Every now and then we get a property launch that is herald as one of the most affordable new launches. Parc Komo is hyping up to be just that. However, cheap may not always be good and it would be important for potential buyers to understand the location and its potential before coming up with an informed buying decision.

Details about the development

Parc Komo is a freehold condominium located along Jalan Mariam. It has a land area of about 202,000 square feet and will consist of 10 five-storey buildings. There will be a total of 276 residential units and 28 commercial units. In October 2017, mainboard-listed Chip Eng Seng purchased bought Changi Garden through a collective sale exercise and this is where the site of Parc Komo will be built on. Each apartment owner received between SGD$2.14 million and SGD$2.27 million while a penthouse owner will receive between SGD$4.03 million and SGD$4.74 million while shop owners received between SGD$4.7 million and SGD$7.08 million. End 2017 was perhaps a period where sentiment in the property market was heating up and this was a bullish bid by Chip Eng Seng as their winning offer exceeded the asking price by 27 per cent. Based on analysts estimates, the breakeven price of units at Parc Komo will be about SGD$1,350 per square foot (psf) to SGD$1,400 psf. Analysts expect prices in the region of SGD$1,500 psf to SGD$1,600 psf for the developer to pocket a 10 per cent profit margin.

Parc Komo will consist of:

30 units of 1 bedroom units with sizes ranging from 452 square feet to 484 square feet

10 units of 1 bedroom + study units with sizes ranging from 549 square feet to 560 square feet

24 units of 2 bedroom compact units with sizes ranging from 614 square feet to 657 square feet

78 units of 2 bedroom deluxe units with sizes ranging from 700 square feet to 775 square feet

2 units of 2 bedroom premium units with sizes at 926 square feet

26 units of 3 bedroom compact units with sizes ranging from 915 square feet to 980 square feet

55 units of 3 bedroom deluxe units with sizes ranging from 969 square feet to 1033 square feet

1 unit of 3 bedroom + study unit with sizes at 1130 square feet

10 units of 4 bedroom compact units with sizes ranging from 1281 square feet to 1302 square feet

20 units of 4 bedroom deluxe units with sizes ranging from 1410 square feet to 1421 square feet

20 units of 5 bedroom luxury units with sizes ranging from 1808 square feet to 1905 square feet

Total: 276 units

Parc Komo is expected to obtain its Temporary Occupation Permit (T.O.P.) in 2023.

Where is the development located?

Location of Parc Komo

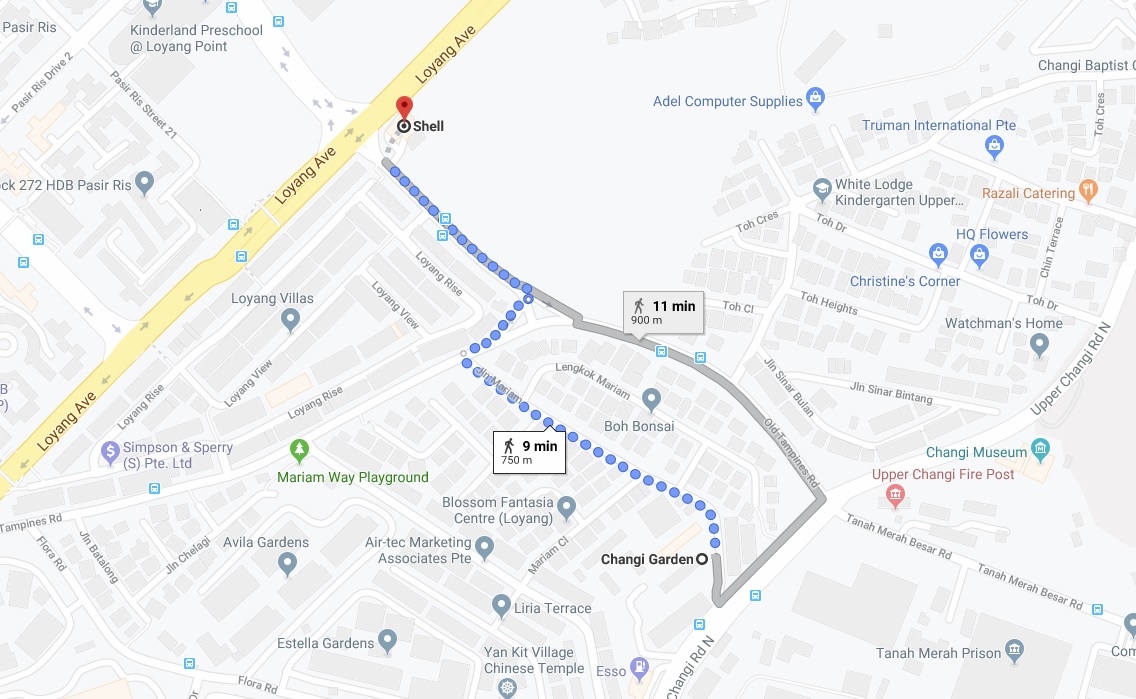

Parc Komo is located along Jalan Mariam. You enter into the development via North Upper Changi Road. Currently, the old Changi Gardens still sits on the site with the shophouses fronting the development. The Cross Island MRT Line will add an MRT station somewhere in front of the Loyang Bus Depot. The station is targeted for completion in 2029.

