The Singapore property market has been on a recession defying run recently. Despite the Singapore economy contracting by a record 5.8% year over year in a pandemic hit 2020, private property prices have remained stubbornly high. In fact, just a day after the Ministry of Trade and Industry released the grim economic contraction estimates, the Urban Redevelopment Authority (URA) announced that private property prices in Singapore rose by 2.1 per cent in the fourth quarter of 2020. This is an even faster pace than the already healthy 0.8 per cent increase in the third quarter of 2020.

The buoyant private property market figure is a precursor to perhaps the largest private property new launch of 2021. Normanton Park should truly test buyers’ appetite for private new homes. I personally am intrigued to see how such a massive development does in the current property buying frenzy.

Details about the development

Normanton Park is a 99-year leasehold development comprising of 1862 residential units spread across 9 24-storey blocks and 22 2-storey strata terraces. There will also be 1 restaurant and 8 retail shops within the development. The development sits on a site area that spans approximately 61,408.9 square meters or 661,005 square feet. Back in October 2017, Kingsford development made headlines when it purchased the previous development, a 488 unit former HUDC estate also named Normanton Park, for SGD$830.1 million. At that point in time, it was the deal with the highest land rate for a 99-year leasehold collective sale. That purchase price was more than SGD$30 million over the reserve price. When we factor in the SGD$231.1 million needed to top up the lease to 99-years and a redevelopment fee of about SGD$283.4 million, this translates to a land price of about SGD$969 per square foot per plot ratio.

Normanton Park made headlines again in the first half of 2019 when the developer, Kingsford Huray Development, a subsidiary of Kingsford Development, was hit with a no-sale licence. This meant that the developer could only start to sell units after the Temporary Occupation Permit (TOP) is obtained. This was due to issues with Kingsford Development’s previous projects, Kingsford Waterbay and Kingsford Hillview Peak. Since then, Kingsford Development has successfully obtained approval to sell units at Normanton Park before obtaining the TOP in December 2020 albeit with certain conditions. For one, all units in Normanton Park must pass BCA’s Quality Mark assessment before applying for a TOP.

Where is the development located?

Normanton Park is located at 1 to 9 Normanton Park. It is located at the end of Portsdown Flyover and at the start of Science Park Road leading up to the National University of Singapore.

