namely Phra Ram 9, Thailand Cultural Centre and Huai Khwang. There was much talk about a Super Tower being constructed in Rama 9. It was slated to be the tallest building in Bangkok. It was supposed to house grade A office spaces. However, plans were shelved after a feasibility study was done and the project was deemed too massive with insufficient demand to support the proposed office space. This plot of land currently sits a night market named Jodd Fairs. Due to the hype, many developers had built new developments in this area. There was a massive oversupply issue pre-covid. That is not to say that this area is devoid of commercial activity. It is still a bustling business district. The elegantly built G Tower houses the Unilever regional headquarters as well as Huawei. Central Rama 9 is a very busy shopping mall catering to those living and working in the area. Fortune Tower is a place for electronics and the like. Demand for properties in the Rama 9 area is very high especially from the Chinese. While there is a Chinatown in the form of Yaowarat which is not close to Rama 9, this area is very popular with the Chinese. For one, the Chinese Embassy is somewhere in between Phra Ram 9 and Thailand Cultural Centre MRT stations. Huai Khwang has many shops that are geared to the Chinese as well. Before the cancellation of the Super Tower, prices for new condo launches were exceptionally high. However, prices have greatly receded and you can get very good yields for new developments in this area.

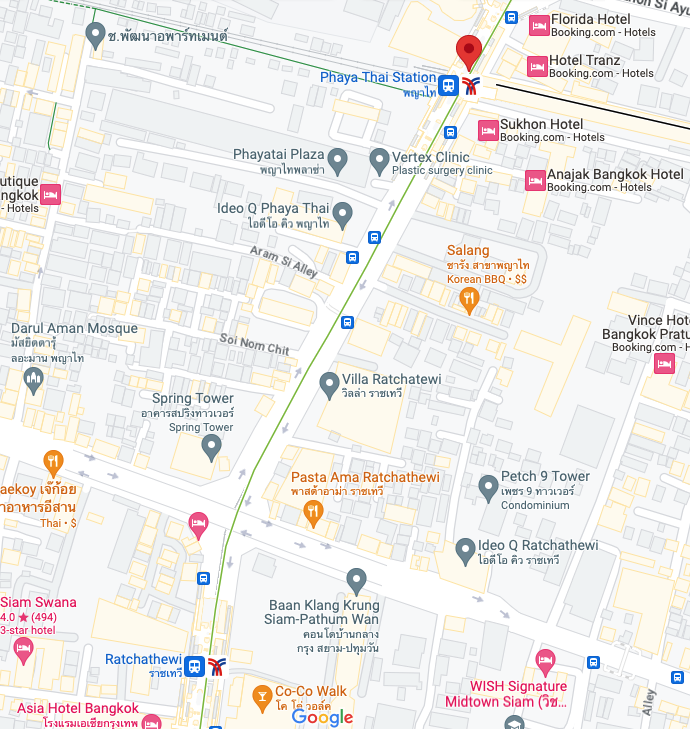

d) Phaya Thai

When speaking of Phaya Thai, I am referring to the area around Ratchathewi, Phaya Thai and Victory Monument. This area is on the west of Lower Sukhumvit whereas Asoke is east. This is an often overlooked area perhaps because it is less bustling. However, if you measure the distance from Phaya Thai to the Chidlom and Siam area, this is perhaps closer as compared to Asoke. For some reason, this area is just less popular with both tenants and buyers alike. However, I am a firm believer that with the additional train lines, properties in and around Phaya Thai will gradually become increasingly popular. Before and during the pandemic we have been receiving enquiries for the developments which we were marketing in Phaya Thai. The bulk of the buyers were from Hong Kong, Singapore and Malaysia with many of them making purchases. It seems like the demand stemmed from the fact that Phaya Thai has a direct train leading to Suvarnabhumi Airport as well as being a mere 2 BTS stations away from major shopping malls like Siam Paragon.