The location of the station and its exits have yet to be confirmed. I am assuming that if the station is at the Loyang Bus Depot, then one of the exits of the station should be around where the current Shell petrol kiosk is at the junction of Loyang Avenue and New Loyang Link.

Estimated walk to future Loyang MRT Station

However, currently, the closest MRT Station is Tampines East MRT Station which is a station along the Downtown Line. The distance to this particular MRT station is about 2.1 kilometres away and I do not think that it is a distance that many residents will consider walking on a daily basis.

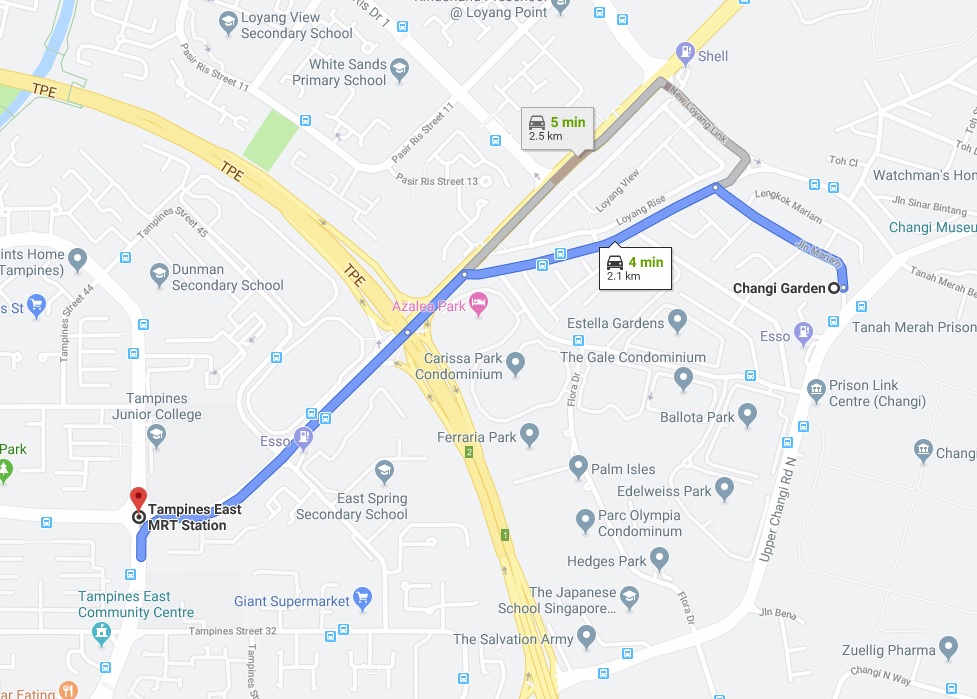

The drive to Tampines East MRT Station

If you were to drive to Tampines MRT Station it will take about 4 minutes to cover the 2.1 kilometres. Residents may consider using private hire transport to get to Tampines East MRT Station.