Normanton Park Location Map

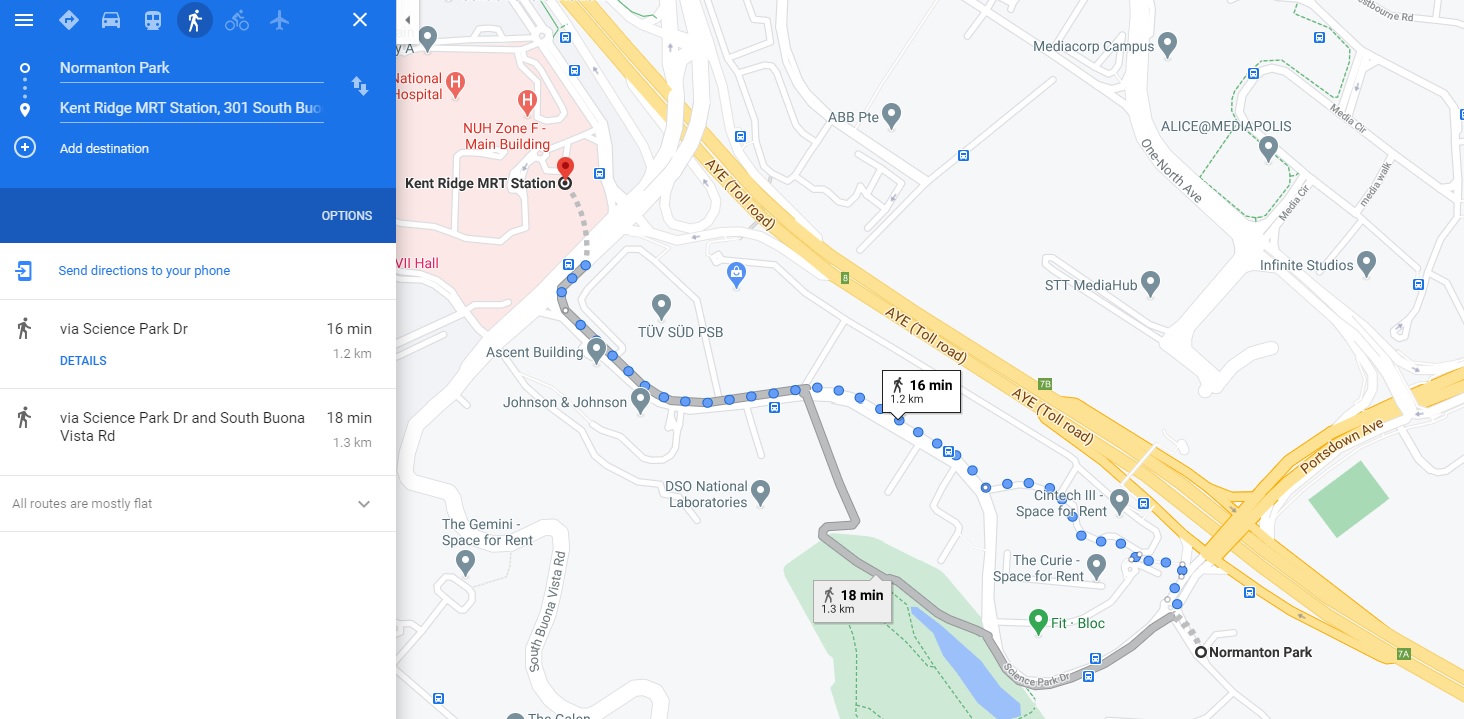

The nearest MRT Station from Normanton Park is Kent Ridge MRT Station which is 1.2 kilometres away. It is approximately a 15-minute walk and is relatively unsheltered. It would be advisable to take bus services 92 and 92A to get to the MRT Station instead.

The walk from Normanton Park to Kent Ridge MRT Station

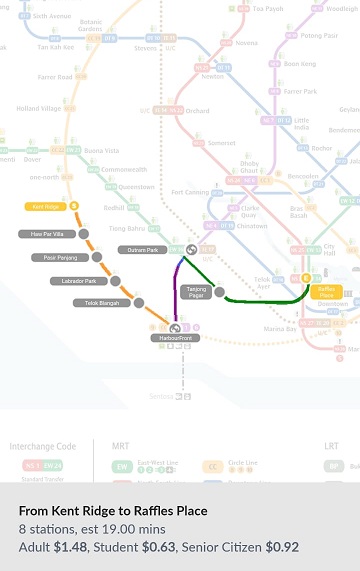

Kent Ridge MRT Station is located along the Circle Line. The train journey to Raffles Place MRT Station will take approximately 19 minutes over 8 stations and will cost $1.48.

Kent Ridge MRT Station to Raffles Place MRT Station

The train journey to Orchard MRT Station will take approximately 17 minutes over 8 stations and will cost $1.44.