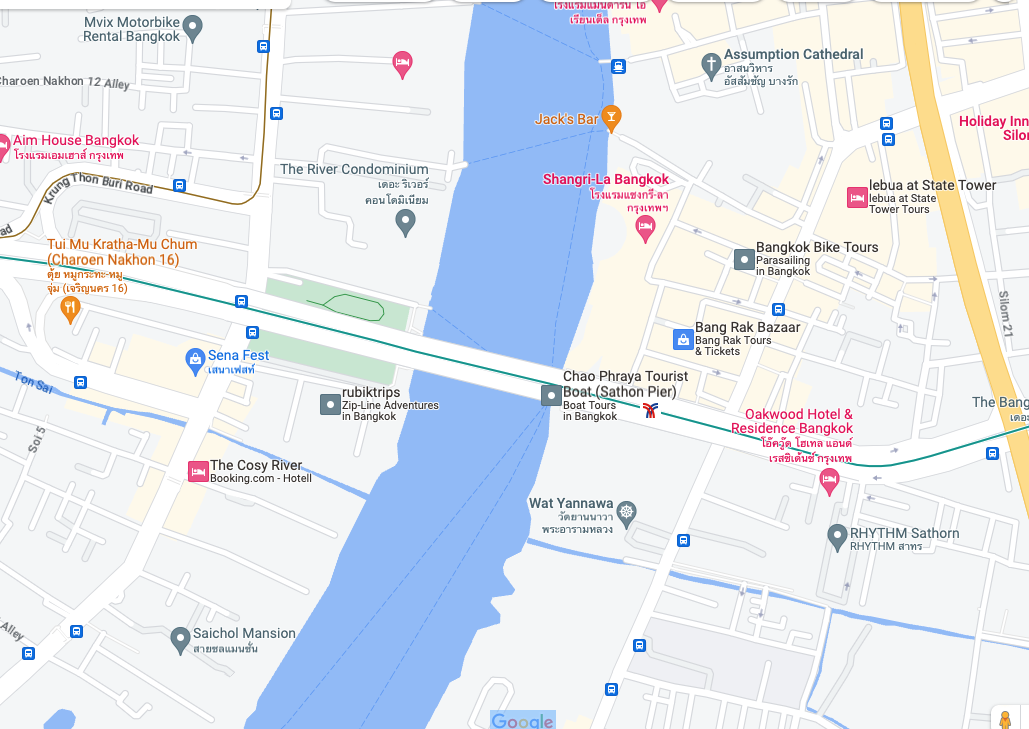

e) The Riverside

Since my first article 6 years ago, this area has seen great developments in terms of new condominiums as well as transport options. There is now a Gold BTS Line that connects BTS Krung Thon Buri to BTS Charoen Nakhon which is the train station next to Icon Siam. It is important for property buyers to note that not the whole of the Chao Phraya River is scenic. There are portions of the river where it is undesirable for a condominium to be situated. It is extremely imperative for property buyers to view the actual site of the proposed development if they are purchasing an uncompleted development along the riverside. Do not equate the views that you get from staying at high-end hotels like Shangri-La Bangkok with every condominium development along the riverside. Occupancy rates are much better as compared to 6 years ago but are still low as compared to other locations previously mentioned. For this reason, this area is still a work in progress and unless pricing and location along the river is very prime, should be avoided if property buyers are looking to buy to rent.

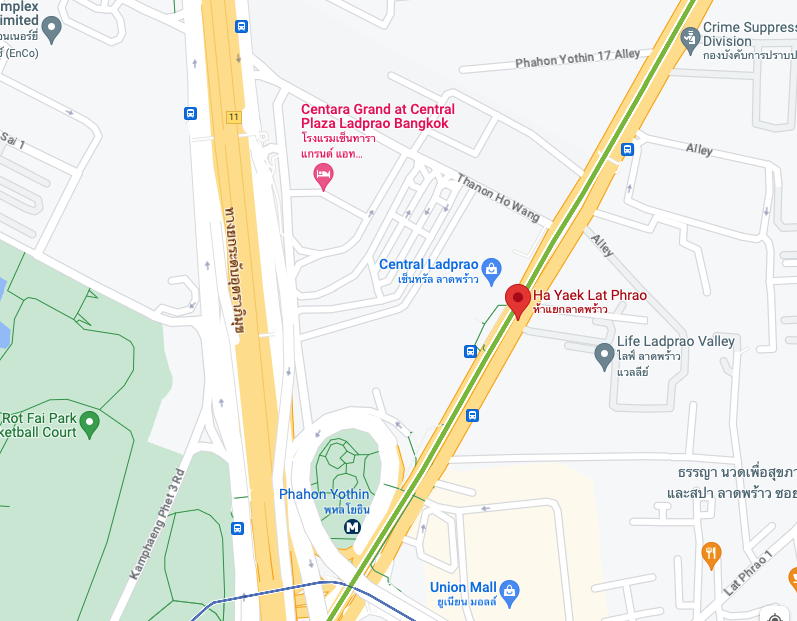

f) Lat Phrao

This is a very popular area with the locals. If you are a foreigner and need a reason as a tourist to visit this area, you may want to take a look at Union Mall as an alternative to the Platinium Fashion Mall. This mall is similar to the Platinium Fashion Mall located along Phetchaburi Road. It sells clothes at wholesale prices. There is also a large mall, Central Ladprao, nearby. This area has a higher concentration of locals. It is a very popular residential area for both locals and foreigners. The locals living in the area are in the upper middle class as things in this area are not necessarily cheaper than in places like Asoke. If you are on a smaller budget but would like healthy yields, properties in this area are a good investment.