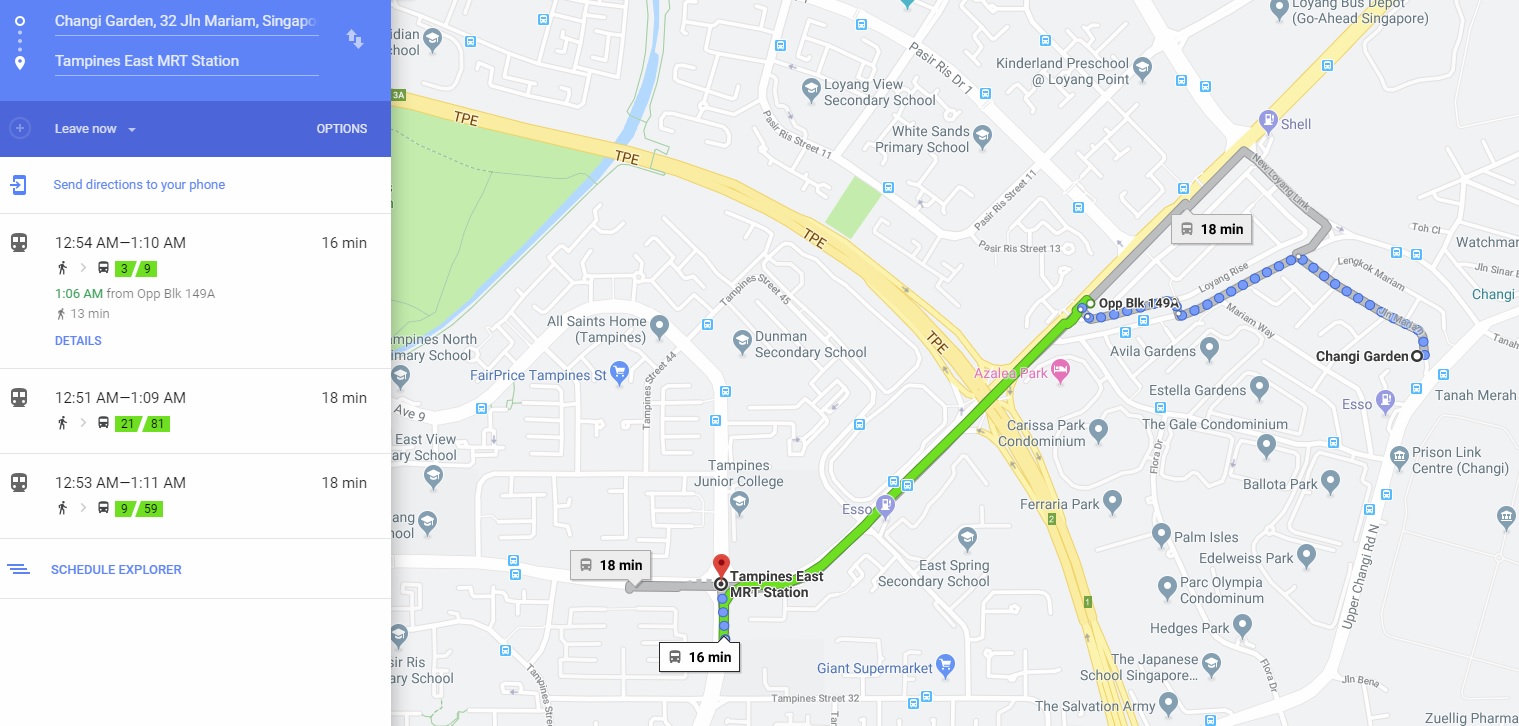

Get to Tampines East MRT Station using public transport

Residents could also use the bus services in the vicinity to get to Tampines East MRT Station. Buses like 3, 9, 21, 59 and 81 will bring residents to Tampines East MRT Station. The total journey, the walk and bus ride, will take approximately less than 20 minutes. Do note that I am doing this review in the wee hours of the morning and thus these timings will vary at different times of the day.

I will be reusing the travel timing from my previous property review of The Jovell for this review.

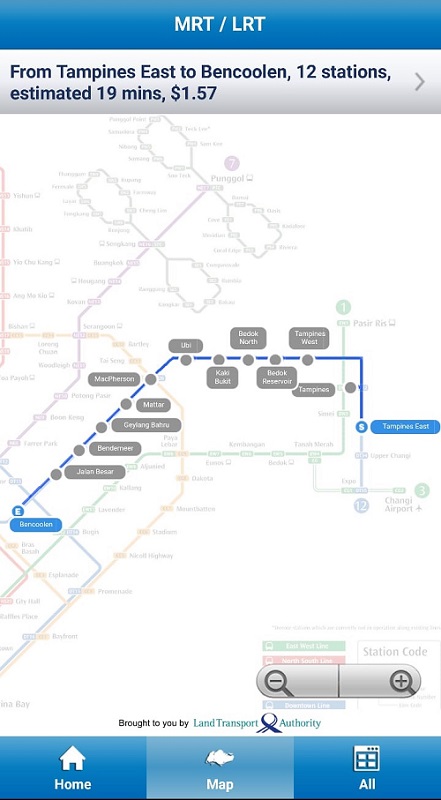

It will take 19 minutes from Tampines East MRT Station to Bencoolen MRT Station. It will cost $1.57.

Tampines East MRT to Bencoolen MRT

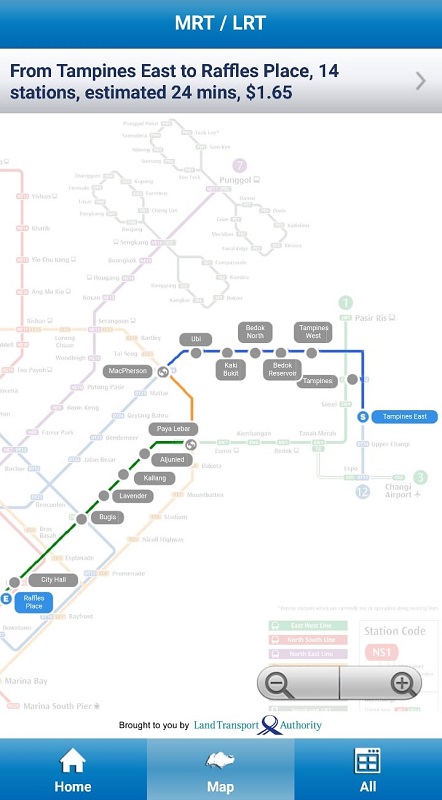

It will take 19 minutes from Tampines East MRT Station to Raffles Place MRT Station. It will cost $1.65. You will need to make some changes to other train lines during the journey. The LTA mobile app advised changing to the Circle Line and then again to the East-West Line at Paya Lebar MRT Station. I would think that perhaps you could travel directly to Simei via bus and then take a train along that line straight down to Raffles Place MRT Station if you do not want to make switches along your journey.