Kent Ridge MRT Station to Orchard MRT Station

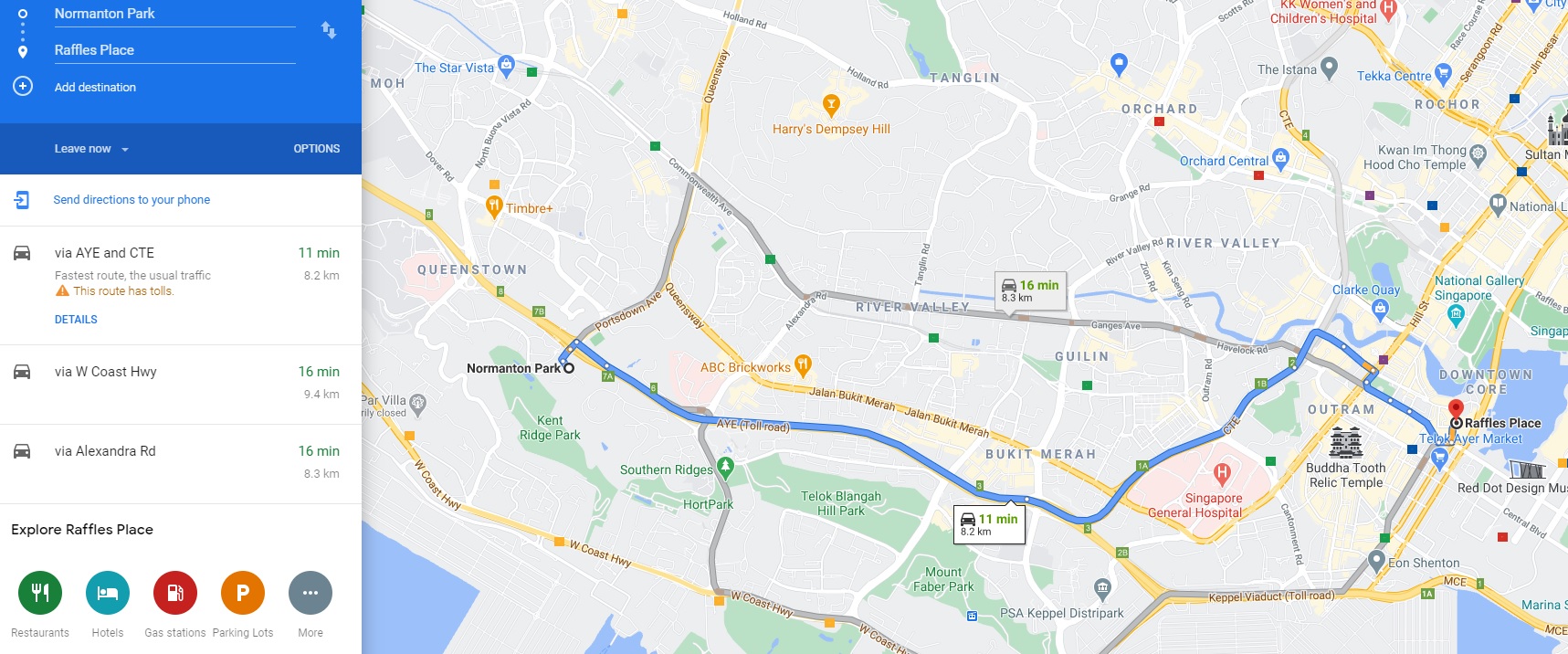

The drive from Normanton Park to Raffles Place will take about 11 minutes and the distance travelled is about 8.2 kilometres. Do note that this Google Map Query was done on a weekend night when traffic conditions are optimal. Do factor in additional time for the usual peak hour traffic.

