The Thai Baht has been the best performing Asian currency for the year. To date, the US Dollar has lost about 7.8 per cent to the Thai Baht in terms of the exchange rate.

The 1-year USD to Thai Baht Chart (Source: XE Currency)

When it comes to comparing a currency’s strength, we peg it to the US Dollar as the US Dollar is the world’s reserve currency. The US Dollar itself has been rather strong itself and this makes the Thai Baht’s growth against the US Dollar even more spectacular. If you were to compare the Thai Baht to other major currencies like the Euro or the British Pound, the Thai Baht’s strength is even more pronounced.

The one year chart for the Euro against the Thai Baht shows that the Euro has weakened by almost 12 per cent against the Baht.

The 1-year Euro to Thai Baht Chart (Source: XE Currency)

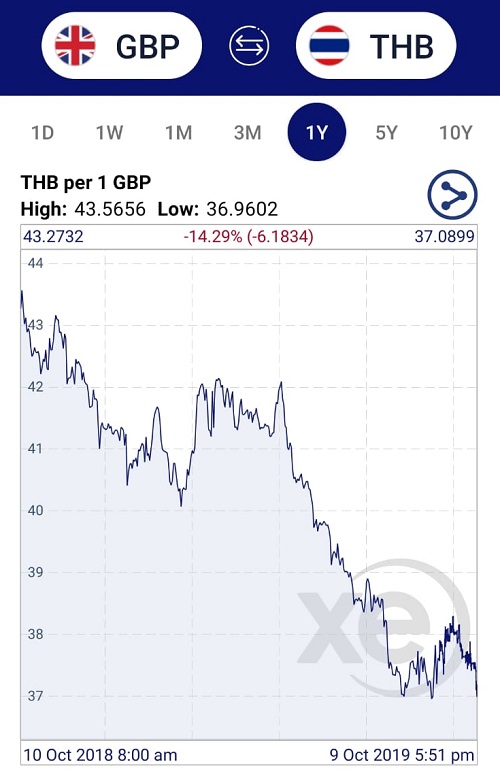

The 1-year Stirling Pound against the Thai Baht chart paints an even bleaker picture for the Pound which has weakened more than 14 per cent against the Baht.

The 1-year GBP to Thai Baht Chart (Source: XE Currency)

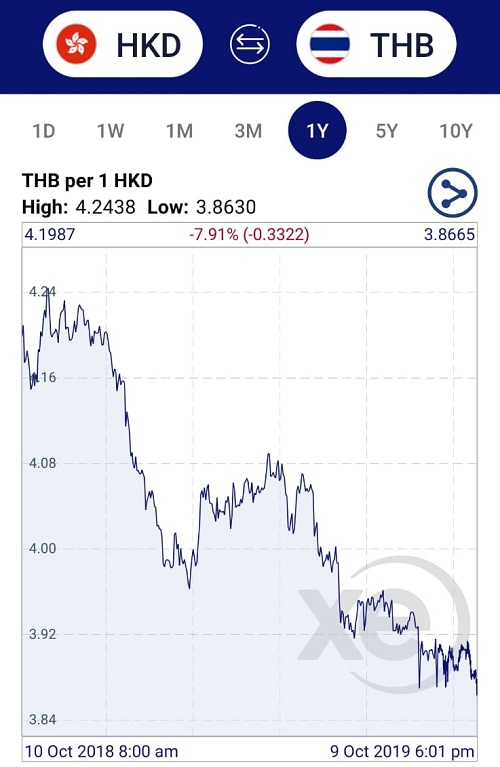

As many of you know, I do deal with Bangkok Properties since 2012 and the purpose of me writing this article is because of some questions posed to me by some clients and Bangkok property seekers. For the purpose of comparison, here is the 1-year chart of the Thai Baht to the Hong Kong Dollar, Chinese Renminbi, Singapore Dollar and Malaysian Dollar.

The 1-year HK Dollar to Thai Baht Chart (Source: XE Currency)

The 1-year Chinese Renminbi to Thai Baht Chart (Source: XE Currency)

The 1-year Singapore Dollar to Thai Baht Chart (Source: XE Currency)

The 1-year Malaysian Ringgit to Thai Baht Chart (Source: XE Currency)

So what happens when the Thai Baht is so strong?