Tampines East MRT to Raffles Place MRT

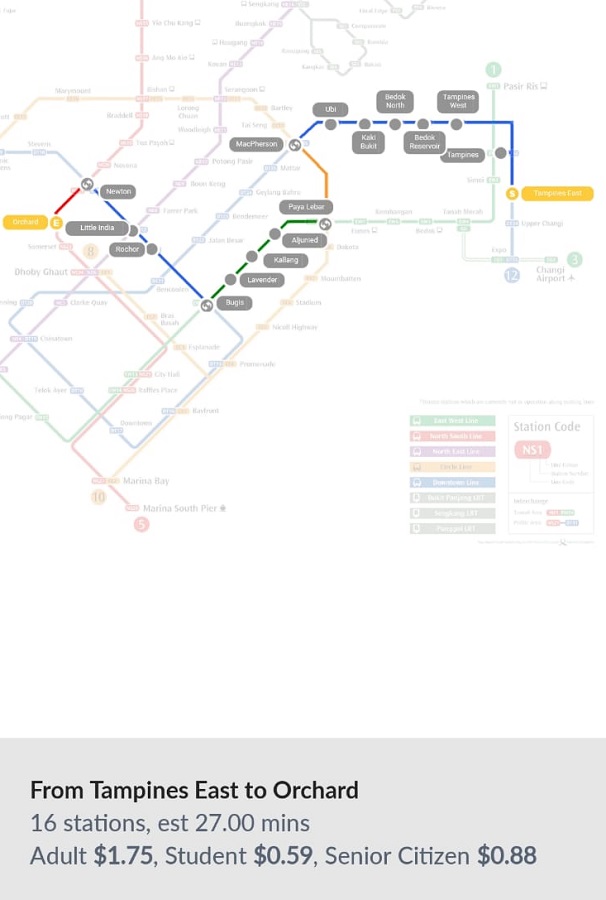

It will take 27 minutes to get to Orchard MRT Station and it will cost $1.75. You do need to make changes to a few different train lines to get to Orchard MRT.

Tampines East MRT to Orchard MRT

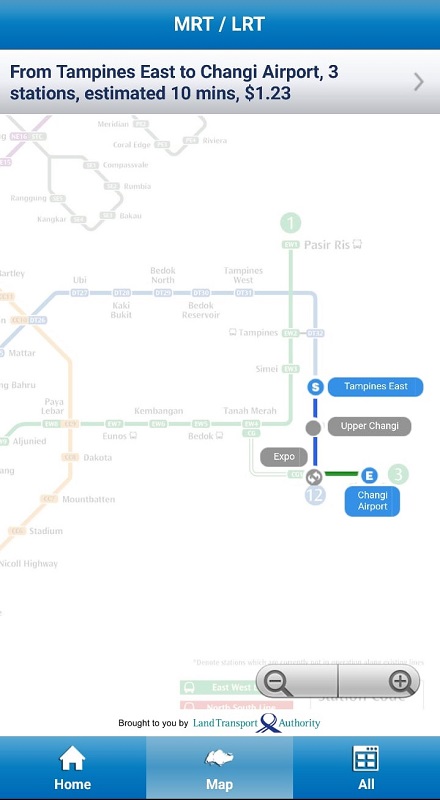

Travelling to Changi Airport would be a lot easier. It takes 10 minutes to do so and would cost $1.23.