The drive from Normanton Park to Raffles Place

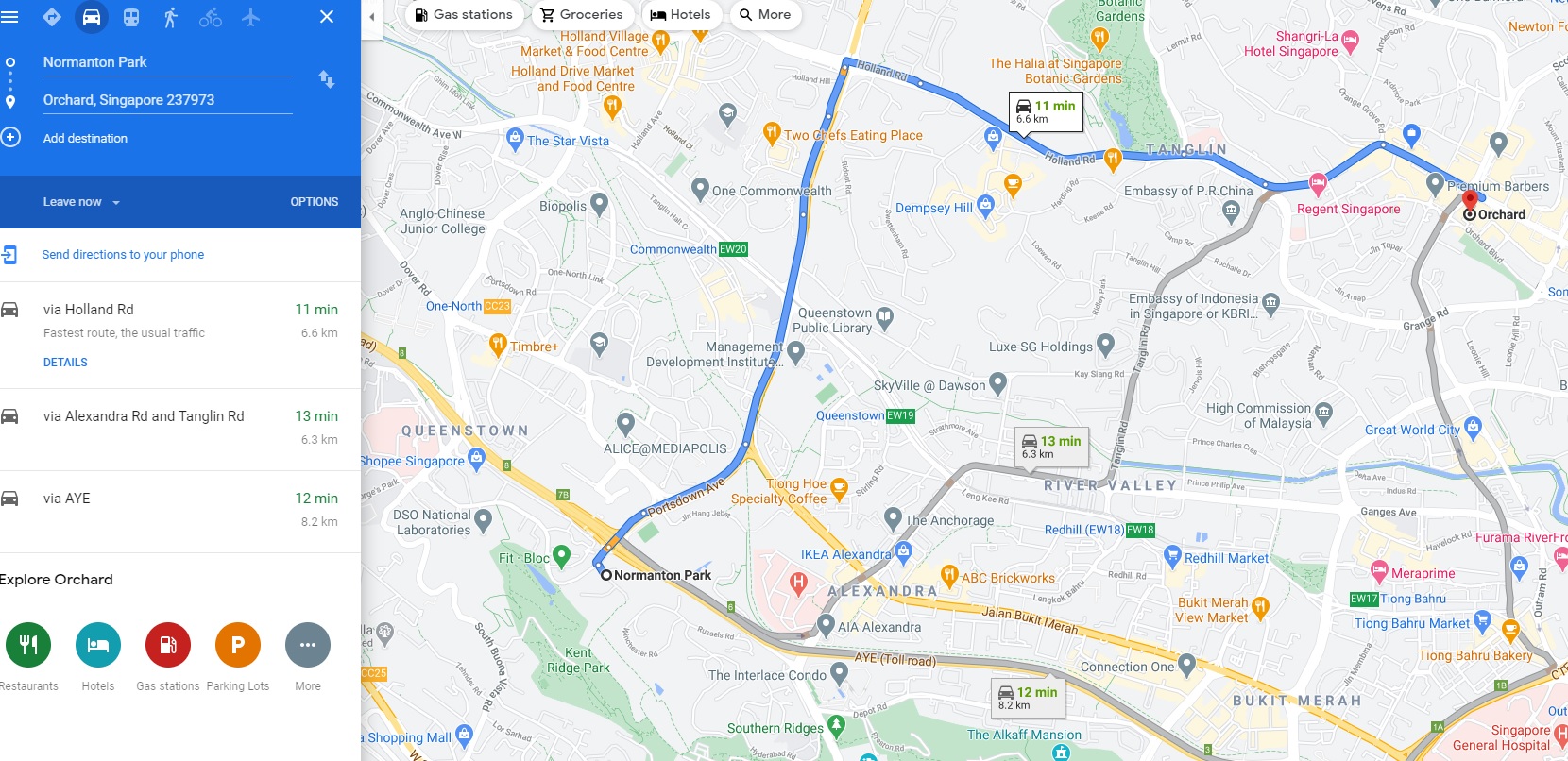

The drive from Normanton Park to Orchard Road will take about 11 minutes and the distance travelled is approximately 6.6 kilometres. Once again, do factor in additional time during the usual peak hours.

The drive from Normanton Park to Orchard Road

The selling points of the development

This is a mega-development and there are benefits that come with living in a large development. For starters, the facilities are going to be extremely comprehensive. In the last few years of new launches, only Treasure at Tampines is a larger development in terms of the number of units. Due to the sheer number of stakeholders that will be splitting the cost of maintaining the development, the maintenance fee is not expected to be high even though the facilities are extremely comprehensive. The developer, in their marketing materials, heralds more than 100 lifestyle facilities for Normanton Park. Moreover, there is even a restaurant and 8 retail shops that will serve the residents of the development.

There is a huge catchment area as Normanton Park is just next to the Singapore Science Park. Tenants should come from the companies in this area as well as from the National University Hospital (NUH), NUS and Mediapolis.

There is also possible residential developments in the future as evidenced in the URA Master Plan. The forested area across the expressway is zoned as a residential area and there should be residential developments springing up in the future. With it, there should be an uptick in the number of lifestyle amenities in the area.