3. The Growth Areas

6 years ago I mentioned that areas which I deemed as Growth Areas are riskier investments and investors should take a longer-term view when investing in these areas. 6 years on, the plans that were set in place did materialise. The Bangsue Grand Station is completed and operational. In the grander scheme of things, this is part of China’s One Belt One Road initiative

These areas include:

a) Bang Sue and Tao Poon

b) Mo Chit and Chatuchak

c) Ari

d) Punnawithi, Udom Suk and Bang Na

a) Bang Sue and Tao Poon

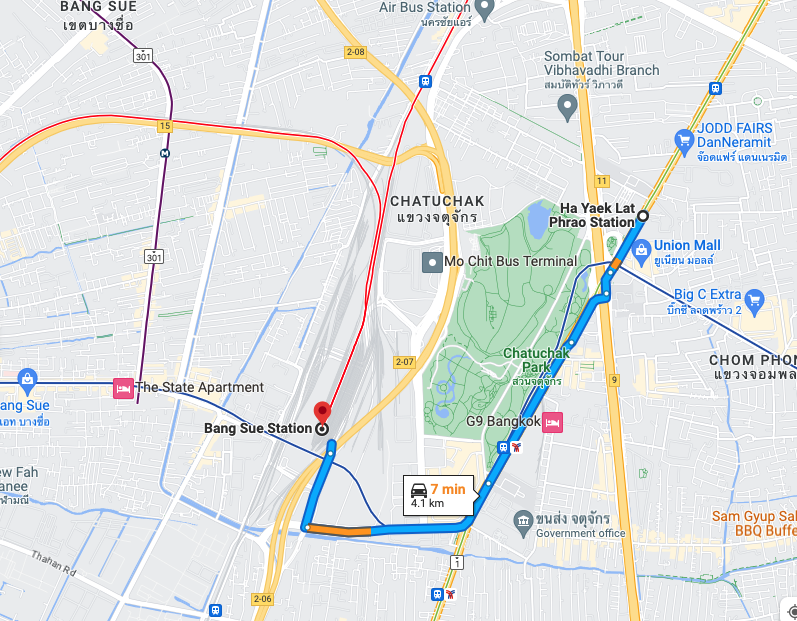

This area is banging on the fact that there is going to be a direct train line going from Bangkok to Kunming. That is part of China’s One Belt One Road plan. The Bangsue Station is already operational. However, personally, I would look to the Lad Phrao and Chatuchak areas to purchase properties to take advantage of the growth in the Bangsue area. As can be seen from the map below, these areas are a stone’s throw away from Bangsue Station. The Lad Phrao area is very well developed as a residential area with upper-middle-class locals and foreigners who prefer a more local and laid-back vibe as compared to living in the Chidlom area.

I would be upfront in saying that properties in this area do not enjoy a high level of demand in the rental market. The consideration for investors would probably focus on the possible capital appreciation in the long run (10 years). It is not as though these are in the plans. Bangsue Station is now Bangkok’s main train station taking the mantle away from Hua Lamphong. If you can afford to wait it out, this is an area which you can look at.