Tampines East MRT to Changi Airport MRT

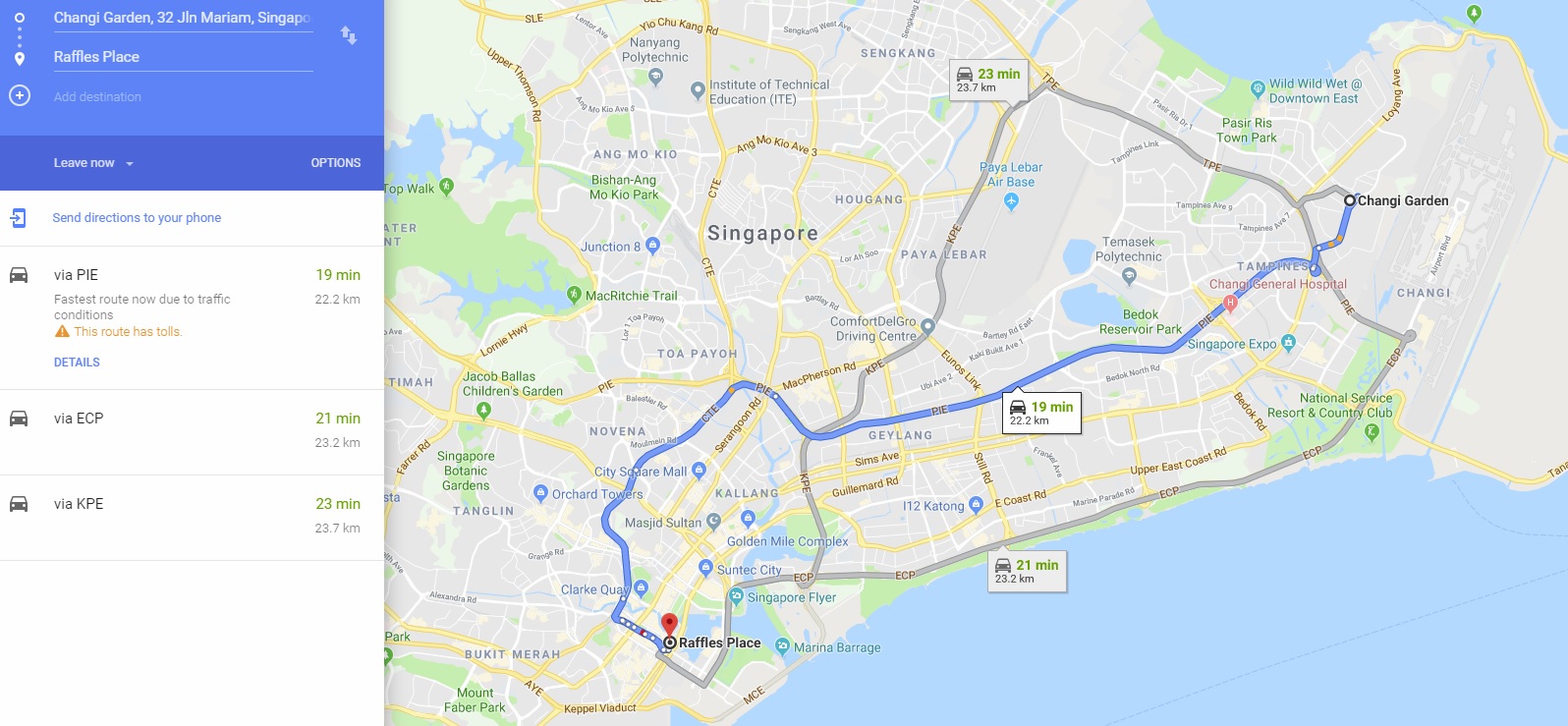

Driving to Raffles Place is rather straightforward with easy access to PIE and ECP.

The drive to Raffles Place

It will take approximately 19 minutes via PIE and the distance travelled would be about 22.2 kilometres. If you were to use the ECP, the time taken will approximately be 21 minutes and the distance covered is about 23.2 kilometres. Do note that when I did this query on Google Maps it was about 1 am in the morning. Do expect to add on some time during peak hour traffic.