Possible bad points of the development

The size of the development can be both a boon and a bane. There is a chance that competition in the resale and rental market will be extremely fierce due to the sheer number of units on offer. Unlike Treasure at Tampines where it is surrounded by residential housing and located in a mature estate, it is difficult to see where the HDB upgraders who will crave for units in Normanton Park will come from.

The nearest train station is 1.2 kilometres away which may put off potential buyers and tenants. Location wise, Normanton Park is not close to a train station nor located in a mature estate with ample amenities. This, to me, is a huge consideration for buyers. Developments over the course of time will improve connectivity and the number of amenities in the area and buyers will have to consider their investment time horizon carefully.

My thoughts about the development

I am curious to see how this pans out. The developer has been placed in a negative light due to issues with their previous two developments, Kingsford Waterbay and Kingsford Hillview Peak. However, due to the requirements set out by URA where all units in Normanton Park must pass BCA’s Quality Mark assessment before the developer can apply for a TOP does sound like the buyers will get a well-made development. I do think that the developer’s reputation will weigh on the minds of potential buyers.

I am also not so sure about the location. The lack of connectivity does deter me from recommending this development more strongly to potential buyers. I also do see a potential issue if the traffic flow is not managed and planned well as there is going to be a four-fold increase in the number of units in the new Normanton Park as compared to the old Normanton Park.

Normanton Park

Normanton Park

Pricing TBC

As of writing, pricing had yet to be released.

Location 2/5

I do think that being close to an MRT station is essential when purchasing a property, especially for investment. Kent Ridge MRT Station is currently the closest MRT station to Normanton Park and it is about 1.2 kilometres away.

Quality 4/5

I am going to go out on a limb here and say that because of the strict criteria that the URA has attached to the sale licence, the developer is going to have to ensure that the units at Normanton Park will come out good. Their first two forays into the Singapore property scene, Kingsford Waterbay and Kingsford Hillview Peak were perhaps good experiences for them.

Yours Sincerely,

p.s. Disclaimer: I am a licensed real estate salesperson at the point of writing this review. My real estate agency is the marketing agency for Normanton Park. Buyers can approach me to purchase a unit at Normanton Park and I will earn a commission from the developer. My reason for writing this review is to share my personal view about the developments not as a real estate salesperson but in the neutral context of a buyer and hopefully share some insight to help buyers make a more informed buying decision.

My other Singapore Property Reviews

My review of The Landmark by SSLE, MCC Land and ZACD

My review of Penrose by CDL and Hong Leong Holdings

My review of Forett at Bukit Timah by Qingjian Realty

My review of Clavon by UOL Group

My review of The M by Wingtai Asia

My review of Kopar at Newton by CEL Development

My review of The Avenir by Hong Leong Holdings and GuocoLand

My review of One Holland Village Residences by Far East Organisation

My review of Neu at Novena and Fyve Derbyshire by Roxy Pacific Holdings

My review of Midwood by Hong Leong Holdings

My review of Royalgreen and Juniper Hill by Allgreen Properties

My review of Sky Everton by Sustained Land

My review of Sengkang Grand Residences by Capitaland and City Developments Limited

My review of One Pearl Bank by Capitaland

My review of The Antares by FSKH Development

My review of Parc Clematis by SingHaiyi Group

My review of Piermont Grand by City Developments Limited

My review of Parc Komo by CEL development

My review of Riviere by Frasers Property

My review of Avenue South Residence

My review of 1953 by Oxley Holdings

My review of Uptown @ Farrer

My review of The Florence Residences

My review of Treasure at Tampines

My review of Fourth Avenue Residences

My review of The Woodleigh Residences

My review of Kent Ridge Hill Residences

My review of Arena Residences

My review of Whistler Grand and Twin Vew

My review of Mayfair Gardens and Daintree Residence

My review of Parc Esta

My review of Jui Residences

My review of The Jovell

My review of JadeScape

My review of Stirling Residences and Margaret Ville

My review of The Tre Ver and Riverfront Residences

My review of Park Colonial

My review of Affinity at Serangoon and The Garden Residences