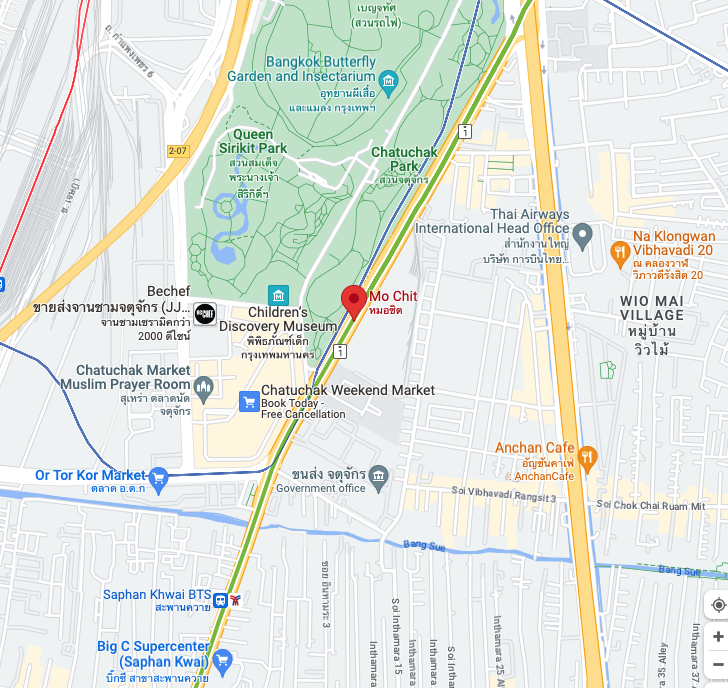

b) Mo Chit and Chatuchak

I contemplated putting this area together with Lad Phrao. By this area I mean the area around Chatuchak which will also encompass properties close to BTS Saphan Khwai and BTS Mo Chit. However, this area is less developed when it comes to amenities. There are many government agencies in the area which will support some rental demand but it pales in comparison to Lad Phrao. When asked to recommend properties in and around the area, I see myself gravitating back towards Lad Phrao. Of course, if the pricing of a development is right, it would make up for the lower rental and the yield may still be just as healthy as compared to those in the Lad Phrao area.

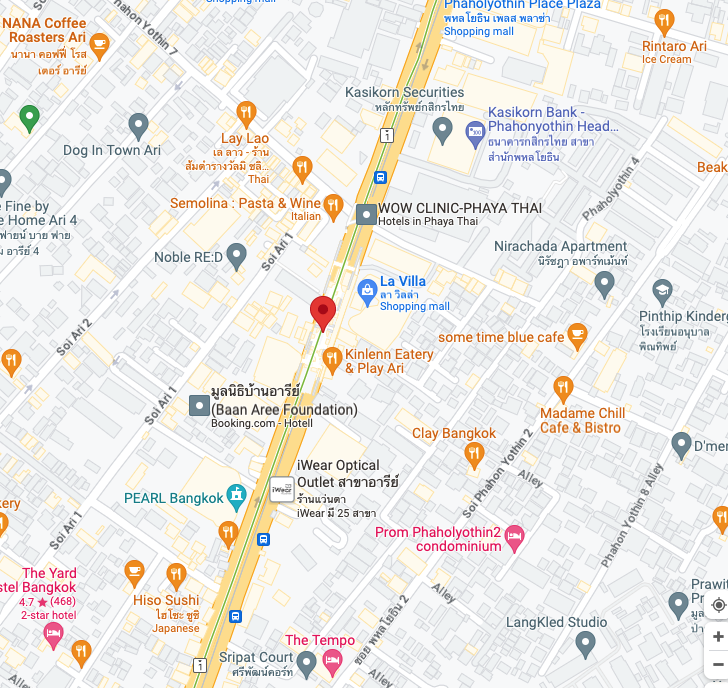

c) Ari

Personally, I see this area as what Thonglor and Ekkamai were 10 years ago. There is a laid-back vibe that makes this a very popular area with the locals and expatriates alike. I would say that out of all the areas in this category, Ari is perhaps the closest to moving out of this growth category. There are many corporate offices around the area which would support the rents. However, this area’s charm is its livability. Food options are scattered around the private estate. While developers like Noble have developments in the area, these are usually catered for locals or foreigners who want to be away from the hustle and bustle of the city. I dread the day Ari becomes highly developed and loses its charm. So who are the tenants you will be renting to if you own a property in Ari? Locals and foreigners both favour this area because of its charm. It still is on the main BTS line which means they can still access their workplace easily. This area is comparable to On Nut. However, it still lacks the level of amenities which you can find in On Nut. That being said, this is an area I confidently recommend to investors if they are looking for a property in this area. Prices are typically lower as compared to developments in Lower Sukhumvit. It is easy to rent out a condominium in Ari. Just that the rents are lower. Hence the pricing of the development has to be right.