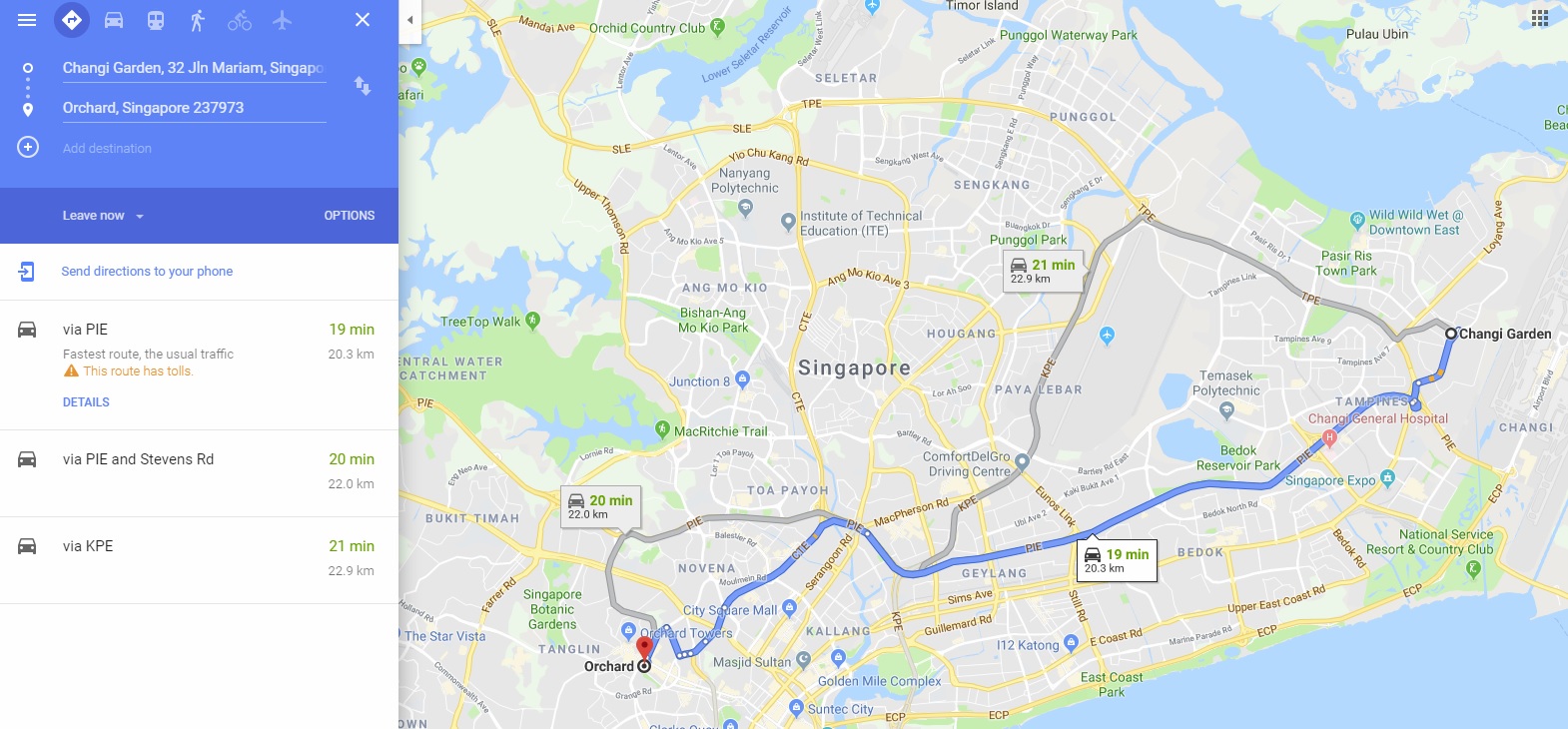

The drive Orchard Road

The drive to Orchard Road will take about 19 minutes and cover about 20.3 kilometres. Once again, do add on time for peak hour traffic.

The selling points of the development

I do think that the main selling point is the freehold status of the development. I do think that as more and more leasehold developments age across Singapore, we will see more instances of land being returned to the state. The recent failed attempts of developments like Mandarin Gardens to push through a collective sale does prove a point that there will be leasehold developments that will run their full tenure to expiry.

The next selling point will be the lack of new plots of land in the vicinity. As mentioned in my previous review of The Jovell, there are no other plots of land that will be released. The only way that there will be new residential units in the area will be if a developer acquires a development in an en bloc sale. There is a natural catchment area just north of Parc Komo and that should provide demand for units that are up for rent. Changi Airport is expanding and the relocation of Paya Lebar Air Base to Changi will result in more demand for housing in the area. Also, with the introduction of Jewel at Changi, this area is seeing some rejuvenation of interest.

The development is a mixed development and there will be 28 commercial units located within Parc Komo. This should be useful for residents although it remains to be seen whether these units can be filled with good tenants. There are many examples of mixed developments not doing particularly well, especially in today’s ever-changing digital landscape where e-commerce is disrupting traditional retail.

Possible bad points about the development

Even though there will be an MRT station coming up, Parc Komo is not exactly very close to it. Tenants may consider something that is closer to the MRT station if they find the commute too tedious.

It is rather inconvenient to get to the city centre from Parc Komo and I do think that demand will be limited to the people working in the area or those who are familiar with the area. The commute to Raffles Place before the opening of Loyang MRT Station via public transport will set residents back about an hour. Parc Komo is expected to obtain its T.O.P. in 2023 and Loyang MRT Station should be completed in 2029. Residents will have to make do with the current transport situation before the Cross Island Line is completed.

My thoughts about the development

Price wise I do think that if you look at it from a quantum perspective, then perhaps a freehold, brand new one bedroom apartment just over SGD$700,000 does seem affordable. Buyers do have to understand that the average price is $1,450 psf. The developer acquired the land at a premium and this development was already slated to set new benchmark prices in the area. That being said, I have always had an affinity for properties in this area. Demand for this area is rather well served by the catchment area just north of the development.

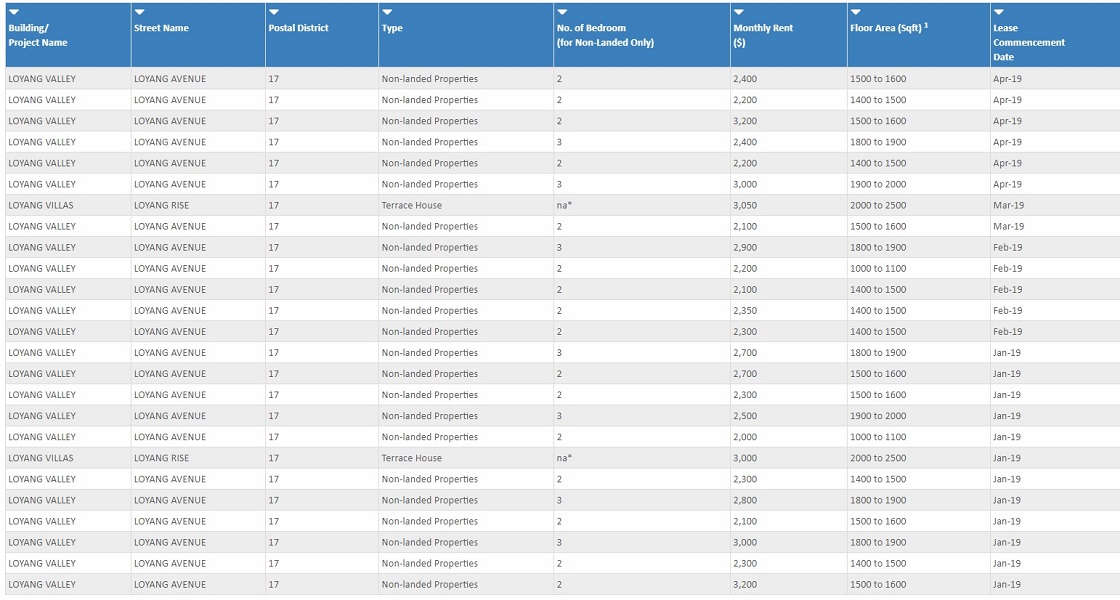

For those who are looking to buy the property as an investment property, it would be good to have a gauge of how much rental prices are.

URA Rental Transactions for Loyang Valley and Loyang Villas

Parc Komo

Parc Komo

Pricing 3/5

I do not agree that the price is cheap. Affordable would be a better adjective to describe the pricing. This development is setting a new benchmark in pricing by having an average price of $1,450 psf. At the point of my writing this article, the launch was already over and 70 units were reportedly sold. I do not think that many of those who bought felt that $1,450 psf is cheap. I do think that many who purchased a unit in Parc Komo have the intention to stay in it. If someone were to purchase say a one-bedroom unit at about $750,000 with an estimated rent of about $1700 a month, that works out to a gross rental yield of 2.72 per cent. If you were to factor in other costs like acquisition, vacancy, agent commission and maintenance fees, then the yield drops even further.

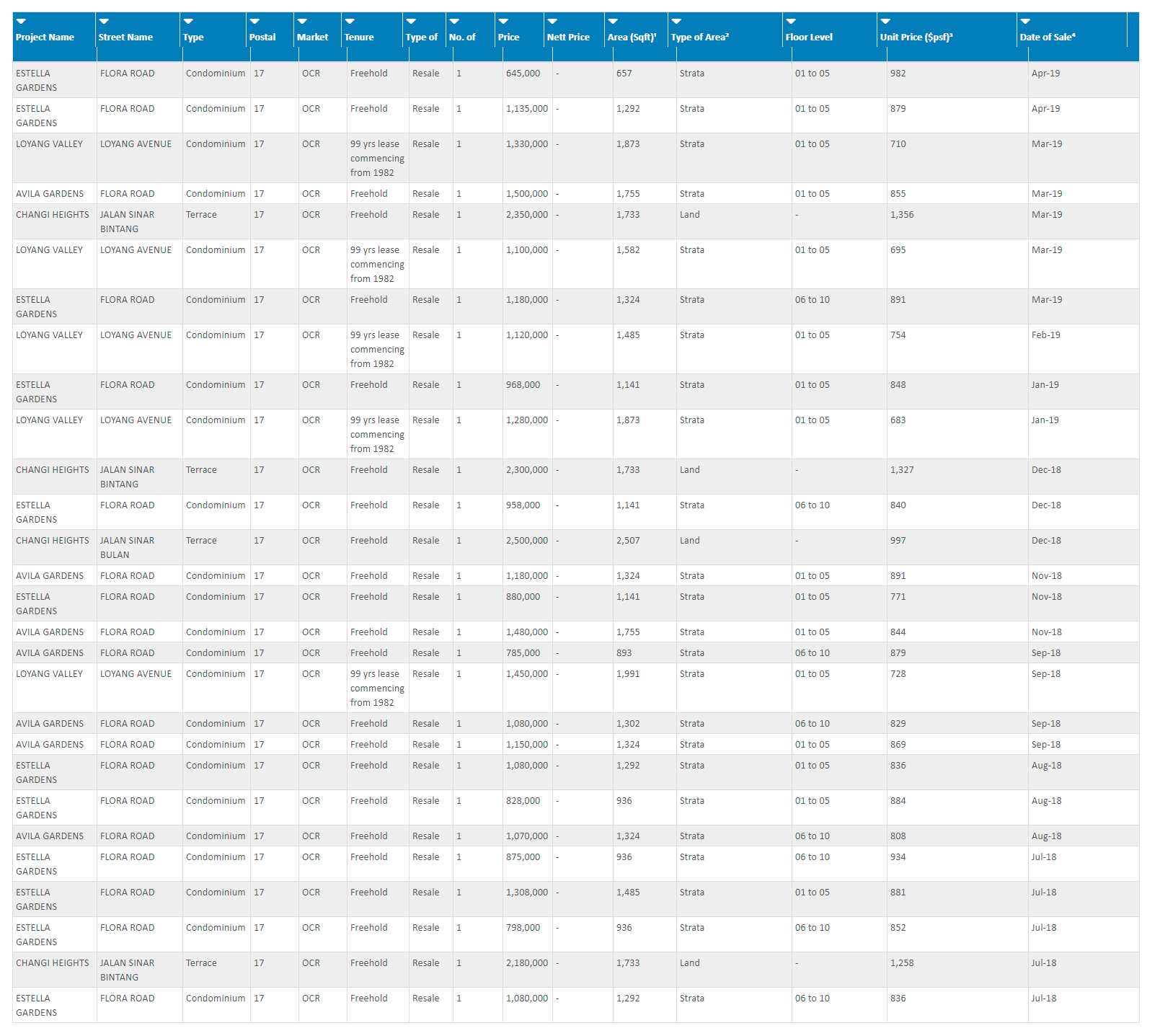

Here are some prices of neighbouring developments in the area. Generally, the condominium prices have yet to cross $1,000 psf till Parc Komo came on board. Although, if you want something that is brand new, this benchmark is quite common in today’s context. Buyers just have to realise that if they are purchasing with the intent to sell the property at a quick profit after a few years. Purchasing a property is a long term investment and buyers were to profit from their purchase in Parc Komo or just about any new project launch these days, they would have to take a longer view of the market.

URA Transactions of developments around Parc Komo

Location 2.5/5

I do think that this location will be very inconvenient for anyone who needs to commute to the city centre on a regular basis. However, much development is happening in the vicinity. The Urban Redevelopment Authority (URA) has drafted a master plan for the development of the Changi Region. This is something that residents in the area can look forward to.

Quality 4/5

CEL development is an experienced developer with a good track record. Notable past projects include My Manhattan, Junction Nine and Nine Residences, Grandeur Park Residences and Fulcrum. They are also part of a consortium that is developing Park Colonial.

p.s. Disclaimer: I am a licensed real estate salesperson at the point of writing this review. My real estate agency is the marketing agency for Parc Komo. Buyers can approach me to purchase Parc Komo and I will earn a commission from the developer. My reason for writing this review is to share my personal view about the developments not as a real estate salesperson but in the neutral context of a buyer and hopefully share some insight to help buyers make a more informed buying decision.

My other Singapore Property Reviews

My review of Penrose by CDL and Hong Leong Holdings

My review of Forett at Bukit Timah by Qingjian Realty

My review of Clavon by UOL Group

My review of The Avenir by Hong Leong Holdings and GuocoLand

My review of One Holland Village Residences by Far East Organisation

My review of Neu at Novena and Fyve Derbyshire by Roxy Pacific Holdings

My review of Midwood by Hong Leong Holdings

My review of Royalgreen and Juniper Hill by Allgreen Properties

My review of Sky Everton by Sustained Land

My review of Sengkang Grand Residences by Capitaland and City Developments Limited

My review of One Pearl Bank by Capitaland

My review of The Antares by FSKH Development

My review of Parc Clematis by SingHaiyi Group

My review of Piermont Grand by City Developments Limited

My review of Parc Komo by CEL development

My review of Riviere by Frasers Property

My review of Avenue South Residence

My review of 1953 by Oxley Holdings

My review of Uptown @ Farrer

My review of The Florence Residences

My review of Treasure at Tampines

My review of Fourth Avenue Residences

My review of The Woodleigh Residences

My review of Kent Ridge Hill Residences

My review of Arena Residences

My review of Whistler Grand and Twin Vew

My review of Mayfair Gardens and Daintree Residence

My review of Parc Esta

My review of Jui Residences

My review of The Jovell

My review of JadeScape

My review of Stirling Residences and Margaret Ville

My review of The Tre Ver and Riverfront Residences

My review of Park Colonial

My review of Affinity at Serangoon and The Garden Residences