1) Exports are more expensive and imports are cheaper

When trading, the buyers of Thai goods will need to pay in Thai Baht. For example, if someone or a company in Singapore were to import a car that is manufactured in Thailand, the car will have to be paid in Baht. This would mean that the buyers of the car would have to change their Singapore dollars to Thai Baht to pay for that car. As the Thai Baht has increased by about 7.65 per cent against the Singapore Dollar over the past year, if the price of the car were to remain constant, the amount that the Singapore buyer would have to pay would have gone up by 7.65 per cent. This would make Thai exports less attractive and thus buyers of Thai goods may consider looking elsewhere for suitable substitutes. The top exports of Thailand are office machine parts, integrated circuits, delivery trucks, cars and broadcasting equipment. The top export destinations of Thailand are China, the US, Japan, Malaysia and Hong Kong. The Thai Baht has strengthened against all of the currencies of these five countries. There is a fear that export volumes will fall as these countries find it expensive to purchase Thai exports, thus hurting the Thai economy.

2) Imports are cheaper

Imports into Thailand would be cheaper as well. Due to the strength of the Thai Baht, Thai companies and consumers may find foreign goods cheaper. They will spend less importing these foreign goods. The top imports are crude petroleum, integrated circuits, vehicle parts, gold and petroleum gas. The top import origins are China, Japan, Singapore, Hong Kong and Malaysia. The Thai Baht has also strengthened against the currencies of all of these countries. The Thais will also find it cheaper to travel to countries which the Baht has strengthened against.

3) Repayment of foreign debt is cheaper

If Thai companies or individuals have borrowed from foreign sources, repaying the debt will become cheaper as well. This is especially true for Thailand which has borrowed from the Chinese and Japanese among others. However, Thai households are among the biggest borrowers in Asia and this is something which we have to keep an eye on. The Thai government had stepped in earlier this year to increase the amount do downpayment for locals when buying a property to try to reduce the amount of debt that local property buyers undertake.

4) Thailand loses its attractiveness as a retirement destination

For a retiree, a rising Baht can severely derail retirement budgets especially if they are living off their pension from their home country. As the Baht continues to rise, some may look to other countries for retirement. In the region, Malaysia stands out as a very viable substitute due to its relatively low cost of living and excellent health care. Inflation remains weak in Thailand, slipping below 1 per cent for June year-on-year. This may mitigate the erosion of the spending power for the retirees from foreign countries.

5) Investment becomes more expensive

Thailand controls foreign investment, especially in the property sector. Property purchases have to be made using foreign currency and if the Thai Baht is strong, property purchases become more expensive. Let us use an example of the Hong Kong Dollar versus the Thai Baht. Back in October 2018, 1 Hong Kong Dollar could but 4.20 Thai Baht. Today it is hovering around 1 Hong Kong Dollar to 3.80 Thai Baht. Let us assume a typical 1-bedroom apartment in a prime location in central Bangkok which costs about THB7,000,000.

In October 2018, THB7,000,000 would convert to HKD1,666,666

In October 2019, THB7,000,000 would convert to HKD1,842,105

That translates to a difference of HKD175,439

So then where do we go from here? Is the Thai Baht truly overvalued or is this a new normal whereby the Baht will stay or even strengthen further? What is the case for a particular currency to increase in value over time? I live in Singapore and I’ve seen the Singapore dollar appreciate against the Malaysian Ringgit, the UK Pound and the Australian Dollar among a host of other currencies. The point now is whether the Thai Baht has the same fundamentals as the Singapore Dollar to continue its upward trajectory. Let us see what has the Thai Central Bank done to try to mitigate, slow down or even halt the Thai Baht’s rise.

1) The Thai government can regulate the supply of Thai Baht in the open market

Open Market Operations are when a central bank buys up or sells assets in the open market. This act increases or decreases the supply of its currency in the market. In the case of the Thai central bank, it can and perhaps has on a number of occasions, tried to increase the amount of Thai Baht in circulation. Imagine this simple analogy, to increase the Thai Baht, the Thai Central Bank would have to buy up foreign assets or foreign exchange in exchange for Thai Baht. This, in turn, increases the amount of Baht in circulation. However, it in turn also means that the Thai Central Bank has more foreign currency and foreign assets on its balance sheet. To many, this is seen as a sign of stability and increases the perception that the Thai Baht is a safe haven currency, thus increasing the demand for it and this inadvertently pushes up its value. This is counter-intuitive as the initial intent was to weaken the Thai Baht, not to strengthen it. However, this is what has happened and will happen moving forward.

2) The Thai government can set a lower interest rate target

By lowering its target interest rate, it should encourage an outflow of funds. Simply put, higher interest rates incentivise those with money to place funds in Thailand. By lowering the target interest rate, those looking for higher returns may look elsewhere. This, however, does not seem to be working as funds continue to flow into Thailand. The US and China trade war is not helping the situation and many companies are relocating to South East Asia from China to circumvent the tariffs that are targeting Chinese made goods. Thailand’s draw is that it has a rather educated workforce as compared to the rest of South-East Asia barring Singapore. Yet labour and other related business costs are cheap.

If we were to look at the 10-year charts, we can see that the current strength of the Thai Baht is not unprecedented. The Thai Baht has actually been stronger against the US Dollar and the Hong Kong Dollar and its strongest point was actually in April 2013. The USD actually hit a low of USD$1 to THB28.6436. This means that the 1-year high of USD$1 to THB30.2852 is still about 5.7 per cent off its 10-year high.

The 10-year USD to Thai Baht Chart (Source: XE Currency)

The 10-year HK Dollar to Thai Baht Chart (Source: XE Currency)

I do think that the Thai Baht is exceptionally strong and it may pose as deterrence for some when it comes to investing in Thailand. However, I do think that there may be some more legs to this rally and here are some reasons why I think so.

1) Thailand is no longer seen as a cheap destination

In fact, Bangkok, for the first time in 2018, was listed in the top 100 most expensive cities in the world. Gone are the days when we could remark that Bangkok or Thailand was exceptionally cheap. Thailand now has a growing reputation for being a place which offers good value. In place of cheap food are high-end, even Michelin starred restaurants providing good bang for your buck. The hospitality sector is growing and improving rapidly as tourism remains a major driver of the Thai economy.

2) Thailand does not depend solely on tourism

Agriculture and manufacturing contribute a great deal to Thailand’s gross domestic product (GDP). In fact, the industrial sector of the economy accounted for 39.2 per cent of Thailand’s 2018 GDP. With the US-China trade war, companies looking to relocate out of China may consider Thailand and this may see further growth in this sector. Thailand has great infrastructure as compared to all its neighbouring countries. In fact, its capital Bangkok has perhaps the second most extensive rail network in South East Asia after Singapore, has two fully functioning international airports and adequate grade A office space. It is strategically located right in the middle of South East Asia and China has made Bangkok an integral component of its One Belt One Road Initiative. A rail network connecting the whole of South East Asia will fan out from Bangsue in Bangkok, Thailand and this will connect Kunming, China to the rest of South-East Asia.

3) The Thai economy has been doing well

The Thai economy is expected to post a growth of 3.8 per cent in 2019 and in 2018 it posted a surplus of 7.5 per cent of its GDP. Major cities like Bangkok and Chiangmai are flourishing. The income disparity is widening though and this is something the Thai government must try to mitigate. I will usually urge would-be investors of Thailand to take a trip to Bangkok and visit the high-end shopping malls and restaurants and realise that the locals are the ones who are spending. Local demand for property has been rather off the charts in recent years as well. Properties in prime locations do see very strong local demand. The Thai government is aware of this bullish sentiment and are wary of household debt levels. This is why they introduced the minimum down payments for locals buying properties earlier this year.

Of course, no one can be sure when it comes to investing. There are many other factors which can cause the Thai Baht to go either way. As always, invest with caution and gauge your own comfort level when investing, especially in a foreign country.

Yours Sincerely,

p.s. Disclaimer: I have been dealing with Bangkok properties since 2013 and I have shares in a real estate company in Thailand that deals with new and resale properties in Bangkok. You can visit my website at InvestBangkokProperty.com.

My other articles about Thailand:

Thailand Property Market Outlook for 2019

My views on the Singapore and Bangkok property markets

Where are the up and coming property investment locations in Bangkok?

The good locations for property investment in Bangkok

A compelling case to invest in Bangkok

Guide to buying a property in Thailand

Thailand Property: Legal and Tax Issues

Recognising the different property title deeds in Thailand

Can a foreigner take a property loan in Thailand?

Buying property in Bangkok: Payment procedures

A guide to the top property developers in Thailand

Thailand Property Market Outlook for 2018

How to get an Investment Visa in Thailand

Thailand as a retirement destination

How to get a Retirement Visa in Thailand

My personal experience purchasing a property in Bangkok

Things to take note when investing in an overseas property

Factors that determine the property price in Bangkok

Looking to buy a Bangkok condo? Things to take note of.

Thailand property inheritance laws: taxes, succession and wills