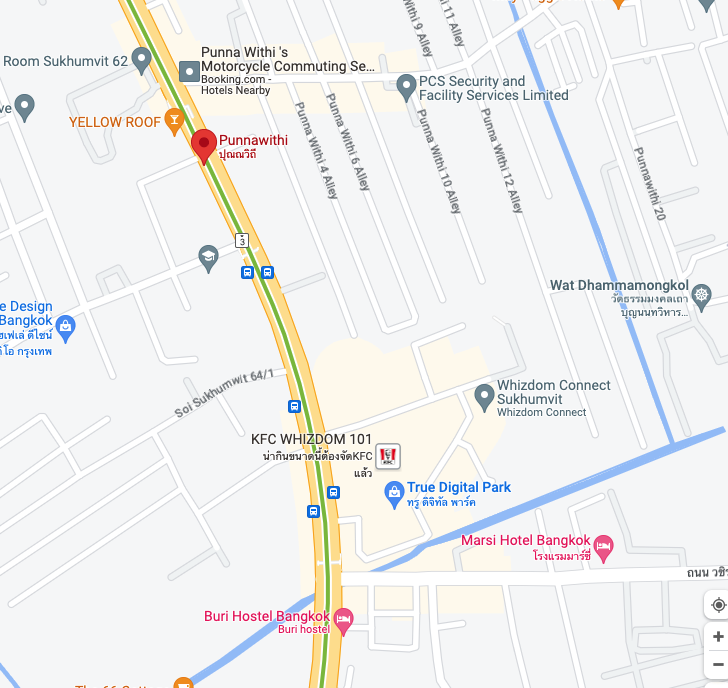

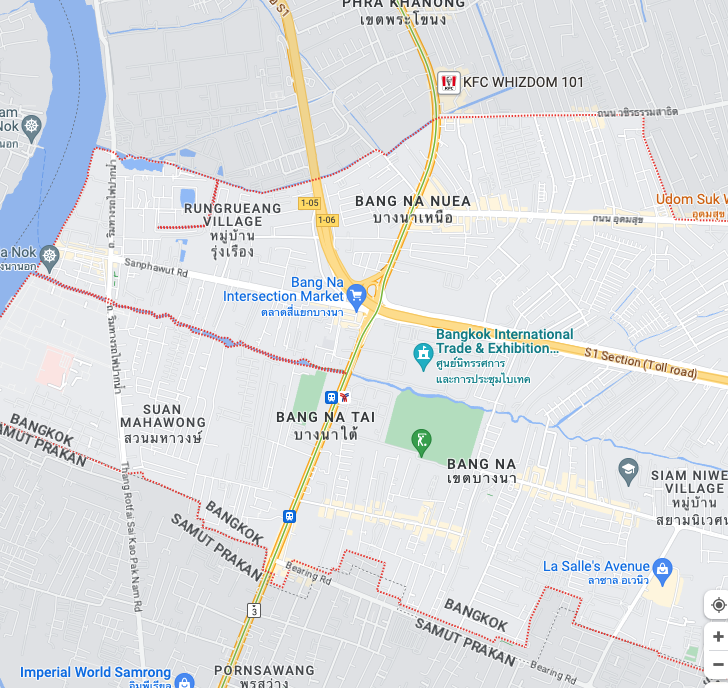

d) Punnawithi, Udom Suk and Bang Na

I cluster these areas into one category for good reason. Many property investors would cut their property search off at On Nut. Some would deem that properties after BTS On Nut would have little to no rental demand. However, these areas debunk these theories to a large extent. The True Digital Park is Southeast Asia’s largest tech and startup hub. Google and Huawei have offices here. Tech startups would consider these situating their offices in this area. This area is in line with the Thai government’s overall aim to digitise and upscale the Thai economy. You can perhaps do a simple search on “Thailand 4.0” to understand what this economic model is.

Bangna is close by. There are also tech-related start-ups setting up offices in this area. These are companies that find the True Digital Park a bit too expensive. There are also many government offices in this area. I would deem this as perhaps the furthest I would go with regard to investing in properties in Bangkok. This is based on Bangkok’s current state of development. Why I can stomach recommending properties in this area because the development is fueled by a government policy and not one that does not have grounds for expansion. The rents in this area are low but so are the prices of the properties on offer.

I would restate what I mentioned in my previous article which was written 6 years ago…

“Location should not be the only consideration when purchasing a property in Bangkok. There are many other factors to consider like developer’s reputation and entry price. However, I do hope that I have managed to shed some light on the various investment locations in Bangkok. I personally have been handling Bangkok properties since 2012 and I do hope that my experience can be of use to anyone looking to invest in Bangkok properties. You may visit my Invest Bangkok Property web portal at InvestBangkokProperty.com. I am contactable via my mobile number +66 66 112 8862 (WhatsApp preferred) or via my email [email protected].”

Yours sincerely,

Daryl Lum

Related Articles:

The good locations for property investment in Bangkok

A compelling case to invest in Bangkok

My personal experience purchasing a property in Bangkok

Thailand as a retirement destination

How to get a Retirement Visa in Thailand

Guide to buying a property in Thailand

Where are the up and coming property investment locations in Bangkok?

Factors that determine the property price in Bangkok

My views on the Singapore and Bangkok property markets

Related Sites: